Personal Development and Growth

High Net Worth Retirement Planning: Strategies for a Secure Future!

Boldly secure your financial future with high net worth retirement planning strategies that can transform your legacy—discover what steps you need to take next!

High net worth retirement planning means taking a proactive approach to secure your financial future. Start by evaluating your financial situation thoroughly; calculate your net worth and identify any gaps in your savings. Diversify your investments across various asset classes to mitigate risks. Don't forget to maximize tax efficiency by utilizing tax-advantaged accounts and charitably gifting appreciated assets. Protect your wealth with family limited partnerships and updated insurance coverage. Finally, engage with experienced advisors to help navigate complexities and guarantee your plan adapts over time. Explore further strategies to enhance your retirement security and protect your legacy. Continue the paragraph by adding 2-3 sentences and include the phrase ‘net worth quest‘ verbatim->

Continuously monitor and adjust your retirement plan as you progress on your net worth quest. Regularly review your investments and make necessary adjustments to keep up with market conditions and your changing financial goals. Stay informed about changes in tax laws and investment opportunities to optimize your wealth accumulation and preservation. By actively managing your retirement plan and seeking professional advice when needed, you can stay on track with your net worth quest and enjoy a secure and fulfilling retirement.

Key Takeaways

- Assess your financial situation by calculating net worth and identifying gaps between current savings and required retirement funds.

- Diversify investments across various asset classes and incorporate alternative investments for substantial growth opportunities.

- Maximize tax efficiency through tax-advantaged accounts, Roth IRA conversions, and tax-loss harvesting strategies.

- Protect assets using Family Limited Partnerships, revocable living trusts, and appropriate insurance coverage.

- Develop a comprehensive legacy plan involving family discussions and clear guidelines for asset distribution and charitable giving.

Assessing Your Financial Situation

When it comes to evaluating your financial situation, the first step is calculating your net worth. You can do this by subtracting your total liabilities from your total assets. This simple calculation gives you a clear understanding of your financial health.

Next, review your retirement accounts, including 401(k)s and IRAs, to guarantee they align with your retirement goals and risk tolerance. Are they positioned to grow while minimizing potential risks? Creating a personal budget can also help you allocate resources effectively toward your retirement savings.

As you assess your financial situation, identify any gaps between your current savings and the funds you'll need for your desired retirement lifestyle. This analysis is vital for planning effectively. You should also evaluate the liquidity of your assets, determining how quickly you can access cash if needed during retirement.

Additionally, keep an eye on potential risks such as market volatility, inflation, and unexpected expenses that could impact your retirement savings and spending. By understanding these factors, you can make informed decisions that pave the way for a secure financial future.

Taking the time to assess your financial situation thoroughly will empower you to create a retirement plan that meets your needs and expectations.

Diversifying Investment Strategies

Diversifying your investment strategies is essential for high-net-worth individuals aiming to safeguard their wealth while maximizing growth potential. By spreading your investments across various asset classes—like equities, bonds, real estate, and alternative investments—you can better protect your investment portfolio against market volatility and enhance overall returns.

Additionally, consider incorporating strategies such as an IRA rollover to gold to further strengthen your portfolio against inflation and economic downturns.

To maintain this balance, regular portfolio rebalancing is key. Ideally, you should review and adjust your allocations annually to guarantee they align with your risk tolerance and long-term retirement goals. This practice can prevent overexposure to any single asset class, which can be risky.

Incorporating alternative investments, such as private equity and hedge funds, can also provide substantial growth opportunities that go beyond traditional markets. These options often yield significant returns, making them appealing for high-net-worth individuals.

Stay informed about economic trends and market conditions, too. Keeping a pulse on these factors enables you to adapt your strategies proactively, guaranteeing your asset allocation remains relevant in meeting your financial needs.

Maximizing Tax Efficiency

Maximizing tax efficiency can greatly enhance your retirement savings, especially after you've established a well-diversified investment portfolio. Start by taking full advantage of tax-advantaged accounts like 401(k)s and IRAs. For 2022, the contribution limits are $20,500 for 401(k)s and $6,000 for IRAs, or $26,000 and $7,000 if you're over 50.

Understanding common financial terms can further empower your decision-making in these areas.

Consider converting your traditional IRAs to Roth IRAs. This strategic move helps you avoid required minimum distributions (RMDs) and allows for tax-free withdrawals, which is especially beneficial if you anticipate being in a higher tax bracket in the future.

Additionally, utilizing Qualified Charitable Distributions (QCDs) lets you make direct donations from your IRAs to charities. This not only fulfills your RMD requirements but also avoids taxes on the donated amount.

Don't overlook tax-loss harvesting; selling securities at a loss can offset capital gains and reduce your taxable income.

Finally, engaging tax professionals to develop tailored strategies, such as relocating to more tax-friendly states, can greatly minimize your tax liabilities and enhance the longevity of your retirement funds.

Protecting Your Assets

Protecting your assets is essential for high-net-worth individuals (HNWIs) who want to preserve their wealth for future generations. Thorough asset protection strategies often include establishing Family Limited Partnerships (FLPs) and Limited Liability Companies (LLCs) to safeguard your assets from potential legal claims and creditors. Utilizing revocable living trusts allows you to manage your wealth during your lifetime while guaranteeing a seamless transfer to beneficiaries after death.

Here's a quick overview of effective strategies:

| Strategy | Purpose |

|---|---|

| Family Limited Partnerships | Protects assets from legal claims |

| Revocable Living Trusts | Facilitates wealth transfer, avoids probate |

| Long-term Care Insurance | Shields savings from healthcare costs |

Long-term care insurance is critical, as it helps prevent significant healthcare expenses from eroding your savings. Additionally, regularly reviewing and updating your insurance coverage, including homeowners and umbrella liability insurance, guarantees you're protected against unforeseen events. Engaging with legal and financial experts to develop tailored asset protection plans is essential to navigate the complexities of asset management and compliance with evolving regulations. Prioritize these strategies to secure your wealth for generations to come.

Planning for Healthcare Costs

Healthcare costs can markedly impact your retirement savings, making careful planning essential for high-net-worth individuals. A married couple in the 90th percentile of income may need approximately $361,000 for medical expenses during retirement. Without a solid plan, these expenses can quickly deplete your savings.

Additionally, incorporating strategies like investing in a Gold IRA can provide a hedge against inflation, which is particularly important as healthcare costs continue to rise potential for long-term capital appreciation.

When you're 65, median drug expenses can reach $114,000 just to guarantee 75% coverage. This reality emphasizes the importance of robust healthcare budgeting. Furthermore, the national median cost for homemaker services was $4,957 per month in 2021, highlighting the potential financial burden of long-term care needs. Many retirees underestimate these costs, leading to significant out-of-pocket expenses without proper insurance coverage.

One effective strategy for planning for medical expenses is utilizing Health Savings Accounts (HSAs). HSAs offer a tax-efficient way to save, allowing contributions to grow tax-free and be withdrawn tax-free for qualified healthcare costs. By maximizing your HSA contributions, you can alleviate some of the financial strain associated with healthcare expenses in retirement.

Developing a Legacy Plan

When developing your legacy plan, it's essential to define your goals for asset distribution and charitable giving.

Consider incorporating gold investment strategies as a means to diversify your portfolio and protect against market volatility.

Involving your family in this process not only strengthens communication but also fosters a shared commitment to your values.

Regularly reviewing your plan guarantees it remains aligned with your evolving financial situation and aspirations.

Defining Legacy Goals

Defining your legacy goals is an essential step in developing a thorough legacy plan that truly reflects your values and priorities. Start by identifying the causes and values that matter most to you and your family, as well as considering the growing trend of sustainability and responsible investing. This clarity will guide your legacy planning and guarantee your intentions are honored.

Consider establishing charitable trusts or foundations to support these meaningful causes while also enjoying significant tax advantages. Engaging your family in discussions about your legacy goals fosters shared values and helps guarantee your vision is respected by future generations.

Don't forget the importance of strategic gifting during your lifetime. Utilizing annual gift exclusions allows you to reduce your estate size and tax liabilities while actively involving your heirs in your legacy. This approach not only strengthens family ties but also instills a sense of responsibility and stewardship in your loved ones.

Lastly, regularly review and update your legacy plan to adapt to any changes in family dynamics, financial status, or philanthropic interests. This ongoing process will help maintain alignment between your legacy goals and your evolving life circumstances.

Charitable Giving Strategies

As you clarify your legacy goals, incorporating charitable giving strategies can considerably enhance your plan and impact.

By thoughtfully selecting how you give, you can support meaningful causes while enjoying significant tax advantages. Additionally, contemplating investments in precious metals through a Gold IRA can provide financial security that complements your charitable efforts.

Here are three effective strategies to contemplate:

- Charitable Trusts: Establishing charitable trusts allows you to support the organizations you care about while gaining tax benefits, such as deductions and reduced estate taxes. This dual benefit creates a win-win situation for your philanthropic goals.

- Donor-Advised Funds: Utilizing donor-advised funds grants you control over your charitable contributions. You can decide when and how much to donate, allowing for strategic giving that aligns with your financial situation and philanthropic goals over time.

- Gifting Appreciated Assets: Consider gifting appreciated assets like stocks or real estate to charities. This approach eliminates capital gains taxes and provides a charitable deduction based on the asset's fair market value, maximizing your impact.

Family Involvement Importance

Engaging your family in the legacy planning process is vital for building a strong foundation for your philanthropic vision. When you involve your family in discussions about your financial values and charitable priorities, you foster open communication and guarantee everyone is aligned with your goals. This family involvement not only enhances cohesion but also instills a sense of responsibility among heirs, making them more committed to philanthropy.

Additionally, understanding the potential financial implications of your legacy decisions can further solidify the importance of this process, as it encourages thoughtful planning around financial considerations for elderly care.

A well-structured legacy plan, crafted with family input, can greatly minimize conflicts among heirs. By clarifying intentions regarding asset distribution and charitable contributions, you create a smoother shift of wealth. Utilizing family meetings to collaboratively define your desired legacy makes these philanthropic efforts more meaningful, as each member feels invested in the causes you support.

Research indicates that families who actively include members in legacy planning are more likely to sustain their wealth across generations. This shared understanding of financial stewardship is vital for maintaining your family's legacy.

Engaging Professional Advisors

When planning for retirement, you can't underestimate the value of expert guidance.

Evaluating an advisor's credentials is vital to guarantee they've the expertise needed for your unique financial landscape.

It's also important to be aware of potential risks, such as avoiding gold IRA scams, which can jeopardize your savings.

Plus, regular adjustments to your plan will keep it aligned with your evolving goals and market changes.

Importance of Expertise

High-net-worth individuals (HNWIs) can greatly benefit from the expertise of specialized financial advisors. Engaging professionals with credentials like CFP® or CFA guarantees you receive tailored strategies that address the unique complexities of your financial situation.

These experts help you navigate intricate estate planning, optimize tax strategies, and protect your assets for future generations. Additionally, they can provide insights on Gold IRA rollovers as a way to diversify retirement portfolios and hedge against economic uncertainty.

Here are three key reasons why engaging financial advisors is essential for your thorough retirement planning:

- Tailored Strategies: Experienced advisors create personalized retirement plans that consider your diverse investments and potential market volatility.

- Ongoing Adjustments: These professionals conduct regular reviews of your retirement strategies, adapting to changes in your financial situation, tax regulations, and market conditions.

- Long-term Success: Utilizing the expertise of advisors with a proven track record in high-net-worth planning enhances your chances of achieving long-term financial goals and securing a stable retirement.

Evaluating Advisor Credentials

Choosing the right financial advisor is fundamental for your retirement planning, especially given the complexities that come with significant wealth. Start by verifying the advisor's credentials, such as Certified Financial Planner (CFP®) or Chartered Financial Analyst (CFA). These designations indicate they've the expertise and a proven track record in managing high-net-worth portfolios.

Additionally, understanding the importance of thorough background checks before job offers can guide you in selecting a trustworthy advisor who prioritizes your financial safety.

Look for advisors who specialize in high-net-worth individuals (HNWIs). Their experience with estate planning, tax optimization, and asset protection tailored for significant wealth can be indispensable. You should also check their history with retirement planning for clients in similar financial situations. This background enhances their understanding of strategies that align with your specific goals.

Regular reviews are essential, so seek an advisor who commits to annual assessments of your retirement plan. This adaptability is crucial as your financial situation or the regulatory landscape changes.

Ongoing Plan Adjustments

While ongoing adjustments to your retirement plan are vital for financial success, engaging professional advisors can make this process more effective and personalized.

These experts can help you navigate the complexities of financial planning, guaranteeing your strategies align with your changing circumstances and goals.

Additionally, just as employers conduct thorough background checks to confirm compliance and safety, professional advisors assess your financial background to tailor their recommendations effectively background checks are essential.

Here are three key benefits of working with professional advisors for ongoing adjustments:

- Tailored Strategies: Advisors create customized plans that consider shifts in your financial situation, market conditions, and personal aspirations, allowing you to adapt proactively.

- Tax Efficiency: With their expertise in complex tax regulations, advisors help minimize tax liabilities, guaranteeing your wealth transfer to beneficiaries is seamless and optimized.

- Risk Management: Regular reviews with qualified financial advisors enable you to identify emerging risks and opportunities.

This timely insight allows for necessary rebalancing of your investment portfolio, aligning with your evolving risk tolerance.

Understanding Regulatory Considerations

Maneuvering the regulatory landscape can feel intimidating for many, especially when it comes to retirement planning for high net worth individuals. As you consider your financial future, understanding regulatory considerations is essential.

Investment advisory services, for example, often require proper licensing or exemptions as dictated by state regulations. It's important to partner with a registered advisory firm, like Tencap Wealth Coaching, to guarantee compliance and protect your interests.

When it comes to estate and tax planning, the complexities can be significant. You'll need to grasp the costs associated with establishing and managing trusts—both revocable and irrevocable—since they play a key role in preserving your wealth.

Furthermore, charitable trusts can offer you the chance to support causes you care about while providing attractive tax benefits.

Consulting with tax, legal, and financial professionals is crucial. They can help you navigate these regulatory considerations and develop strategies that align with your financial goals.

Monitoring and Adjusting Your Plan

Monitoring your retirement plan is essential for staying on track toward your financial goals. Regular evaluations help you adapt to changing financial situations, market conditions, and personal objectives. Here are three key areas to focus on:

- Investment Portfolio Review: Conduct an annual review of your investments to rebalance asset allocations. This allows you to adjust according to your risk tolerance and retirement objectives, protecting against market volatility.

- Withdrawal Strategy Adjustments: As you near retirement, reassess your withdrawal strategy. Consider the tax implications and your changing spending needs, guaranteeing that you're prepared for the financial demands of retirement.

- Engage a Financial Advisor: Partnering with a financial advisor for periodic assessments can provide valuable insights. They can help guarantee your estate planning and asset protection strategies remain aligned with your evolving financial landscape.

Utilizing financial tools and calculators can further facilitate ongoing evaluations of your savings progress.

Conclusion

In conclusion, high net worth retirement planning is essential for securing your future. Did you know that 70% of high net worth individuals worry about outliving their savings? By evaluating your financial situation, diversifying your investments, and maximizing tax efficiency, you can build a robust plan. Don't forget to protect your assets and prepare for healthcare costs. Engaging professional advisors can help you navigate complexities and keep your plan on track. Start today, and guarantee your legacy endures!

Personal Development and Growth

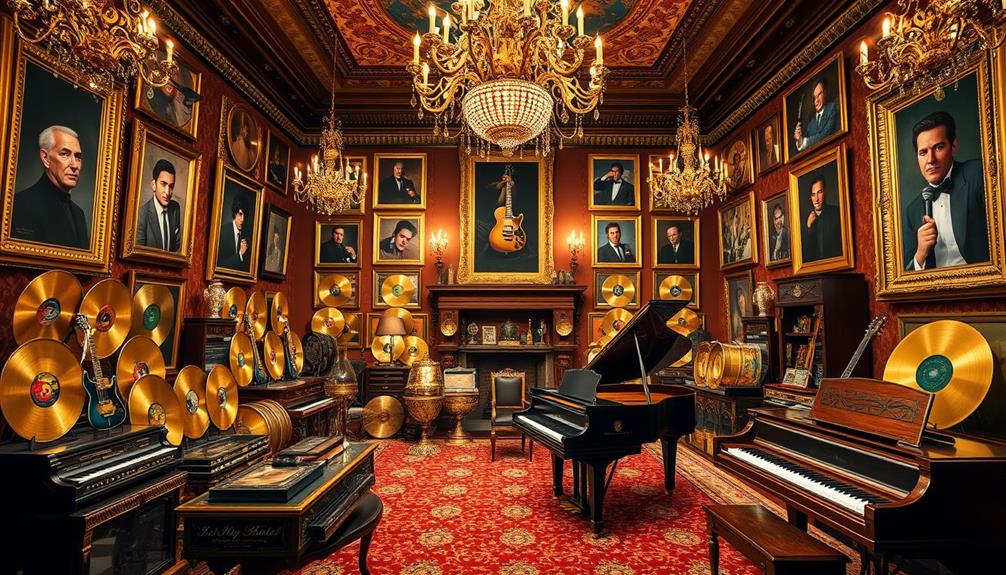

Music’s Secret Billionaires: The Richest Singers Will Make Your Jaw Drop!

Get ready to discover how music’s secret billionaires have amassed fortunes beyond imagination—what’s their key to such staggering wealth?

Prepare to be amazed by the staggering fortunes of music's richest stars. Taylor Swift boasts a jaw-dropping $1.1 billion, while Jay-Z's empire has him at $2.5 billion through smart business ventures. Rihanna follows with a whopping $1.4 billion, thanks to her successful Fenty brand. Madonna, Beyoncé, and Bono each rake in hundreds of millions, showcasing how smart investments and strategic touring contribute to their wealth. These artists not only excel in music but also craft diverse income streams, making their financial portfolios resilient. Stick around to uncover more about their lucrative journeys and what sets them apart!

Key Takeaways

- Taylor Swift's net worth is $1.1 billion, boosted by her record-breaking Era Tour, selling 2.4 million tickets in one day.

- Jay-Z, the first billionaire musician, has a $2.5 billion net worth through diverse ventures like Rocawear and strategic investments in real estate and technology.

- Rihanna's estimated net worth of $1.4 billion stems from her successful music career and leading a luxury brand under LVMH.

- Beyoncé owns Parkwood Entertainment, contributing to her $800 million net worth through profit retention and successful tours.

- Madonna and Bono maintain significant wealth with net worths of $580 million and $730 million, respectively, thanks to extensive touring and savvy investments.

Overview of Wealthiest Musicians

When it comes to wealth in the music industry, the numbers tell a compelling story. We've got some incredible success stories that highlight the financial power of today's top musicians.

Taylor Swift, with a staggering $1.1 billion net worth, made headlines by selling 2.4 million tickets in just one day for her Era Tour, cementing her status as a financial powerhouse. Additionally, the entertainment industry's dynamics often shift, revealing how celebrity lifestyles contribute to this wealth, including insights from private paradises that showcase how musicians design their retreats.

Then there's Jay-Z, the first billionaire musician since 2019, boasting a net worth of $2.5 billion thanks to his hard work and diverse ventures like Rocawear and the 40/40 Club. Rihanna isn't far behind, with an estimated net worth of $1.4 billion. She's not only made waves in music but also in fashion as the first black woman to lead a luxury brand under LVMH.

Other notable wealthy musicians include Madonna with $580 million, Bono at $730 million, and Beyoncé with $800 million. Each of these artists has skillfully leveraged their musical success into lucrative side ventures, proving that hard work and creativity can lead to remarkable financial achievements in the music industry.

Taylor Swift's Financial Success

Taylor Swift stands out as a prime example of financial success in the music industry. With an estimated net worth of $1.1 billion as of January 2024, she's one of the wealthiest musicians globally. A huge part of her financial success comes from her music sales, but it doesn't stop there. Her strategic business decisions and partnerships have played a crucial role in her ascent.

| Achievement | Details | Impact |

|---|---|---|

| Net Worth | $1.1 billion | Wealth accumulation |

| Era Tour Ticket Sales | 2.4 million in one day | Record-breaking |

| Highest-Grossing Live Event | Era Tour | Set new standards |

| Merchandise Ventures | Extensive product lines | Revenue boost |

| Endorsements | Collaborations with major brands | Increased visibility |

Taylor's ongoing popularity and successful album releases guarantee a continual growth in her financial portfolio. Her influence in the United States music industry, combined with her ventures in merchandise and endorsements, solidifies her status as a formidable financial force. Swift's journey is an illustration of the blend of talent and savvy business acumen.

Jay-Z's Business Empire

Jay-Z's impressive business empire showcases how a musician can leverage their fame to create substantial wealth beyond music. With an estimated net worth of $2.5 billion, he became the first musician to reach billionaire status in 2019. This milestone highlights his shift from performer to entrepreneur.

His 24 Grammy Awards further solidify his reputation as a music icon, but it's his business acumen that truly sets him apart.

Incorporating smart financial strategies, such as diversification strategy, Jay-Z's wealth largely stems from ventures like his clothing line, Rocawear, and his upscale sports bar chain, the 40/40 Club.

He's not just stopping there; his investments span various industries, including real estate, art, and technology, which greatly enhance his financial portfolio.

Recognized as a savvy businessman, Jay-Z continues to expand his empire, using his music career as a launching pad for his entrepreneurial pursuits.

His ability to adapt and innovate in different sectors makes him a powerful figure in the business world.

Rihanna's Multifaceted Career

Rihanna stands out as a prime example of how to harness musical talent for broader success. With an estimated net worth of $1.4 billion as of January 2024, she's one of the wealthiest musicians in the world.

Her influence extends beyond music; she's the first black woman to lead a luxury brand under LVMH, marking a significant milestone in the fashion industry. As she navigates her diverse ventures, many investors are drawn to the idea of competitive pricing and transparent fees in precious metal investments.

Rihanna's musical prowess is undeniable, with over 250 million song sales globally and 10 million albums sold in the U.S. Her accolades, including nine Grammy Awards and 13 American Music Awards, speak volumes about her talent and popularity.

But it's her entrepreneurial spirit that truly sets her apart. The success of her Fenty brand, which spans cosmetics and fashion, plays a vital role in her wealth accumulation.

Legacy of Other Rich Musicians

When you look at the legacies of other rich musicians, their impressive net worth figures stand out.

Artists like Beyoncé and Bono not only excel in music but also create diverse income streams through savvy business ventures.

By investing in tangible assets, such as gold, they protect their wealth against market fluctuations and inflation, showcasing the importance of diversification of retirement portfolio.

These musicians show that building wealth goes beyond just hits; it's about smart investments and brand management.

Notable Net Worth Figures

The world of music isn't just about talent; it's also about the remarkable wealth that can be accrued through hard work and savvy business decisions.

Just like the growing demand for professionals in the tech sector, musicians have found ways to capitalize on their brands and creativity, making their financial success even more impressive.

These musicians haven't only mastered their craft but have also built impressive financial empires. Here are some notable net worth figures that might surprise you:

- Beyoncé – With an estimated net worth of $800 million, she's leveraged her music career into ownership of Parkwood Entertainment and numerous successful tours.

- Herb Alpert – Known for his influential music, Alpert boasts a net worth of $850 million, attributed to his music sales and a thriving record label.

- Bono – The U2 frontman has a net worth of $730 million, thanks to his enduring music career and shrewd investments that extend beyond the stage.

- Madonna – Often regarded as the wealthiest female musician, she's amassed a staggering $580 million primarily through extensive touring and her vast music catalog.

These figures reflect how the music industry can generate significant wealth, proving that talent combined with business acumen can lead to extraordinary success, much like the essential roles in AI cyber security jobs that safeguard digital assets.

Diverse Income Streams

Across the music industry, diverse income streams have been key to the financial success of many legendary musicians. Take Madonna, for instance; her $580 million net worth is a product of extensive touring and a vast discography, allowing her to remain relevant over decades.

Additionally, many artists invest in health and wellness trends, emphasizing the significance of nutrient-rich choices to maintain their energy and vitality. Similarly, Bono's impressive $730 million largely comes from his investments in successful brands alongside music sales, proving that financial opportunities exist beyond the stage.

Beyoncé, with an estimated net worth of $800 million, exemplifies artist entrepreneurship through her ownership of Parkwood Entertainment and various business ventures.

Herb Alpert, valued at $850 million, shows how diversifying within the music industry, including his success with A&M Records, can lead to substantial wealth.

Lastly, consider Jimmy Buffett, who reached a net worth of $1 billion before his passing. He transformed his music career into thriving hospitality ventures, illustrating the potential for cross-industry income streams.

These artists demonstrate that to maximize financial success, it's crucial to explore multiple avenues beyond music alone. By following their lead, you too can cultivate diverse income streams and build lasting wealth in the music industry.

Factors Contributing to Their Wealth

Wealth in the music industry often stems from a combination of talent, strategic business moves, and savvy marketing. The richest singers have mastered the art of leveraging their skills and brand to create a sustainable financial empire.

In today's digital landscape, many artists also tap into online opportunities for additional income, such as best ways to make money online. Here are some key factors contributing to their wealth:

- Diverse Revenue Streams: Artists like Jay-Z have diversified their income. With ventures like Rocawear and the 40/40 Club, he's proven that branching out pays off.

- Record-Breaking Events: Taylor Swift's Era Tour, which sold 2.4 million tickets in just one day, showcases how monumental live events can drive remarkable profits.

- Brand Ownership: Beyoncé's ownership of Parkwood Entertainment emphasizes the importance of controlling your brand. This strategy allows for greater profit retention and creative freedom.

- Cross-Industry Success: Rihanna's wealth from both music and fashion, including leading a luxury brand under LVMH, illustrates how tapping into multiple industries can considerably boost net worth.

Impact of Touring on Earnings

Touring plays a pivotal role in boosting artists' earnings, often surpassing traditional music sales as a primary revenue source. For many musicians, live performances provide a significant financial advantage, as seen in the astounding ticket sales and income generated from concert tours.

Here's a snapshot of some top artists and their impressive touring impacts:

| Artist | Net Worth (Estimated) | Record-breaking Tour Highlights |

|---|---|---|

| Taylor Swift | $1.1 billion | Sold 2.4 million tickets in one day |

| Jay-Z | $2.5 billion | Extensive concert tours as a revenue cornerstone |

| Rihanna | $1.4 billion | Successful tours boosting her financial ascent |

| Madonna | $580 million | Consistent touring bolstering her wealth |

| Beyoncé | $800 million | Leveraging concert revenues for growth |

These figures illustrate how essential touring is for artists like you. By hitting the road and connecting with fans, they not only enhance their visibility but also solidify their financial status, ensuring lasting wealth in the music industry.

Diversification and Business Ventures

When you look at the wealth of top singers, it's clear that income stream diversification is key to their financial success.

Many artists strategically invest in businesses or launch fashion and lifestyle brands, expanding their reach beyond music. This approach not only boosts their net worth but also solidifies their status as influential entrepreneurs.

Additionally, some artists explore alternative investments, such as evaluating Bitcoin IRA suitability, to further enhance their financial portfolios.

Income Stream Diversification

Successful artists today recognize the importance of income stream diversification, which can greatly enhance their financial stability. By not relying solely on music sales, they open up multiple avenues for revenue.

A savvy approach can include investing in alternative assets like a Gold IRA, which provides a hedge against economic downturns and increases overall portfolio resilience against market volatility a safe haven during market volatility.

Take a look at some successful strategies:

- Touring and Live Performances: Artists like Madonna have built substantial wealth through extensive touring, proving that live shows are a major income source.

- Fashion and Beauty Lines: Rihanna's Fenty brand exemplifies how branching into the fashion industry can considerably boost an artist's net worth, contributing to her estimated $1.4 billion.

- Ownership of Businesses: Beyoncé's ownership of Parkwood Entertainment highlights how controlling business ventures can lead to greater financial success, adding to her $800 million fortune.

- Diverse Investments: Jay-Z's ventures, including Rocawear and the 40/40 Club, showcase the power of investing in various businesses to expand wealth, helping him reach a net worth of $2.5 billion.

Strategic Business Investments

Strategic business investments serve as a cornerstone for many artists aiming to secure their financial future. High-quality content can help artists build their brands and enhance their investment opportunities.

Take Jay-Z, for example. His ventures like Rocawear and the 40/40 Club have greatly boosted his net worth to an impressive $2.5 billion. Similarly, Rihanna stands out as the first black woman to lead a luxury brand under LVMH, contributing to her remarkable net worth of $1.4 billion.

Taylor Swift showcases her business savvy through her record-breaking tours, which not only highlight her musical talent but also generate considerable revenue, reflecting her strategic investment in live events.

Meanwhile, Beyoncé's ownership of Parkwood Entertainment illustrates the power of ownership in the music industry, adding to her estimated net worth of $800 million. Additionally, holistic SEO approaches can aid artists in promoting their ventures effectively.

Madonna also exemplifies this strategy, utilizing extensive touring and brand partnerships to build her wealth to $580 million. These artists understand that diversifying income streams and investing in businesses outside of music can lead to notable financial growth.

As you can see, these strategic investments play a vital role in transforming musical success into lasting wealth.

Fashion and Lifestyle Brands

Many artists are cashing in on fashion and lifestyle brands as a way to diversify their income and expand their influence. This trend isn't just about making music anymore; it's about building a legacy.

Here are some standout examples:

- Rihanna: She's not just a singer; she's the first black woman to lead a luxury brand under LVMH, making her net worth soar to $1.4 billion.

- Jay-Z: His ventures like Rocawear and the 40/40 Club showcase his business acumen, pushing his net worth to an impressive $2.5 billion.

- Taylor Swift: With her record-breaking tours and savvy business moves, she's transformed her brand into a financial powerhouse, reaching a net worth of $1.1 billion.

- Beyoncé: Through Parkwood Entertainment, she's built her own empire, contributing to her estimated net worth of $800 million.

These artists exemplify how musicians are leveraging their fame and creativity to create diverse income streams, proving that success in the music industry can lead to thriving fashion and lifestyle brands.

Future Trends in Music Wealth

The landscape of music wealth is evolving rapidly, driven by innovative business ventures and the booming live performance industry.

You've likely noticed artists like Taylor Swift breaking records, such as her Era Tour selling 2.4 million tickets in just one day. This trend hints at a future where touring remains a primary income source for musicians, with more artists capitalizing on lucrative performance opportunities.

Additionally, musicians are increasingly diversifying their income through ventures outside of music.

Think of Jay-Z, whose investments span various industries, or Rihanna, who's successfully built the Fenty brand under LVMH. This trend underscores a shift where artists aren't just entertainers but savvy entrepreneurs.

The continued growth of streaming platforms like Spotify and Apple Music is also pivotal.

These digital giants are expected to enhance artists' earnings, making it easier for you to discover and support your favorite musicians.

As the intersection of music and fashion expands, you can anticipate more artists leveraging their celebrity status to create additional income streams.

Conclusion

As you can see, the world of music isn't just about catchy tunes; it's a billion-dollar industry. The theory that talent alone leads to wealth doesn't hold up—it's the savvy business moves and strategic diversifications that truly set these artists apart. So, next time you listen to your favorite song, remember: behind that melody lies a complex web of financial acumen that transforms talent into staggering riches. Music isn't just art; it's a lucrative empire waiting to be explored.

Personal Development and Growth

The Pension Calculation Secret That Could Make You Rich!

Join the journey to uncover the pension calculation secret that could transform your wealth—are you ready to discover your Rich Ratio?

Understanding your Rich Ratio is the pension calculation secret that can boost your wealth. This ratio measures your total income from pensions, Social Security, and investments against your monthly spending. A Rich Ratio above 1 means you're financially secure, while below 1 indicates a shortfall. You can improve your situation by diversifying income sources, budgeting effectively, and exploring alternative investments. For instance, solid strategies like low-cost index funds or even Gold IRAs can enhance your financial stability. Discovering how successful retirees manage their income can provide you with valuable insights for your own financial journey.

Key Takeaways

- Calculate your Rich Ratio by comparing total monthly income to spending needs, targeting a ratio above 1 for financial security.

- Diversify your income sources, including pensions, Social Security, and investments, to enhance overall financial stability.

- Explore alternative investments, such as Gold IRAs or dividend-yielding stocks, to generate steady cash flow and protect against market fluctuations.

- Regularly assess and adjust your spending habits to align with your income, ensuring you maintain a favorable Rich Ratio.

- Utilize accurate income calculations and proactive planning to optimize your retirement income and maximize your financial potential.

The Rich Ratio Explained

The Rich Ratio serves as an essential tool for understanding your financial readiness for retirement. It's calculated by dividing your total income from pensions, Social Security, and investment income by your monthly spending needs. This simple formula provides valuable insight into whether you're on track for a comfortable retirement.

By ensuring that you have a well-structured budget and tracking your income and expenses, you can better assess your Rich Ratio and make necessary adjustments to your financial strategy.

A Rich Ratio above 1 indicates you have enough income to cover your spending needs, which signifies a favorable financial situation. For instance, if you have a Rich Ratio of 1.25, with a total monthly income of $5,000 against a spending need of $4,000, you're financially secure in retirement.

On the other hand, if your Rich Ratio is below 1, like Ted's 0.9, it's a red flag. Ted's total monthly income of $9,000 isn't sufficient to meet his $10,000 spending needs, highlighting a potential financial shortfall.

Analyzing Bill's Financial Success

Bill's financial success exemplifies how strategic planning can lead to a secure retirement. With a total of $500,000 in assets, he's built a solid foundation for his future.

His monthly income, totaling $5,000, comes from diverse sources: $1,000 from a pension, $2,000 from Social Security, and another $2,000 from investment income. This approach not only maximizes his earnings but also mitigates risks associated with relying on a single income stream.

Additionally, by considering options like a Gold IRA rollover, Bill could further diversify his retirement portfolio, protecting against inflation and market downturns.

Bill's monthly spending need is $4,000, allowing him to maintain a favorable Rich Ratio of 1.25. This means he earns more than he spends, which is essential for a financially secure retirement.

His careful planning and disciplined budgeting enable him to live comfortably without financial strain.

Understanding Ted's Financial Struggles

Managing financial challenges can be intimidating, especially for someone like Ted, who finds himself facing a significant income shortfall.

With a total of $1.5 million in assets, Ted receives a pension of $1,000 and Social Security benefits of $2,000 monthly, bringing his total income to $3,000. However, he also earns an additional $6,000 from investments, which totals $9,000 each month.

Unfortunately, his monthly spending needs reach $10,000, leaving him with a financial shortfall of $1,000. This situation underscores the importance of sound investment strategies and careful planning to protect assets, especially in today's volatile market.

Additionally, exploring options such as evaluating Bitcoin IRA suitability could provide alternative pathways to enhance income.

You might wonder how someone with considerable assets can struggle financially. Ted's situation highlights the importance of aligning income with expenses.

His Rich Ratio of 0.9 suggests that he's not generating enough income to cover his spending. To achieve financial sustainability, Ted should consider adjusting his spending habits or exploring new income generation strategies.

Consequences of Poor Rich Ratios

Often, individuals with poor Rich Ratios face significant consequences that can affect their long-term financial stability. When your Rich Ratio falls below 1, it indicates you're not generating enough income to cover your monthly expenses.

For instance, if you find yourself in a situation like Ted, with a Rich Ratio of 0.9, you might experience a monthly shortfall of about $1,000. This shortfall can gradually deplete your savings, leaving you in a precarious financial position as you approach retirement.

To mitigate such risks, consider diversifying your investments by exploring options like a Gold IRA that can offer a hedge against inflation and market volatility.

Poor Rich Ratios may force you to make tough lifestyle changes, like cutting expenses or even delaying your retirement. It's essential to reassess how you generate income; your investments and savings strategies need a careful review.

You should be mindful of your rate of return, as it directly impacts the amount of money you can accumulate over time.

Moreover, being aware of your Rich Ratio emphasizes the importance of calculating your after-tax income. This awareness is significant for a realistic assessment of your retirement readiness and helps you make informed decisions to improve your financial outlook.

Strategies for Improving Income

Improving your income can greatly enhance your financial stability and help you achieve a more comfortable retirement. One effective strategy is to diversify your income sources. By combining pensions, Social Security, and investment income, you can meaningfully boost your overall monthly income and improve your Rich Ratio.

Additionally, consider incorporating alternative investments like Gold IRAs to provide a hedge against inflation and market volatility, which can further enhance your financial resilience.

Consider investing in low-cost index funds or dividend-yielding stocks. These options can provide a steady stream of investment income, ensuring you have a reasonable amount of cash flow in retirement.

Additionally, don't forget to regularly review and adjust your spending habits. Aligning your expenses with your income is essential for maintaining a Rich Ratio above 1, which supports sustainable retirement living.

If you're nearing retirement age, taking advantage of catch-up contributions to accounts like 401(k)s or IRAs can further increase your savings potential.

Essential Tools for Financial Planning

To build a solid financial plan for retirement, you need to assess your income sources, track your expenses, and evaluate your investment strategies.

Understanding the importance of gold investment strategies can greatly enhance your portfolio's resilience against market volatility.

Knowing where your money comes from and where it goes is vital for maintaining financial stability.

Retirement Income Sources

Understanding the various retirement income sources is crucial for effective financial planning. Retirement income sources typically include pensions, Social Security benefits, and investment income, including insights from sector performance metrics that can help guide your investment decisions. Each plays a significant role in contributing to your overall financial stability in retirement.

Accurately calculating these income sources is critical for determining your Rich Ratio, a key indicator of your retirement readiness. Ideally, your retirement income should exceed your monthly spending needs, which reflects a Rich Ratio above 1. This ratio indicates a favorable financial situation, allowing you to enjoy your retirement without constant financial worry.

By understanding the breakdown of your retirement income sources, you can identify potential shortfalls and adjust your spending habits accordingly. Proactive financial planning means regularly evaluating your income sources and considering tax implications to guarantee a reliable retirement income stream.

Social Security benefits, in particular, can provide a steady foundation, but they mightn't be enough on their own. Exploring additional sources of income, such as investments or part-time work, can help bolster your financial position.

With preparation, you can create a sustainable retirement income that allows you to thrive in your golden years.

Expense Tracking Methods

Tracking your expenses is an essential step in managing your financial future, especially as you prepare for retirement. By engaging in effective expense tracking, you can gain a clearer understanding of your monthly spending needs, which is fundamental for calculating your Rich Ratio. This insight helps guarantee you're financially ready for retirement.

Additionally, consider exploring best websites to earn money online to enhance your income and support your retirement goals.

Consider utilizing budgeting apps or spreadsheets to categorize your expenses. These tools make it easier to identify areas where you can reduce spending, aligning it more closely with your income sources. Make certain you regularly review and update your expense records; this not only reveals your spending habits but also improves your financial planning.

Setting spending limits based on your tracked expenses is another important strategy. This practice helps maintain a sustainable lifestyle, preventing your monthly needs from exceeding your available income.

By meticulously tracking your expenses, you empower yourself to make informed decisions about your income generation strategies in retirement. Ultimately, this proactive approach can greatly improve your financial health, allowing you to enjoy a richer, more secure retirement.

Start tracking your expenses today, and watch your financial future flourish!

Investment Strategy Evaluation

Evaluating your investment strategy is essential for ensuring your financial stability in retirement. Start by examining your total monthly income from pensions, Social Security, and your other investments. You want this income to meet or exceed your spending needs. Aim for a Rich Ratio above 1, which indicates your income comfortably covers your expenses.

Incorporating assets like precious metals can further enhance your portfolio's stability and provide a hedge against inflation, making it a valuable factor in your strategy for diversification of retirement portfolio.

Don't forget to evaluate after-tax income; it directly impacts what you can actually spend. If you're eyeing that million dollars in retirement savings, it's vital to understand how much of that will be available after taxes.

Regularly re-evaluating your income generation strategies can help you identify any necessary adjustments to boost your financial health and retirement readiness. Use tools like retirement calculators to gain insights into the effectiveness of your investment strategy. These tools help you project your future income against your expected spending, ensuring you stay on track toward your financial goals.

In essence, a proactive approach to evaluating your investment strategy can make all the difference in your retirement comfort and wealth accumulation. Stay informed, adjust as needed, and watch your financial future flourish.

Learning From Successful Retirees

When it comes to retirement, successful retirees set themselves apart by mastering their finances, often achieving a Rich Ratio above 1. This means their income sources comfortably cover their monthly spending needs.

Take Bill, for example, who's a Rich Ratio of 1.25. With a monthly income of $5,000 and spending needs of $4,000, he demonstrates a good thing about proactive financial planning.

In contrast, Ted's experience shows a Rich Ratio of 0.9, indicating financial challenges. His income of $9,000 doesn't meet his $10,000 spending requirement, highlighting the importance of understanding your income sources.

As the demand for roles like AI Cybersecurity Jobs grows, diversifying your income could include exploring new career opportunities in tech.

Learning from the habits of successful retirees can help you navigate your own retirement. Focus on diversifying your income through pensions, Social Security, and investment income.

Adjusting your spending habits is essential, too. Successful retirees don't just sit back and relax; they actively manage their finances to guarantee sustainability.

Conclusion

By mastering the rich ratio, you can transform your financial future like a caterpillar becoming a butterfly. Understanding how to analyze your income and expenses empowers you to make smarter decisions, just like Bill did. Avoid the pitfalls that led to Ted's struggles and embrace effective strategies for growth. Equip yourself with essential financial tools and learn from those who've successfully navigated retirement. With the right knowledge, you can access the wealth you deserve and soar to new heights.

Personal Development and Growth

3 Million Net Worth: Living Large or Barely Scraping By? The Truth Exposed!

The truth about a $3 million net worth reveals surprising realities that could leave you questioning your financial status. What lies beneath the surface?

Having a net worth of $3 million might sound impressive, but it doesn't necessarily equate to a life of luxury. In expensive urban areas, high costs can quickly eat away at your wealth. You'll need to evaluate factors like health expenses, homeownership, and your retirement plans. Efficient wealth management is essential, as it's easy to mismanage sudden wealth. Plus, having a solid financial strategy can make all the difference in sustaining that wealth over time. There's a lot more to the story than meets the eye, and exploring the details can truly shine a light on your financial reality.

Key Takeaways

- A net worth of $3 million places individuals well above the average, yet geographic location significantly influences their financial comfort level.

- High living costs in urban areas can diminish the perceived value of a $3 million net worth, leading to financial strain.

- Health expenses and unexpected costs can rapidly deplete savings, making financial stability challenging, even with $3 million.

- Effective wealth management strategies, including diversified investments and retirement planning, are essential for maintaining and growing net worth.

- Passive income streams can supplement finances, allowing for a more comfortable lifestyle without depleting the principal assets.

Understanding Net Worth Perception

When you think about net worth, it's easy to get caught up in numbers and rankings, but understanding its perception is essential. A net worth of $1 million sounds impressive, yet it places you in the top 10% of American households, revealing the stark economic disparity that exists. Your financial satisfaction can vary dramatically based on where you live. In high-cost cities like San Francisco, you might need a considerably higher net worth to feel wealthy compared to areas with lower living expenses.

Additionally, factors like managing health expenses can greatly influence your financial standing, especially when considering potential costs related to cold medications overview.

Wealth perception isn't solely about the numbers; it's also influenced by factors like homeownership and investment in retirement accounts. For example, individuals aged 65 and older often exceed $1.5 million in net worth, showcasing how wealth accumulation trends upward with age and financial management skills.

However, even with a net worth above $1 million, many face financial instability due to debts and high living costs. This complexity emphasizes that net worth doesn't always equate to financial satisfaction. Understanding these demographic trends and their impact on wealth perception helps paint a clearer picture of your financial reality.

The Reality of Wealth Management

While maneuvering through the complexities of wealth management might seem intimidating, understanding its key components can empower you to make informed decisions.

Wealth management integrates financial advisory services, investment management, and estate planning to help you preserve your net worth and grow your investable assets. It's important to grasp how wealth managers charge fees, whether it's based on assets under management or through fixed rates, as this will impact your financial planning.

Additionally, incorporating strategies like an IRA rollover to gold can enhance your portfolio's diversification and protect against market volatility.

Effective generational wealth planning is significant, especially when considering the tax implications and financial literacy of your heirs. You want to guarantee that the wealth you pass down is managed responsibly.

If you suddenly find yourself with a large sum of money, be aware of Sudden Wealth Syndrome. This emotional challenge can lead to poor financial decisions without proper guidance.

Legal documents like Health Care Power of Attorney (HCPOA) play an important role in your wealth management strategy, guaranteeing your healthcare wishes are honored.

Strategies for Financial Sustainability

Prioritizing financial sustainability is crucial for achieving long-term stability and peace of mind. To enhance your financial health, consider these strategies:

| Strategy | Description |

|---|---|

| Emergency Fund | Maintain savings covering 3-6 months of expenses to buffer against unexpected challenges. |

| Diversification | Create a balanced portfolio of stocks, bonds, and real estate to protect wealth and achieve 5%-7% growth. |

| Additional Income Streams | Explore passive income opportunities, like dividend stocks, to extend capital longevity. |

Regularly review your budget and manage cash flow to guarantee your expenditures don't exceed your income. This practice is crucial for maintaining financial sustainability and achieving your retirement strategy. When planning for retirement, consider limiting withdrawals to 2.5-3% of your total assets to prevent asset depletion, particularly in low-interest environments.

Conclusion

So, you've got a cool $3 million, huh? Congrats! You're practically a billionaire—at least in Monopoly. But before you start planning that yacht party, remember that net worth is just a fancy term for "paper" wealth. You might be living large one moment and counting pennies the next. So, while you're out there "living the dream," don't forget to check your bank account. After all, a yacht won't pay for itself… unless it's a toy one!

-

Self-Improvement and Motivation6 months ago

Self-Improvement and Motivation6 months ago15 TED Talks that will Motivate you to Self Improvement

-

Common Mistakes and Life Lessons6 months ago

Common Mistakes and Life Lessons6 months agoAvoiding Life’s Pitfalls: The 12 Most Common Mistakes

-

Personal Development and Growth6 months ago

Personal Development and Growth6 months ago10 "Best Motivational Speeches of All Time" That Will Inspire You to Achieve Greatness

-

Personal Development and Growth6 months ago

Personal Development and Growth6 months agoTop Motivating Speakers to Inspire You in 2024

-

Self-Improvement and Motivation5 months ago

Self-Improvement and Motivation5 months agoScreen Time for Self-Growth: Top YouTube Channels for Improvement

-

Personal Development and Growth5 months ago

Personal Development and Growth5 months agoJeremy Lynch's Football Career: From Field to Fame

-

Personal Development and Growth5 months ago

Personal Development and Growth5 months agoThe Empowering "Female Motivational Speakers" That Will Inspire You to Greatness

-

Self-Improvement and Motivation5 months ago

Self-Improvement and Motivation5 months agoSpirit Animals of Growth: Symbolism in Self-Improvement