This free budgeting template can truly transform how you manage your finances. It helps you visualize your income and expenses, making it easier to align your spending with your financial goals. By using this template, you can prioritize saving and debt repayment, leading to increased financial discipline. You'll gain insight into your spending habits and discover areas for improvement. Plus, it features user-friendly tools like transaction trackers and debt trackers to keep you organized. When you embrace this template, you're on the path to financial success, and there's so much more you can uncover to enhance your journey!

Key Takeaways

- Utilize free budget worksheets to visualize income and expenses, aligning spending with financial goals.

- Implement zero-based budgeting to ensure every dollar is intentionally allocated for maximum impact.

- Use debt trackers to develop strategic repayment plans, focusing on high-interest debts first.

- Explore budgeting apps that sync with financial accounts for real-time insights and adjustments.

- Engage with community support for motivation and accountability in your financial journey.

Understanding the Debt Cycle

Understanding the debt cycle is vital for anyone looking to improve their financial health. When you start purchasing on credit, you create ongoing payments that divert funds from savings and investments, ultimately hindering your financial growth.

For instance, carrying a $25,000 car loan at an 8% interest rate incurs $2,000 in annual interest. That's money that could've been saved or invested towards achieving your financial goals. Additionally, maintaining a balanced budget can help guarantee that you're not overspending and can keep you on track towards financial stability a plan for managing income.

As your income increases, you might fall into the trap of lifestyle inflation, which often leads to accumulating even more debt instead of prioritizing repayment. This cycle can create a false sense of financial capability, making you believe you can afford more than you truly can.

True affordability should be measured by cash purchases, yet many get caught up in the allure of credit. Recognizing this debt cycle is essential because it stifles your ability to reach long-term financial goals.

Strategies for Debt Elimination

Breaking free from the debt cycle requires actionable strategies that can help you eliminate what you owe. One effective method is the Debt Snowball approach, where you focus on paying off the smallest debts first. This not only provides quick wins but also boosts your motivation to tackle larger debts.

Additionally, prioritize high-interest debts, like credit cards with rates above 15%. Paying these off first can save you significant money in interest over time. It's also vital to evaluate risk management strategies when planning your financial future, as they can help you make informed decisions about your investments.

Establishing a zero-based budget is another essential step. It guarantees every dollar has a purpose, whether it's for expenses, savings, or debt repayment, preventing unnecessary spending.

To visualize your debt and create a tailored repayment plan, think about using tools like the "Add Up Your Debt" worksheet. This can help you stay organized and focused on your goals.

Benefits of Financial Discipline

Practicing financial discipline helps you build healthy habits that set you up for success. By sticking to a budget and prioritizing your spending, you can achieve long-term goals like saving for a home or retirement.

Additionally, exploring options for investing in precious metals through a Gold IRA can further enhance your investment strategy and provide a hedge against inflation.

This focused approach not only enhances your financial awareness but also empowers you to make smarter decisions about your money. This improved understanding enables you to allocate resources more effectively, prioritize long-term goals, and navigate complex financial landscapes with confidence. By adopting strategies reminiscent of the US Treasury’s shock and awe approach, you can take decisive actions that have a significant and immediate impact on your financial stability. Ultimately, this proactive mindset positions you to weather economic challenges and seize opportunities as they arise.

Building Healthy Habits

How can building healthy financial habits transform your life? By establishing financial discipline through budgeting, you can see significant improvements in your savings and overall financial health. Imagine what you could do with an extra $13K in a year simply by tracking your expenses and income. Here's a quick look at how these habits can impact your life:

| Healthy Habit | Emotional Benefit |

|---|---|

| Implementing a zero-based budget | Feel in control of your finances |

| Committing to a "no-spend" challenge | Experience financial freedom |

| Prioritizing debt repayment | Reduce stress and anxiety |

| Regularly reviewing your budget | Gain confidence in your decisions |

| Avoiding lifestyle inflation | Focus on what truly matters |

Developing these habits not only enhances your financial awareness but can also lead to improved credit scores and greater financial freedom. By actively managing your budget and making conscious spending choices, you're setting yourself up for long-term success. The journey to financial wellness starts with small, consistent steps—let these healthy habits guide you toward a brighter financial future.

Achieving Long-Term Goals

While you may face challenges on your journey to financial stability, achieving long-term goals becomes much more attainable with financial discipline. By establishing a zero-based budget, you can guarantee every dollar is intentionally allocated, whether toward savings, debt repayment, or necessary expenses. This approach leads to better financial management and sets you on a clear path to your financial future.

Additionally, exploring top platforms for income can provide you with opportunities to supplement your earnings, further supporting your financial objectives.

When you prioritize your long-term financial goals, you're not just dreaming; you're visualizing your way to financial independence. This visualization enhances your motivation and commitment to sticking to your budgeting plans. Research shows that maintaining discipline in your spending and saving can greatly increase your net worth over time, with some individuals saving over $13,000 in a single year.

Developing awareness of your spending habits through tracking expenses is essential. This reflection fosters the discipline necessary for achieving long-term financial stability and wealth accumulation.

Building Wealth Over Time

Building wealth over time starts with consistent savings; setting aside a portion of your income can lead to significant growth.

By diversifying your income streams and planning for the long term, such as considering options like a Gold IRA rollover, you create a stronger financial foundation.

Importance of Consistent Savings

Consistent savings play an essential role in enhancing your financial health and building wealth over time. By saving just $100 a month, you could accumulate over $36,000 in 30 years, assuming a 6% annual return. This power of compounding highlights how consistent savings can greatly impact your future.

Additionally, incorporating assets like a Gold IRA can provide a hedge against inflation and diversify your retirement portfolio, further supporting your long-term financial goals investing in precious metals.

Establishing an emergency fund that covers 3-6 months of living expenses gives you financial security and peace of mind during unexpected situations. Automating your savings transfers helps you maintain consistent savings without the temptation to spend that money. It makes reaching your savings goals easier and more reliable.

Utilizing high-yield savings accounts can also boost your savings. These accounts often offer interest rates much higher than traditional savings accounts, allowing your money to grow faster.

Additionally, setting specific, actionable savings goals—like saving for a home or retirement—can increase your motivation and focus, making it easier to stick to your consistent savings habits.

Diversifying Income Streams

Establishing a solid foundation of savings is just the start of your financial journey; diversifying your income streams can greatly amplify your financial stability and growth. Studies show that individuals with multiple income sources experience less financial hardship during economic downturns.

Consider these diverse avenues to boost your income:

| Income Source | Potential Earnings | Benefits |

|---|---|---|

| Side Hustles | 20-30% of annual income | Extra cash for savings and investments |

| Real Estate | 8-12% annual returns | Passive income and asset appreciation |

| Passive Investments | Compounding dividends | Long-term wealth accumulation |

By engaging in side hustles or freelance work, you can create a financial buffer. Investing in real estate, even as a part-time landlord, allows you to generate passive income. Additionally, passive income streams like dividends from stocks can compound over time, leading to substantial wealth.

Financial experts recommend having at least three diverse income sources, which can increase your overall financial security by 50% and help you pay off debt faster. Diversifying income streams is essential for building wealth over time and securing your financial future.

Long-Term Financial Planning

Effective long-term financial planning is vital for achieving lasting wealth and security. Start by setting specific savings goals, like building an emergency fund with three to six months' worth of living expenses. This safety net provides peace of mind and financial stability.

Additionally, consider diversifying your retirement portfolio by exploring options such as a Gold IRA, which can serve as a hedge against inflation and economic uncertainty diversification of retirement portfolio.

Don't underestimate the power of compound interest; investing early can greatly boost your wealth. For instance, a modest investment of $1,000 at a 7% annual return could grow to about $7,612 over 30 years.

Strategic asset allocation is another important element of long-term financial planning. By diversifying your investments across different asset classes, you can create a more stable portfolio that reduces risk while enhancing returns.

Make the most of retirement accounts like 401(k)s and IRAs. These accounts offer substantial tax advantages, and employer matching contributions can double your investment rate of return.

Essential Budgeting Tools

When diving into budgeting, you'll want to arm yourself with essential budgeting tools that make managing your finances more straightforward. A free budget worksheet can help you visualize your income and expenses, aligning your spending with the 50/30/20 budgeting rule for better financial management. This clarity allows you to make informed decisions about your spending habits.

Additionally, incorporating insights from sector performance metrics can enhance your understanding of where to allocate funds effectively.

Budgeting apps are another vital tool, as they can sync with your financial accounts, providing a real-time view of your spending. This feature enables you to track and adjust your budget efficiently.

If you prefer a more hands-on approach, consider zero-based budgeting, where every dollar is allocated to specific expenses. This method guarantees no money is left unassigned, promoting disciplined financial behavior.

Incorporating a debt tracker into your essential budgeting tools can aid in developing a strategic repayment plan, prioritizing high-interest debts.

Finally, regularly adjusting your budgeting approach, such as implementing the envelope system for cash spending, can help you adhere to your financial goals and reduce overspending.

With these essential budgeting tools at your disposal, you're well on your way to achieving financial stability.

Tracking Income and Expenses

To successfully manage your finances, tracking your income and expenses is essential. This practice helps you understand your financial flow, revealing spending patterns and areas for improvement. By keeping a well-organized income and expense tracker, you'll quickly spot discrepancies that indicate where you can cut costs and increase savings.

Implementing effective email marketing strategies can also serve as a reminder for your financial goals, reinforcing the importance of staying on track.

Studies show that individuals who track their expenses are more likely to stick to their budgets and achieve their financial goals. Categorizing your expenses allows you to align your spending with the 50/30/20 budgeting rule, dedicating 50% for needs, 30% for wants, and 20% for savings or debt repayment. This structured approach simplifies your financial management.

Utilizing a digital tracker can make the process even easier. You can enter data quickly and visualize your financial situation over time, which keeps you motivated and informed.

Whether it's an app or a simple spreadsheet, a digital tracker enhances your ability to stay on top of tracking income and expenses. By adopting this strategy, you're setting yourself up for financial success and improving your overall money management skills.

Start tracking today, and watch how it transforms your finances!

Community Support for Success

Connecting with a supportive community can greatly boost your journey toward financial success. Engaging with others who share similar goals provides motivation and accountability, which are essential in your personal finance journey.

The Easy Budget community encourages you to share both successes and challenges, creating a collaborative environment that fosters financial growth. By leveraging data-driven strategies and participating in community discussions, you can enhance your financial knowledge and decision-making skills.

By connecting with others on platforms like Instagram and Facebook, you'll find daily inspiration and practical tips for managing your finances effectively. These interactions can empower you to explore additional income opportunities through resources such as success stories and side hustle guides.

Joining community discussions not only keeps you motivated but also opens the door to valuable insights and strategies from those who've successfully transformed their financial situations. You'll learn from their experiences, avoiding common pitfalls and gaining new perspectives on your own financial challenges.

In essence, the community support for success can be a game-changer for your personal finance endeavors. So, don't hesitate to reach out, share your journey, and learn from others. Together, you can navigate the path to financial freedom more effectively.

Transforming Financial Goals

To transform your financial goals, start by aligning them with your budget to guarantee you're directing funds where they matter most.

Prioritizing savings over unnecessary expenses can create a solid foundation for achieving your ambitions.

Regularly tracking your progress allows you to make necessary adjustments and stay on the right path.

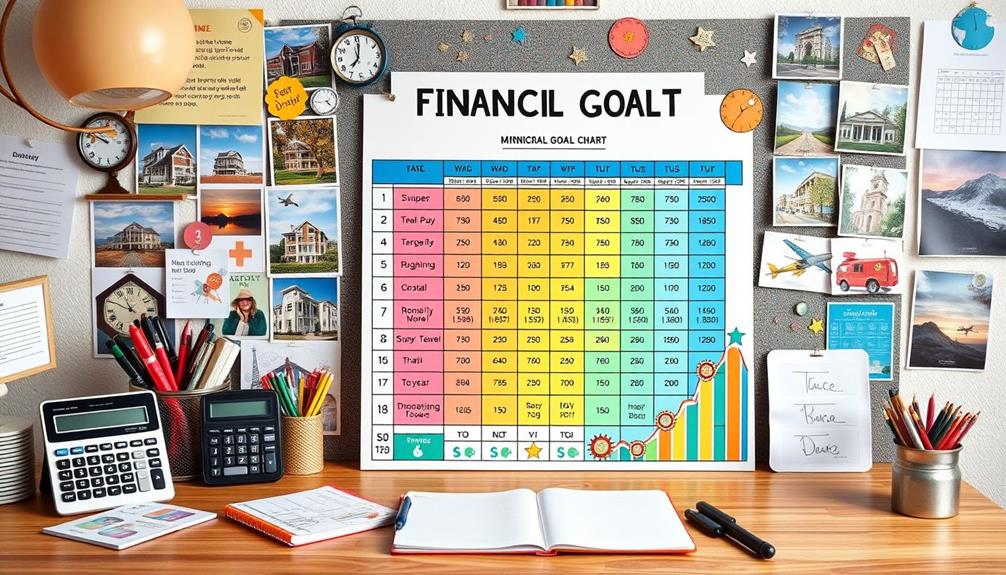

Aligning Goals With Budget

Aligning your financial goals with a well-structured budget is essential for steering your financial journey successfully. By allocating resources effectively, you can work towards your objectives without feeling overwhelmed. The 50/30/20 budgeting rule is a great starting point, allowing you to designate 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment.

To visualize your progress, consider using a monthly budget planner. This tool helps you track your financial goals and identify areas for adjustment. Setting specific, measurable goals—like saving for a vacation or paying off debt—can enhance your motivation and accountability.

Here's a simple table to help you align your goals with your budget:

| Goal | Monthly Allocation | Target Date |

|---|---|---|

| Save for Vacation | $200 | June 2024 |

| Pay Off Debt | $150 | December 2023 |

| Emergency Fund | $100 | March 2024 |

Regularly reviewing your budget guarantees your financial goals remain aligned and achievable. By making informed decisions, you increase your chances of long-term financial success.

Prioritizing Savings Over Expenses

Transform your financial future by prioritizing savings over expenses. One effective method is the 50/30/20 budgeting rule, which allocates 20% of your income specifically for savings and debt repayment. This approach guarantees you make consistent progress toward your financial goals.

To bolster your savings, automate your savings transfers; doing so can lead to a 10-20% increase in savings over time, as it prevents the temptation to spend that money.

Creating an emergency fund that covers 3-6 months of living expenses is vital. This financial safety net enables you to handle unexpected costs without derailing your plans.

Additionally, consider implementing a "no-spend" challenge for a month. This can help you identify unnecessary expenses and potentially save hundreds of dollars, which you can redirect toward savings.

Tracking Progress and Adjustments

Monitoring your financial progress is key to achieving your goals and making necessary adjustments along the way. By regularly tracking your financial progress, you can visualize how effective your budgeting strategies are and pinpoint areas that need improvement. This practice not only enhances your financial discipline but also empowers you to make informed decisions.

To guarantee your budget remains realistic, adjust it based on your actual spending and savings. This flexibility helps you stay aligned with your goals, adapting to any changes in your financial situation. Setting specific milestones, like saving a designated amount each month, can motivate you to stay on track and monitor your progress effectively.

Utilizing tools such as monthly progress reports gives you a clear overview of your financial health. These reports make it easier to celebrate achievements and identify areas that need attention.

Furthermore, implementing a zero-based budgeting approach encourages you to allocate every dollar of your income wisely. This fosters a habit of continuous evaluation and adjustments, making sure you're always working towards your financial aspirations.

User-Friendly Template Features

When it comes to managing your finances, a user-friendly template can make all the difference. This Budget Planner is designed to simplify your financial journey with intuitive tracking and organization.

You'll find features that allow you to easily record and categorize transactions, giving you clarity on your spending habits. Plus, the dedicated debt tracker inputs your outstanding balances and interest rates, helping you create a strategic repayment plan.

Here's a look at some key features:

| Feature | Description | Benefit |

|---|---|---|

| Transaction Tracker | Record and categorize your spending | Clarity on financial habits |

| Debt Tracker | Input balances and interest rates | Strategic repayment planning |

| Budget Tracker | Set and monitor budgets across categories | Disciplined spending |

| Subscription Tracker | Manage due dates for bills and subscriptions | Reduces late fee risks |

This template also supports a zero-based budgeting approach, ensuring every dollar is allocated effectively. With these user-friendly template features, you'll feel empowered to take control of your finances and achieve your goals.

Getting Started With Budgeting

Getting started with budgeting can feel overwhelming, but breaking it down into manageable steps makes it much easier. First, track every single dollar of income and expenses. Create a monthly budget planner to visualize where your money goes.

Follow the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% for savings or credit card debt repayment.

Next, consider implementing a zero-based budget. This method guarantees that every dollar has a purpose, preventing unnecessary spending and helping you stay accountable. By identifying non-essential expenses, you could save over $6,000 annually!

Regularly review and adjust your budget to promote financial awareness. This practice allows you to adapt to changes in income and expenses, guaranteeing you stay on track.

Lastly, leverage budgeting apps for more efficient tracking. Many users find that consistent monitoring leads to improved financial outcomes and greater accountability.

Frequently Asked Questions

How Do I Customize the Budgeting Template for My Needs?

To customize the budgeting template for your needs, start by identifying your income sources and expenses. Adjust categories, set realistic goals, and regularly update the template to reflect any changes in your financial situation.

Can I Access the Template on Mobile Devices?

Yes, you can access the template on mobile devices. Just download the app or open the website in your browser. You'll find it easy to manage your budget on the go, anytime you need.

Is There a Cost Associated With Downloading the Template?

When it comes to costs, you won't have to break the bank. There's no fee for downloading the template, so you can dive right in without worrying about spending a dime. Enjoy! Plus, because it’s so easy to use, you’ll save both time and effort, making it an even smarter choice for your needs. The free millionaire template download gives you professional, polished results without the hefty price tag. Start creating today and see how this resource can simplify your projects while keeping your budget intact!

What Formats Is the Template Available In?

The template's available in several formats, including Excel, Google Sheets, and PDF. You can choose the one that fits your needs best, making it easy to manage your finances in a way that works for you.

Can the Template Help With Irregular Income Tracking?

Yes, the template's designed to help you track irregular income effectively. You can customize it to log various income sources, making it easier to manage your finances and plan for future expenses.

Conclusion

So, you thought a simple template couldn't change your financial future, huh? Ironically, it's often the small things that lead to big transformations. By taking control of your debt, practicing financial discipline, and utilizing your newfound budgeting tools, you'll find yourself on a path to wealth you never imagined. Who knew that a free template could hold the power to reshape your finances forever? Now, it's time to get started and watch your financial goals come to life!