If you're looking for a free Excel tool that can transform your finances, check out LibreOffice Calc. It mimics Excel's interface and offers powerful budgeting features without the cost. You can customize templates to fit your unique financial needs and automate calculations, saving you time and reducing errors. Plus, its data visualization tools make understanding your budget easy and intuitive. With its real-time collaboration capability, you can even work with others on your financial goals. There's so much more to explore about how LibreOffice can elevate your financial management, making it worth your while to uncover additional insights.

Key Takeaways

- LibreOffice Calc is a free alternative to Excel, offering similar functionalities for effective financial management without the cost.

- User-friendly interfaces in both tools allow for easy customization of budgeting templates tailored to individual financial needs.

- Automation features in Excel reduce manual entry, saving time and minimizing errors in financial tracking.

- Data visualization tools in Excel help identify spending patterns, simplifying complex data for better financial decision-making.

- Security features like password protection and encryption in Excel safeguard sensitive financial information during use and data sharing.

Overview of LibreOffice Calc

LibreOffice Calc is a powerful tool that serves as a free alternative to Microsoft Excel, making it perfect for anyone looking to manage finances without breaking the bank. If you're familiar with Excel, you'll find that Calc mimics its interface and functionality, allowing for a smooth changeover.

This open-source spreadsheet program is part of the LibreOffice suite, which includes multiple applications to help with various office tasks. By utilizing features like income tracking, you can easily document all sources of income for accurate budgeting, enhancing your financial health.

One of the standout features of LibreOffice Calc is its collaboration capability. You can work simultaneously with others, allowing for real-time editing and feedback on shared expense trackers. Whether you're tracking personal finance or managing a group budget, this feature helps streamline your efforts.

Calc frequently gets updates to enhance its features and maintain compatibility with Excel files, ensuring you won't have issues while shifting your data. With powerful capabilities like data integration and summarization, it's well-suited for both personal and professional financial management.

Features of Financial Tools

When managing your finances, leveraging specialized financial tools can considerably simplify the process. Excel spreadsheets, particularly budget spreadsheets, offer user-friendly interfaces that allow you to customize your financial tracking to suit your individual needs. With these tools, you can easily track your monthly expenses and income, helping you stay organized and informed.

Additionally, there are best websites to earn money online that can provide additional resources to enhance your financial management.

One standout feature of Excel templates is their automation capabilities. This reduces manual data entry, minimizing errors and inaccuracies in your financial tracking.

Additionally, thorough data visualization tools, such as charts and graphs, enable you to analyze financial trends quickly. This way, you can make informed decisions based on clear insights.

Excel's financial reporting capabilities provide detailed insights into your budgeting effectiveness, enhancing your overall performance analysis. These reports can help guarantee you comply with your financial goals and strategies.

Moreover, the compatibility of Excel templates with various financial software enhances their utility. However, it's crucial to evaluate any limitations in integration when selecting your financial tools.

With these features, you'll find that managing your finances becomes much more straightforward and efficient.

Benefits of Using Free Tools

Many people find that using free financial tools, like Excel, offers considerable advantages in managing their budgets effectively. One of the biggest perks is access to customizable budgeting templates, which let you tailor your financial tracking to fit your unique needs—all without spending a dime.

By opting for free Excel tools, you can avoid the subscription fees that come with many paid budgeting apps, maximizing your savings. Additionally, utilizing these tools can help in tracking investments, including options such as IRA rollovers to gold, which can further enhance your financial strategy.

Moreover, Excel's built-in functions and formulas automate calculations, reducing the likelihood of manual entry errors and saving you precious time. With data visualization features like charts and graphs, you can easily understand your spending patterns and financial trends, empowering you to make informed decisions about your finances.

Additionally, free tools often come with robust community support and ample online resources. This means you can learn and improve your financial management skills without any additional costs.

Comparison With Excel Templates

When comparing Excel templates to the free Excel tool, you'll notice key differences in customization and flexibility.

The free tool not only simplifies the budgeting process but also allows you to make informed financial decisions similar to those provided by Noble Gold's educational resources.

While templates let you create your own budget structures, the free tool simplifies the process with pre-defined categories that save you time and effort.

Plus, the ability to access your finances on multiple devices enhances your financial management experience markedly.

Excel Vs. Clickup Templates

Choosing between Excel templates and ClickUp templates for managing finances can greatly impact your workflow and efficiency. Excel templates provide a user-friendly interface with thorough coverage of your financial needs. However, they often require manual data entry, which can lead to errors and inefficiencies. You might find yourself spending more time inputting data rather than focusing on your financial goals.

Additionally, the growing demand for transparency in private equity has made it essential to utilize tools that enhance accuracy and oversight in financial management.

On the flip side, ClickUp templates offer automation capabilities that can help you streamline your budgeting processes. With real-time updates, you'll reduce the need for manual input, allowing for a smoother experience.

While Excel's customizable charts and graphs are visually appealing, ClickUp integrates project management features that enhance collaboration and oversight, making it easier to work with teams or stakeholders.

Moreover, Excel's compatibility with various versions can be limiting, whereas ClickUp is designed for seamless integration with other tools. This promotes a more efficient workflow tailored to your needs.

If you're managing complex financial scenarios or anticipate growth, ClickUp templates are built to scale, accommodating diverse financial requirements more effectively than traditional Excel templates.

Customization and Flexibility Options

In evaluating financial tools, customization and flexibility stand out as key advantages of Excel templates. Unlike rigid budgeting apps, Excel allows you to tailor your budgeting methods to fit your individual financial needs. You can easily modify categories to reflect your unique spending habits, enhancing the flexibility of tracking expenses.

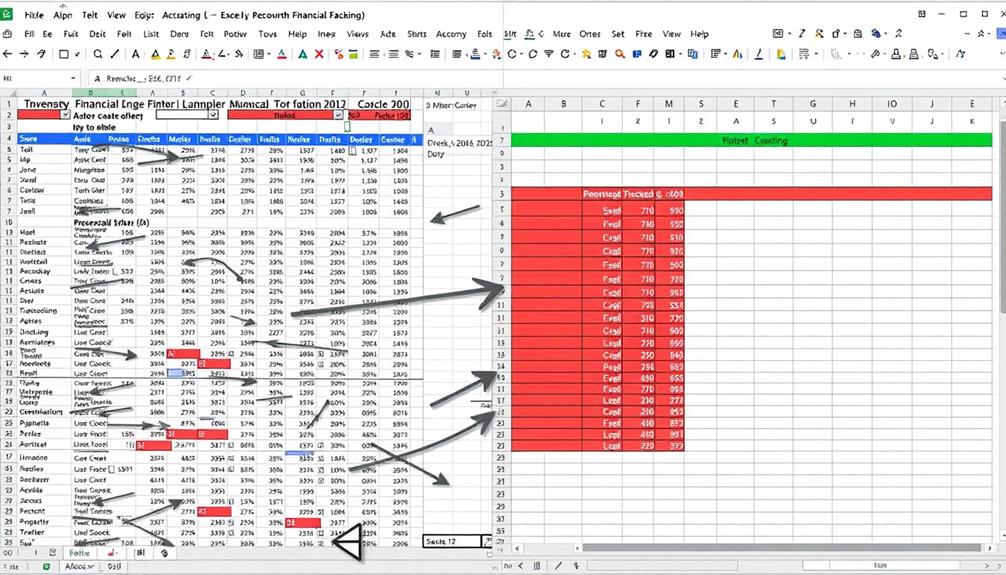

Here's a simple comparison of customization and flexibility in Excel templates:

| Feature | Excel Templates | Budgeting Apps |

|---|---|---|

| Custom Categories | Yes | Limited |

| Visualizations | Personalized Charts | Predefined Layouts |

| Control Over Layout | Complete | Restricted |

| Automation Features | Advanced Formulas | Basic Calculations |

| Adaptability | Highly Flexible | Low Flexibility |

With Excel, you can create personalized charts and tables to visualize your financial information, making it easier to analyze spending trends and adjust budgets. Plus, Excel's automation features streamline calculations, allowing for quick adjustments. This level of customization and flexibility makes Excel a versatile option for dynamic financial management.

Customization and Integration

Customizing your Excel budget template can greatly enhance its effectiveness in managing your finances. With extensive customization options, you can tailor expense categories and key financial metrics to align precisely with your goals. This personalization allows you to track what matters most to you, ensuring your budgeting process is relevant and efficient.

Additionally, focusing on content quality and topical authority when creating your budget can further boost your financial planning efforts.

Moreover, the integration capabilities of Excel with various financial software enable seamless data import and export. This feature streamlines your workflow, though keep in mind that limitations may arise regarding real-time updates and compatibility with certain platforms. By leveraging these integrations, you can maintain a thorough view of your financial situation.

Another significant benefit is the ability to create personalized charts and graphs. These visual representations of your financial data can make analysis simpler and promote informed decision-making.

Additionally, Excel supports formulas and automation, which reduces manual input and minimizes errors in tracking your finances.

Security and Data Protection

When working with your Excel budget, it's crucial to secure your sensitive data with password protection and encryption features.

Additionally, consider integrating strategies from cold medications overview to manage any health-related expenses effectively.

Sharing your files can expose them to risks, so consider using secure cloud storage with controlled access.

Regularly updating your software and employing version control can further safeguard your financial information.

Encryption and Password Protection

Securing sensitive financial data is essential, and Excel provides robust options for encryption and password protection. By utilizing these features, you can guarantee that only authorized users can access your critical information.

Additionally, just as proper aftercare is fundamental for healing piercings, maintaining security for your financial data is imperative to prevent unauthorized access and potential breaches proper aftercare for piercings.

Here's how you can enhance your data security:

- Apply Password Protection: Set a password for opening or modifying your Excel files. This keeps unauthorized users out.

- Control Access Levels: Use different passwords for viewing and editing to allow collaboration without compromising security.

- Utilize Encryption: Excel offers encryption options that scramble your data, making it unreadable without the correct password.

- Regularly Update Passwords: Regularly changing passwords and using strong, unique combinations can greatly reduce the risk of unauthorized access.

While Excel's security features are robust, always remain cautious. If you share files via email or cloud storage, be aware that they could be exposed to potential breaches.

Data Sharing Risks

Sharing Excel files can pose significant risks to your financial data security. When you share these files, you might unintentionally expose sensitive financial information.

Unlike specialized financial software, Excel often lacks robust encryption features, making it easier for malicious actors to access your data. Additionally, employers conducting background checks often face similar risks when sharing sensitive information.

Every time you create multiple local copies of budget templates, you increase the chances of a data breach, as each copy can become an entry point for unauthorized access.

Excel's password protection features may give you a false sense of security. These protections can often be bypassed by determined individuals or specialized software.

Furthermore, without built-in collaboration tools, you risk sharing outdated versions of your files, leading to inconsistent data and potentially misinformed financial decisions.

Secure Account Connections

Establishing secure account connections is essential for protecting your financial data in Money in Excel. By utilizing Plaid, a trusted financial services technology provider, you can guarantee that your financial information is accessed only with your permission and remains secure during transmission.

Additionally, employing advanced technology for enhanced temperature regulation can offer improved safety in digital transactions. Here are key aspects of secure account connections that you should know:

- Encryption: Microsoft 365 employs robust encryption methods to safeguard your financial information from unauthorized access.

- Multi-Factor Authentication: This adds an extra layer of security, requiring more than just a password to access your linked accounts.

- User Permissions: You maintain control over which financial accounts are linked, allowing you to manage your connections easily and securely.

- Regular Updates: Money in Excel receives security updates to comply with industry standards, prioritizing data protection continuously.

Limitations of Free Tools

While free tools can be tempting for managing finances, they come with several limitations that can impact your overall efficiency and accuracy. For instance, when using a free version of Excel templates, you'll likely face significant manual data entry. This not only consumes your time but also opens the door to potential errors, complicating your financial tracking.

Collaboration is another challenge. If you're not using shared platforms like Microsoft 365, you might struggle with version control, making it tough to work with team members effectively.

Additionally, many free budgeting tools lack advanced features such as automated reporting or integration with other financial software, which can limit their usefulness for anyone trying to manage their finances on a larger scale.

Security is a vital concern too. Free Excel templates often don't offer adequate protection, increasing the risk of data breaches when sharing files.

Strategies for Effective Budgeting

To effectively manage your finances, start by creating a clear monthly budget that captures all sources of income and categorizes your expenses. This initial step helps you identify spending patterns and areas for potential savings.

Here are some strategies to enhance your budgeting process:

- Utilize a Monthly Expense Tracker: Document your daily expenditures to guarantee all transactions are accounted for. This awareness keeps your cash flow in check.

- Regularly Review Your Budget: Compare your actual spending against your planned allocations. Adjust your budget to reflect changing financial circumstances and avoid overspending.

- Set Specific Financial Goals: Establish clear objectives and use budgeting tools to track your progress. This instills accountability in managing your financial situation.

- Implement a Three-Month Spending Review: Analyze your spending trends over three months. This review allows you to make informed decisions about future budgeting and adjust your habits accordingly.

Visualizing Financial Data

Visualizing your financial data can make a big difference in understanding your budget at a glance.

With Excel's built-in charts and graphs, you can easily spot trends in your spending and income.

Importance of Data Visualization

Data visualization plays an essential role in managing finances effectively. By turning complex financial data into visual formats, you can quickly identify spending patterns and trends that directly impact your financial health. This clarity enhances your understanding and helps you make informed decisions.

Here are four key benefits of using data visualization in your financial management:

- Identify Spending Patterns: Visual tools like charts and graphs reveal where your money goes, making it easier to spot unnecessary expenses.

- Enhance Comprehension: Studies show that visualizing data improves retention and comprehension, allowing you to grasp complex information better.

- Facilitate Budget Adjustments: Effective visualizations highlight areas for potential savings, enabling you to make timely budget adjustments.

- Improve Communication: Incorporating visuals in reports helps you quickly share your financial status with stakeholders, promoting better collaboration and strategic planning.

Tools for Financial Insights

Using the right tools can greatly enhance your financial insights, especially when it comes to visualizing data. Excel offers powerful features that allow you to create charts and graphs, giving you a clear picture of your income and expenses over time.

By automating the creation of visual reports with Excel's built-in templates, you can easily track your monthly budget and assess your financial performance.

Customizable data visualization options in Excel let you tailor charts to reflect your unique spending plan. This customization helps you identify areas where you could save more effectively. For example, by tracking your monthly expenses visually, you can compare spending patterns month-over-month and adjust your budget accordingly.

Incorporating data visualization into your financial reports simplifies complex information and encourages proactive financial management. You'll quickly spot significant changes in your spending habits, enabling you to make informed decisions.

With these tools at your disposal, you'll not only manage your finances better but also gain the insights needed to achieve your financial goals. Embrace Excel to manage your financial journey, and watch your financial insights transform!

Future of Financial Management Tools

Increasingly, financial management tools are evolving to meet the demands of a digital age, where automation and real-time collaboration become essential.

You'll find that the future of finance software is geared toward simplifying your financial management experience. Here's what to expect:

- Automation: Tools like Money in Excel allow you to automatically import transactions, making it easier to manage your personal budget without manual entry.

- Cloud-Based Solutions: Services such as Google Sheets and ClickUp enable real-time collaboration, letting multiple users access and update financial information simultaneously.

- Enhanced Data Visualization: Future tools will incorporate intuitive charts and graphs, helping you better understand your financial health at a glance.

- Robust Security Features: With rising cybersecurity threats, expect finance tools to prioritize encryption and multi-factor authentication, ensuring your sensitive money data is well-protected.

As these trends continue, you'll find that managing your finances will become more efficient, secure, and user-friendly, allowing you to focus on your financial goals effortlessly.

Embrace these advancements to revolutionize your approach to financial management.

Conclusion

In a world where financial freedom feels like a distant star, LibreOffice Calc can be your guiding lighthouse. By harnessing its powerful features and customizable tools, you can navigate the turbulent waters of budgeting and expenses with ease. Embracing this free resource can transform your financial landscape, illuminating paths you never thought possible. So, grab your metaphorical compass, set sail, and let this tool help you chart a course towards a brighter, more secure financial future.