If you want to know where you rank financially, the net worth calculator making waves is an excellent tool to use. It helps you calculate your net worth by subtracting your total liabilities from your assets. With just a few inputs, you'll get a clear snapshot of your financial health, guiding you in making better investment decisions and setting achievable goals. Regularly updating your net worth can uncover opportunities for improvement and motivate you to manage your finances more effectively. Curious about the steps to maximize your net worth and financial strategy? There's more to discover!

Key Takeaways

- A net worth calculator provides an easy way to assess your financial standing by calculating total assets minus total liabilities.

- Comparing your net worth with national averages can help you understand your financial position relative to others.

- Regularly updating your net worth insights allows for tracking progress and adjusting savings and investment strategies.

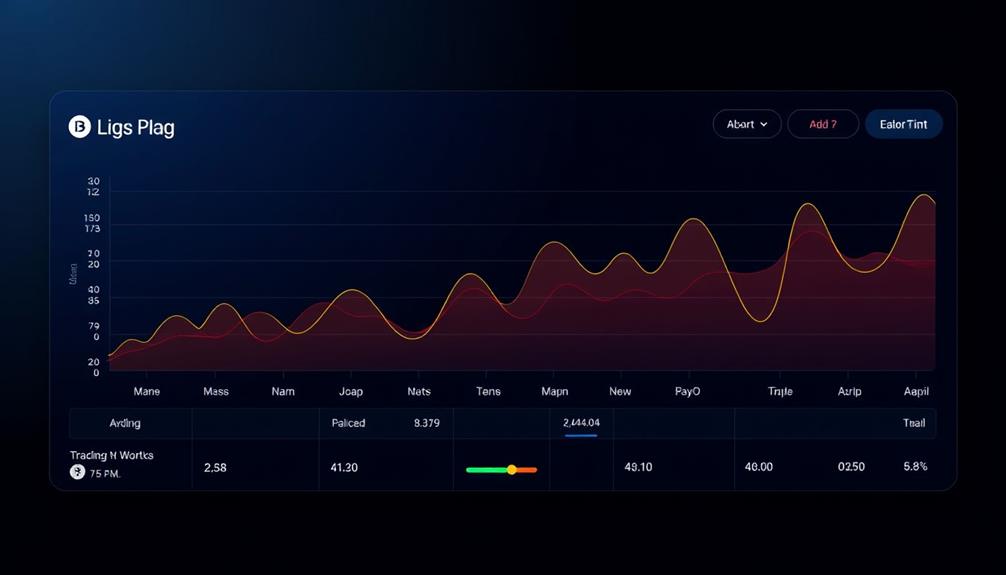

- Many calculators offer visualizations to clearly show trends in your financial health over time.

- Understanding your net worth ranking can highlight areas for improvement and guide future financial planning.

What Is Net Worth?

Net worth is fundamentally a snapshot of your financial health, as it reflects the total value of your assets minus your liabilities. To calculate your net worth, you'll need to list all your assets, which can include cash, investments, real estate, and personal property.

Understanding your common financial terms is vital for this process, as it helps you accurately evaluate your financial situation. On the other hand, liabilities encompass all your debts, such as mortgages, loans, and credit card balances.

When you subtract your total liabilities from your total assets, you get your net worth. A positive net worth indicates financial stability, suggesting that your assets exceed your liabilities. Conversely, a negative net worth can signal financial challenges, as it means you owe more than you own.

Understanding your net worth is essential for evaluating your overall financial situation. By regularly updating this figure, you can track your financial progress and make informed decisions about budgeting and investments.

In 2019, the average net worth of American families was $746,820, while the median net worth was $121,760, highlighting significant wealth inequality. Knowing where you stand in relation to these figures can help motivate you to improve your financial health.

Importance of Calculating Net Worth

Calculating your net worth gives you a clear snapshot of your financial health by showing the balance between your assets and liabilities.

It also helps you track your progress over time, making it easier to set and adjust your financial goals. By regularly evaluating your net worth, you can identify areas that need improvement and plan effectively for your future.

Additionally, understanding your financial standing can aid in making informed decisions about investments, such as whether to contemplate a Bitcoin IRA's potential benefits.

Snapshot of Financial Health

Understanding your financial health is fundamental, and one of the best ways to achieve that's by calculating your net worth. By subtracting your total liabilities from your total assets, you gain a clear snapshot of your overall financial standing.

This calculation not only highlights where you stand today but also allows you to track your progress over time. Additionally, considering investments like a Gold IRA can offer a unique avenue to enhance your financial portfolio, providing potential protection against market downturns and inflation through diversification investment strategies in precious metals.

Here are three key reasons why knowing your net worth is imperative:

- Identify Areas for Improvement: A negative net worth signals financial instability and areas needing attention.

- Set Realistic Financial Goals: Understanding your net worth helps you make informed decisions regarding spending and saving.

- Comprehensive Financial Picture: Including all assets—like cash, investments, and real estate—against liabilities, such as mortgages and loans, provides clarity on your financial health.

With the average net worth of American families at $746,820 in 2019 and a median of $121,760, it's clear that individual assessments are essential.

Regularly calculating your net worth empowers you to take control of your financial health and plan for a more secure future.

Goal Tracking and Planning

Knowing your financial standing equips you to set effective goals and develop a plan for achieving them. By tracking your net worth regularly, you gain a clear snapshot of your financial health, which helps you establish realistic short-term and long-term financial goals. This clarity allows you to align your aspirations with your current situation.

Additionally, utilizing SMART criteria for goal setting can enhance your approach to financial planning.

When you monitor your net worth, you can identify areas needing improvement, like reducing liabilities or increasing your asset accumulation. This proactive approach to financial management enhances your ability to secure loans or investments, as lenders often weigh your net worth when evaluating creditworthiness.

Additionally, consistent goal tracking of your net worth enables you to measure your financial progress over time. You can adjust your spending and saving strategies based on what you discover, keeping you on track to meet your financial goals.

Understanding your net worth is also essential for effective retirement planning; it helps you evaluate your readiness and the necessary savings strategies to achieve your retirement dreams. With these insights, you can confidently navigate your financial future and make informed decisions that align with your goals.

Identifying Improvement Opportunities

When you evaluate your net worth, you gain valuable insights into your financial health and identify improvement opportunities. This process allows you to determine your net worth accurately, revealing where you stand financially.

Understanding your net worth is essential for achieving long-term financial stability, much like how a Gold IRA can diversify retirement portfolios and protect against economic downturns.

Here are three key benefits of regularly reviewing your net worth:

- Spotting Weaknesses: Identifying areas of debt or underperforming assets helps you take corrective action.

- Tracking Progress: Regular evaluations let you see how your financial strategies are working, allowing for necessary adjustments.

- Setting Realistic Goals: With a clear picture of your financial position, you can prioritize actions that foster wealth growth.

Key Components of Net Worth

What makes up your net worth? Your net worth is fundamentally the difference between your assets and your liabilities. To calculate it, you'll subtract your total liabilities—like credit card debt, student loans, and mortgages—from your total assets, which include cash, investments, and real estate. Investing in alternatives such as a Gold IRA can also be a significant asset, as it diversifies your portfolio and can protect against inflation precious metal investment options.

Common assets that boost your net worth include savings accounts, stocks, bonds, retirement accounts, and the market value of properties you own. Each of these contributes positively to your financial picture.

On the flip side, liabilities can weigh you down, impacting your overall net worth. The more you manage these debts, the better your financial standing will be.

In 2019, the average net worth of American families was about $746,820, but the median net worth was only $121,760, highlighting a significant wealth gap.

Regularly updating your net worth calculation is essential; it helps you track your financial progress and make informed decisions about savings and investments. By understanding the key components of your net worth, you empower yourself to work toward a healthier financial future.

How to Use the Net Worth Calculator

Using a net worth calculator is a straightforward way to assess your financial health. To get started, gather information about your assets and liabilities.

First, input your total assets, which may include cash, investments, real estate, and personal property. Additionally, consider including any investment strategies you might have, such as a Gold IRA investment for a diversified portfolio.

Next, enter your total liabilities, like mortgages, car loans, and credit card debt. The calculator will then compute your net worth by subtracting total liabilities from total assets, giving you a clear picture of your financial situation.

To make the most of this tool, consider these tips:

- Regularly update your net worth to track progress over time.

- Use the insights to adjust your financial goals accordingly.

- Compare your net worth to national averages for perspective on your financial standing.

Strategies to Increase Your Net Worth

To boost your net worth effectively, focus on strategies that target both asset growth and liability reduction. Start by investing in appreciating assets like stocks and real estate. These investments typically increase in value over time, greatly enhancing your net worth.

Additionally, consider diversifying your portfolio with options like a Gold IRA, which can serve as a hedge against inflation and economic uncertainty, as noted in Gold IRA Rollovers. Prioritize paying off high-interest debts, such as credit card balances or personal loans. Reducing these liabilities directly lowers your total debt burden, which is essential for improving your net worth.

Consider regularly contributing to retirement accounts like 401(k)s or IRAs. This not only offers tax benefits but also helps your net worth grow through compound interest and investment gains. Setting specific financial goals, such as saving for a down payment on a home or building an emergency fund, can guide your financial decisions and foster disciplined savings habits.

Don't forget the importance of diversification. By spreading your investments across various asset classes, you can mitigate risks and potentially achieve higher returns. If you're unsure where to start, consulting a financial advisor can provide personalized strategies to increase your net worth effectively.

Embrace these strategies to pave the way for a more secure financial future.

Understanding Assets and Liabilities

Understanding the difference between assets and liabilities is essential for managing your finances effectively. Assets are valuable resources you own, like cash, investments, real estate, and personal property, which contribute positively to your net worth.

On the other hand, liabilities are the debts you owe, such as mortgages, car loans, and credit card debt, which subtract from your net worth. Exploring best ways to make money online can also help you increase your assets over time.

To help you grasp these concepts better, consider the following:

- Assets: These add value to your financial profile and can grow over time.

- Liabilities: These represent your financial obligations and can hinder your wealth accumulation.

- Net Worth Calculation: Your net worth is the difference between your total assets and total liabilities.

Accurately estimating the value of your assets is essential, as market fluctuations can greatly impact your overall financial picture.

Additionally, regularly updating both your assets and liabilities is important for maintaining an accurate net worth assessment. By understanding these components, you can make informed financial decisions that lead to greater stability and growth in your financial journey.

Tracking Net Worth Over Time

Tracking your net worth over time is essential for understanding your financial progress and making informed decisions.

By regularly updating your calculations, you can visualize growth and identify areas needing improvement. This practice not only helps you set future goals but also keeps your financial strategies aligned with your aspirations.

Additionally, as the private equity market evolves with increased focus on sustainability and responsible investing, understanding these broader trends can further enhance your financial outlook.

Importance of Regular Updates

How often do you take a moment to reassess your net worth? Regular updates are essential for understanding your financial health and guiding your decisions. By tracking your net worth over time, you can spot trends, monitor your progress toward financial goals, and identify areas needing improvement.

Consider these key benefits of regular updates:

- Informed Decisions: Knowing your current net worth helps you make smarter choices about spending and saving.

- Goal Monitoring: You can keep an eye on how close you're to achieving your financial objectives.

- Adaptation to Change: Significant financial events can impact your net worth, and regular checks allow you to adjust your strategy accordingly.

The Federal Reserve's report indicates that the average American family had a net worth of $746,820 in 2019. Understanding where you stand in relation to this average highlights the importance of maintaining updated records.

Visualizing Financial Progress

Visualizing your financial progress can be a game-changer when it comes to managing your wealth. By tracking your net worth over time, you can identify trends and patterns that reveal how your financial health is evolving. Regular updates to your net worth calculations help you see the impact of income growth, investment returns, and changes in asset values.

When you compare your net worth at different intervals, you're not just looking at numbers; you're setting the stage for realistic financial goals and adjusting your strategies accordingly. This consistent practice highlights areas for improvement, like debt reduction or increased savings, enhancing your overall financial management.

Using an online Calculator simplifies the process of tracking net worth. It allows you to visualize financial progress in a way that's accessible and easy to understand. With just a few clicks, you can see how your financial decisions impact long-term wealth accumulation.

Setting Future Goals

Establishing clear financial goals is essential for effectively tracking your net worth over time. By setting specific targets, like increasing your net worth by a certain percentage within a set timeframe, you can motivate yourself to adopt disciplined saving and investing habits.

Utilizing a net worth calculator simplifies this process, giving you a clear picture of your financial journey.

To make your goals more effective, consider these strategies:

- Regular Updates: Calculate your net worth at least annually to monitor changes in assets and liabilities.

- Identify Trends: Observe your net worth over time to spot patterns and make informed adjustments to your financial strategies.

- Prepare for Life Events: Use your net worth insights to plan for significant milestones, such as retirement or buying a home.

Financial Planning and Net Worth

Understanding your net worth is a key component of effective financial planning. It gives you a clear picture of your financial life and helps you develop a roadmap to achieve your goals.

Regularly calculating net worth allows you to track your financial progress, pinpoint areas needing improvement, and adjust your strategies accordingly.

Setting specific financial goals, like saving for a down payment or paying off debt, enhances your financial planning's effectiveness and can lead to an increase in your net worth over time.

A well-structured budget is essential as it aligns your spending with your financial goals, helping you manage expenses and improve your overall net worth.

Make it a habit to monitor your net worth periodically—at least annually or after significant financial changes. This practice empowers you to make informed decisions about investments and spending habits.

By understanding the connection between financial planning and net worth, you can take proactive steps to enhance your financial health.

Real-life Impact of Net Worth

Net worth plays an essential role in shaping your financial reality and overall stability. Understanding where you stand can deeply affect your life choices and opportunities.

For instance, knowing your net worth helps you navigate challenges and make informed decisions. Here are some key impacts of net worth in your life:

- Homeownership: If you own a home, you likely have a notably higher net worth. Homeowners typically boast a median net worth of $255,000, while renters sit at just $6,300.

- Education: Your education level correlates directly with your net worth. Those with a bachelor's degree average a median net worth of $300,000, while individuals without a high school diploma have just $26,000.

- Economic Disparities: The racial wealth gap remains a pressing issue, with White households holding a higher median net worth compared to Black and Hispanic households, highlighting systemic inequities.

It's also important to recognize the reality of negative net worth, which affects about 8% of U.S. households.

Understanding these dynamics helps you make strategic choices that can enhance your financial well-being and bridge gaps in wealth.

Conclusion

So, are you ready to take control of your financial future? By calculating your net worth, you're not just crunching numbers; you're revealing a clearer picture of your financial health. With the insights gained, you can implement strategies to boost your wealth and achieve your goals. Remember, every financial journey starts with that first step. Don't just dream about financial freedom—calculate your net worth today and see where you stand on the path to success!