Net assets and equity may look similar, but they have key differences that can impact your finances. Net assets show the total value of your assets minus liabilities, giving you insight into your overall financial health. On the other hand, equity represents your ownership value, factoring in retained earnings and other elements. Understanding these nuances can help you make better investment decisions and assess risk levels. Keep in mind, positive net assets don't always mean positive equity, and the implications of negative equity could be serious. There's more to uncover about these concepts and their real-world applications!

Key Takeaways

- Net assets are calculated as total assets minus total liabilities, reflecting overall financial health.

- Equity represents ownership value, including components like retained earnings and treasury shares.

- Both metrics are derived from the same formula, but net assets focus on financial position, while equity emphasizes ownership interest.

- Negative equity indicates greater financial risk and potential insolvency, impacting a company's ability to secure financing.

- Understanding these differences is crucial for informed investment strategies and assessing a company's financial stability.

Understanding Net Assets

When evaluating a company's financial health, understanding net assets is essential. Net assets represent the total value of a company's assets minus its total liabilities. This calculation serves as a vital measure of financial stability.

To find net assets, you can use the formula: Net Assets = Total Assets – Total Liabilities. A positive net asset value indicates that the company's assets exceed its liabilities, which boosts investor confidence and reflects a healthy financial position.

Additionally, managing a budget can help companies effectively allocate resources to maintain or grow their net assets, ensuring long-term sustainability. Creating a personal budget also provides insights into a company's ability to meet its obligations.

They're often highlighted in the equity section of financial statements, emphasizing the ownership stake shareholders have after all debts are settled. Regular assessments of net assets allow you to gauge a company's financial position accurately, especially during significant events like mergers, acquisitions, or investment evaluations.

Defining Equity

Equity boils down to the ownership value you hold in a company after subtracting all liabilities from its assets. In simple terms, it's calculated using the formula: Equity = Assets – Liabilities. This essential financial metric is prominently reflected on the balance sheet, showcasing your net worth in relation to the company's financial position.

Understanding common financial terms related to equity can also enhance your financial literacy.

Key components of equity include retained earnings, which represent profits that haven't been distributed as dividends. Additionally, treasury shares, or stock repurchased by the company, can also impact the equity figure. When liabilities exceed assets, you encounter negative equity, a warning sign of increased financial risk and potential insolvency.

Understanding equity is crucial, as it serves as a benchmark for evaluating a company's health. Investors use equity metrics, like price to book value, to assess risk and make informed decisions.

Whether you're an investor or a business owner, grasping the concept of ownership value through equity can greatly influence your financial strategies and outlook. Recognizing how equity functions will better position you in maneuvering the complexities of finance and investment.

Key Differences Between Net Assets and Equity

How do net assets and equity differ in the financial landscape? At their core, both metrics stem from the same calculation: total assets minus total liabilities. However, net assets focus on the overall financial position of a company, while equity zeroes in on the ownership interest remaining after debts are settled. Understanding the implications of different investment strategies, such as gold investment strategies, can also influence how one perceives these financial metrics.

When you look at equity, it includes specific components like retained earnings and contributed capital, which reflect the shareholders' rights and value. This makes equity a significant metric for understanding shareholder value and the financial health of a company from an investor's perspective.

On the other hand, net assets provide a broader view of a company's resources available after liabilities are accounted for. In non-profit organizations, net assets are often used interchangeably with total equity, underscoring the importance of context in understanding these terms.

Ultimately, while both net assets and equity are essential for evaluating a company's financial health, they serve different purposes: net assets highlight resource availability, while equity emphasizes ownership and shareholder interests. Understanding these differences can guide your financial analysis effectively.

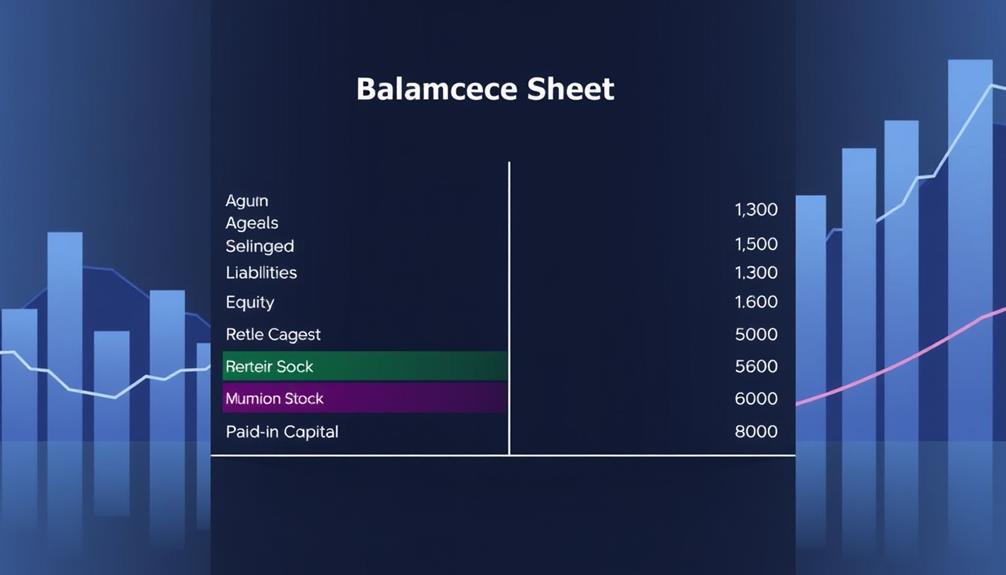

Components of Shareholder Equity

Understanding the components of shareholder equity can give you valuable insights into a company's financial health. Shareholder equity is calculated using the formula: Shareholder Equity = Total Assets – Total Liabilities. This means that when a company's assets exceed its liabilities, it achieves positive shareholder equity, indicating financial stability.

For investors looking to diversify their portfolios, precious metal investment options can serve as a hedge against market volatility and inflation.

One key component of shareholder equity is retained earnings. These represent the net earnings that a company hasn't distributed as dividends, showcasing its ability to reinvest in growth. The accumulated retained earnings reflect the total profits a company has retained throughout its existence, greatly contributing to overall equity value.

Another aspect you should consider is treasury shares, which are included in shareholder equity as a contra account. These represent stock repurchased by the company and aren't available for public trading, affecting the total equity.

Calculating Net Assets

Calculating net assets is vital for gaining a clear understanding of your financial position. To determine your net assets, you'll use the formula: Net Assets = Total Assets – Total Liabilities. This straightforward calculation gives you a snapshot of your financial health at any given moment.

Additionally, understanding the importance of diversification in your investment portfolio can also play a role in your overall financial strategy, especially when considering options like IRA rollovers to gold. It's important to use current market values for both total assets and total liabilities to guarantee accuracy. Regularly calculating net assets can greatly aid in financial planning, helping you account for changes in your financial status over time.

For corporations, net assets are often reflected on the balance sheet as shareholders' equity, indicating the residual interest of shareholders after all liabilities are settled.

Understanding your net assets is essential for determining your net worth, which can fluctuate due to asset appreciation or depreciation and changes in your liabilities. By keeping a close eye on these figures, you can make informed decisions that impact your financial future.

Fundamentally, calculating net assets provides you with invaluable insights that can guide your financial strategies and help you achieve your long-term goals.

Importance of Equity in Business

Equity plays an essential role in the health and growth of your business, serving as a clear indicator of financial stability. It's calculated as total assets minus total liabilities, showcasing the ownership value you hold. A positive shareholder equity means you have more assets than liabilities, which is vital for attracting investors and securing financing.

Additionally, understanding the importance of risk management in your financial strategy can further enhance your equity position. Retained earnings, a key component of your equity, represent profits that you haven't distributed as dividends. By reinvesting these earnings, you can greatly enhance your company's capacity for growth.

The equity-to-asset ratio, which divides total equity by total assets, provides insights into your company's leverage and risk level. A strong equity position not only reflects financial health but also indicates business stability.

When your equity is solid, you're better positioned to withstand economic downturns, making your business a lower-risk investment for creditors and stakeholders. This stability can give you the confidence to pursue new opportunities and strategies, ensuring long-term success.

In short, understanding and managing your equity is essential for maintaining a thriving business and planning for the future.

Implications of Negative Equity

When you encounter negative equity, it usually means your total liabilities are greater than your assets, which can seriously impact your financial stability.

This situation can lead to higher borrowing costs, making it tougher to secure necessary financing.

Employers often conduct background checks to guarantee a candidate's financial responsibility, which may be particularly relevant if you're seeking a new job during recovery.

To turn things around, you'll need to explore recovery strategies like restructuring debt, boosting revenue, or cutting expenses.

Causes of Negative Equity

Negative equity can arise from several factors that greatly impact a company's financial health. When a company's total liabilities exceed its total assets, it creates a scenario where shareholders may struggle to recover their investments. High debt levels are a significant contributor to this situation, as they increase total liabilities and often lead to substantial financial risk.

Additionally, factors such as cold medications overview can indirectly affect a company's costs, further complicating its financial standing.

Furthermore, significant losses or declining asset values can push a company into negative equity. In these cases, the value of the company's assets drops to a point where it's no longer sufficient to cover its debts. This position can hinder a company's ability to secure financing, as lenders typically view negative equity as a red flag for financial instability.

For shareholders, the consequences are dire; negative equity can lead to reduced stock prices and lower returns on investment, especially during economic downturns. Investors often scrutinize companies in this position, raising concerns about their long-term viability and the looming threat of restructuring or bankruptcy.

Understanding these causes is essential for anyone looking to assess a company's financial health accurately.

Impact on Financial Stability

A company's financial stability can take a hit when it finds itself in a negative equity situation. When liabilities exceed total assets, this negative equity signals that the company owes more than it owns, raising red flags about its net worth. Such a precarious financial position can lead to insolvency if not addressed swiftly.

In today's market, where increased focus on sustainability and responsible investing is gaining traction, companies with negative equity may find themselves at an even greater disadvantage as investors seek stability and transparency in their portfolios.

Moreover, companies grappling with negative equity often struggle to secure loans or attract investors. Lenders may impose higher interest rates to offset the perceived risk, resulting in increased costs of capital. This can further strain your resources and limit operational flexibility.

Persistent negative equity not only endangers financial stability but also affects shareholder confidence. As uncertainties grow, shareholders may see declining stock prices and reduced market valuation, which can deter potential investors from considering your company.

Regularly monitoring equity levels is essential for any business. If negative equity persists, it may indicate ongoing operational losses or mismanagement, making it important to take proactive measures to restore financial health and maintain stakeholder trust.

Recovery Strategies and Solutions

Addressing negative equity is essential for restoring financial health and stability. When your liabilities exceed your assets, implementing effective recovery strategies becomes vital.

Start by conducting regular financial assessments to understand your situation better. This can help you identify areas for improvement in your budget and set realistic financial goals. Additionally, consider diversifying your investments by incorporating alternative assets such as gold, which can provide a hedge against inflation and enhance overall portfolio resilience, especially during economic downturns.

Gold IRAs offer potential for long-term capital appreciation and act as a safe haven during market volatility.

Consider debt consolidation as a solution. By streamlining your payments through a personal loan or credit counseling services, you can reduce the overall interest rates and make repayment more manageable.

You might also explore the debt snowball method, where you tackle smaller debts first to gain momentum, or the debt avalanche method, focusing on high-interest debts to minimize costs.

If recovery seems out of reach, bankruptcy might be a last resort, but be aware that not all debts are dischargeable, such as student loans and tax obligations.

Evaluating Financial Health: Net Assets Vs Equity

When you're evaluating a company's financial health, understanding net assets and how they differ from equity is vital.

Net assets give you a snapshot of the company's overall value, while equity focuses on what shareholders actually own.

Additionally, just as diversifying a retirement portfolio can enhance long-term financial security, a thorough understanding of these financial metrics can better inform your investment strategy.

Understanding Net Assets

Net assets play a vital role in evaluating an entity's financial health, serving as a snapshot of what remains after all debts are settled. Fundamentally, net assets represent the difference between total assets and total liabilities, providing significant insights for both individuals and corporations.

Understanding content relevance and authority is key when interpreting these figures, as it can affect perceptions of financial stability.

- A positive net asset value indicates overall financial stability.

- Negative net assets signal potential solvency issues and higher financial risk.

- The calculation of net assets can help you assess your or your business's financial position.

When you understand your net assets, you can gauge your financial health more accurately. This calculation follows the simple formula: Net Assets = Total Assets – Total Liabilities.

It's vital to recognize that while net assets apply broadly, shareholders' equity is a specific type of net assets used mainly in corporate finance.

Differentiating From Equity

Understanding net assets gives you a solid foundation for judging financial health, but it's important to recognize how they differ from equity. Net assets represent the total assets of a company minus its total liabilities, providing a snapshot of its financial stability at a given moment. This calculation shows a company's ability to cover its obligations, which is essential for evaluating risk.

On the other hand, equity, often referred to as shareholders' equity, reflects the residual interest in those net assets attributable to shareholders. It includes retained earnings and contributed capital, indicating the value of ownership after all debts are settled. While positive net assets signal a healthy financial position, negative equity can imply potential insolvency, putting investors on alert.

For you as an investor, understanding this distinction is significant. Net assets give you insight into overall financial health, while equity helps you gauge shareholder value and potential returns on investment.

Real-World Examples and Applications

Many people mightn't realize how net assets and equity play an important role in various financial scenarios. Understanding these concepts can greatly impact your investment and financial decisions.

For instance, consider the following situations:

- A corporation with total assets of $10 million and total liabilities of $4 million has net assets of $6 million, which also represents its equity.

- Homeowners calculate their net assets by subtracting their mortgage balance from the property's market value; as they pay down the mortgage, their equity increases.

- A company's equity may fluctuate due to retained earnings, which accumulate from profits reinvested back into the business.

Recognizing the distinction between net assets and equity is essential for evaluating financial health.

For example, negative equity can signal financial distress, even when net assets appear positive. This understanding is critical for making informed choices in real estate and corporate investments.

Whether you're a homeowner evaluating your property's value or an investor analyzing a company's balance sheet, grasping these concepts can guide you toward better financial outcomes.

Resources for Further Learning

To deepen your knowledge of net assets and equity, a variety of resources are available that can enhance your understanding and application of these financial concepts. The U.S. Securities and Exchange Commission offers invaluable guidelines and educational materials that clarify the calculation of net worth, emphasizing the relationship between total assets and total liabilities.

Annual reports from public companies, like Apple, provide practical examples of how net assets and equity appear on balance sheets, illustrating a company's financial health and performance. These reports often detail the equity equation, allowing you to see how ownership interest is calculated after debts are deducted.

Additionally, financial educational platforms like Investopedia are excellent resources for further learning. They break down complex financial ratios and concepts, helping you make informed investment decisions.

Conclusion

In the financial landscape, think of net assets as the sturdy foundation of a house, while equity represents the beautiful roof that adds value and protection. Understanding the distinction between the two lets you navigate your financial journey with confidence. Just as a house needs both a solid base and a secure top, your financial health thrives on grasping these concepts. Embrace this knowledge, and you'll build a resilient future, ensuring your financial structure stands strong against any storm.