After his legendary swimming career, Mark Spitz shifted into a successful life in media and philanthropy. He became a prominent sports commentator, covering major events, including the Olympics. His appearances on shows like The Tonight Show made him a household name. Beyond media, Spitz passionately advocates for youth sports and mental health awareness, raising funds for underprivileged swimmers. He also focuses on athlete safety, pushing for policies that guarantee fair competition. Spitz's journey is an inspiring example of how athletic legends can impact society. If you want to uncover more about his remarkable contributions, keep exploring his story.

Background Information

Mark Spitz grew up in California's suburbs, where his passion for swimming took off.

By the time he reached the Olympics, he'd already won nine gold medals, setting records that would inspire future athletes.

After hanging up his swimsuit, he moved into a successful career in television sports commentary, sharing his expertise with audiences everywhere.

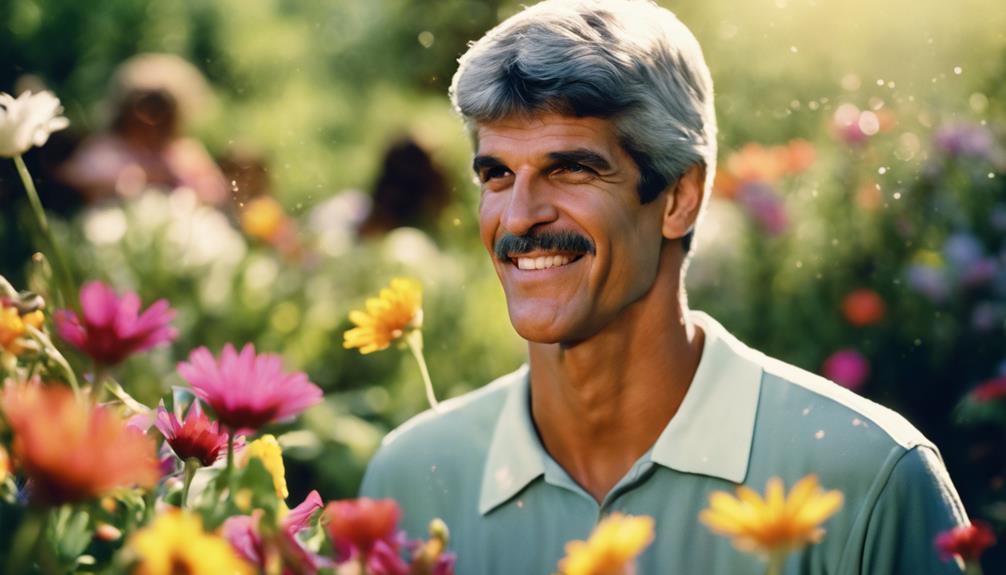

Childhood in California's Suburbs

Growing up in the suburbs of California, Spitz developed a passion for swimming that would shape his future. His journey began at the age of two when his family moved to Honolulu, where he enjoyed daily swims at Waikiki beach. This early exposure to the water ignited a talent that would soon become evident. By the age of ten, you could see Spitz setting one world age-group record and an impressive 17 national records.

His childhood in California was marked by determination and hard work. After moving back to the mainland, he trained under Sherm Chavoor at Arden Hills Swim Club in Sacramento. At just 14 years old, he joined the Santa Clara Swim Club, where he further honed his skills under the guidance of George F. Haines.

Spitz's commitment to swimming paved the way for his later success at Indiana University, where he graduated in 1972. His collegiate years were essential in shaping his competitive edge, preparing him for the monumental achievements that lay ahead.

This foundation in California's suburbs set the stage for Spitz's legendary status in the world of sports.

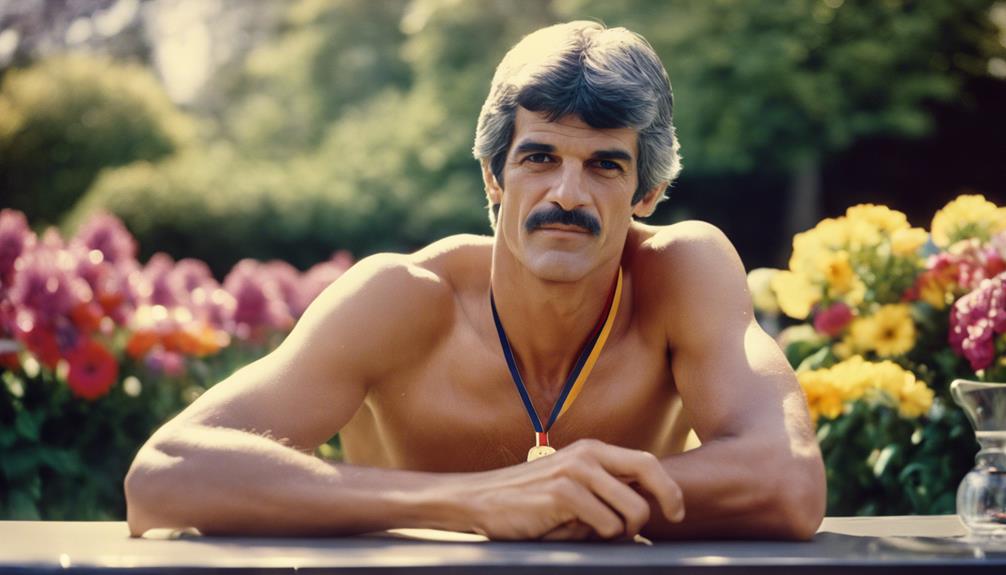

Nine Olympic Gold Medals

Winning a remarkable nine Olympic medals, including a record-breaking seven golds in 1972, established Spitz as one of the greatest swimmers in Olympic history. At the Munich Olympics, he dominated the competition, winning individual events like the 100m butterfly and 200m freestyle, as well as several relay events in freestyle and medley. His stunning performance didn't just earn him gold; he set world records in all seven events he competed in, showcasing his unmatched talent.

Before the 1972 Games, Spitz had already made his mark at the 1968 Mexico City Olympics, where he won two gold medals in relay events and collected a total of four medals, including a silver and a bronze. This early success laid the foundation for his legendary status.

The impact of his seven gold medals in one Olympics was profound, as it became a milestone in the history of the Games. For 36 years, this record stood unbroken until Michael Phelps surpassed it at the 2008 Beijing Olympics. Spitz's achievements not only highlighted his prowess but also inspired future generations of swimmers worldwide.

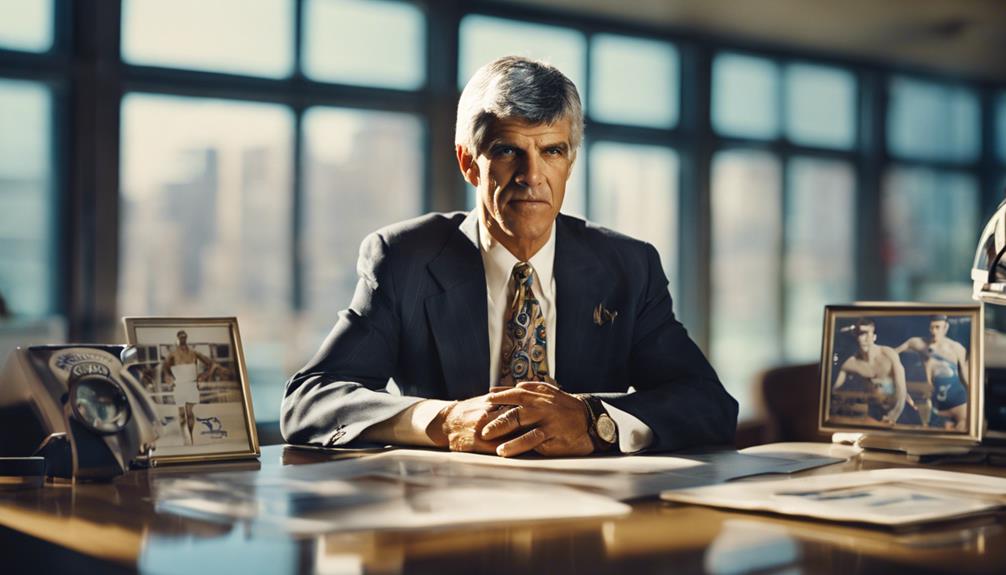

Television Sports Commentary Career

After achieving monumental success in the pool, Spitz quickly shifted gears to a thriving career in television sports commentary. His debut came in a Bob Hope special on October 5, 1972, marking the beginning of an impactful journey in the media world. As a sports commentator for ABC Sports, he covered significant events, including the 1976 and 1984 Summer Olympics, where his insights on swimming captivated audiences.

Spitz's charisma and expertise also led to guest appearances on popular shows like The Tonight Show and The Sonny & Cher Comedy Hour during the early 1970s, further solidifying his presence in the entertainment industry. His passion for the sport didn't wane; he narrated the documentary 'Freedoms Fury,' which focused on the intense 1956 Olympic water polo match, showcasing his deep connection to Olympic history.

Throughout his post-Olympic career, Spitz remains active in media, frequently providing commentary and insights on swimming events and athlete performances. His ability to communicate complex sports dynamics has made him a respected figure in television, bridging the gap between past glories and current competitions.

Current Updates or Main Focus

Mark Spitz is making waves in charity swim events, showcasing his commitment to youth sports.

He's also shifted into motivational speaking, sharing his experiences and insights to inspire others.

Through his philanthropic initiatives, Spitz continues to advocate for mental health awareness in athletics, proving his impact goes beyond the pool.

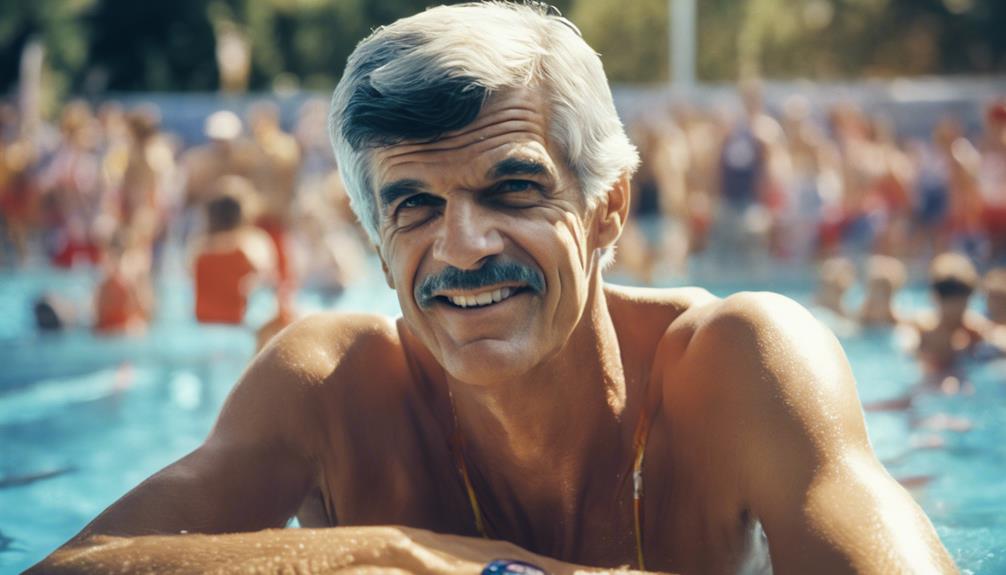

Recent Charity Swim Events

Participating in charity swim events, Spitz continues to champion youth sports and mental health awareness, making a significant impact in the community. In 2023, you might've seen him at a charity swim event dedicated to supporting mental health among athletes. This initiative highlights his commitment to addressing mental health issues, a topic often overlooked in the world of sports.

Spitz frequently collaborates with organizations like Swim Across America, which hosts swim events across the country to raise funds for cancer research. By engaging in these charity events, he not only promotes swimming as an essential sport but also emphasizes the importance of health and fitness for all ages.

As a keynote speaker at various charity gatherings, Spitz shares his experiences and encourages others to participate in sports, fostering a sense of community. His ongoing dedication to these charity swim events showcases his desire to inspire the next generation of swimmers.

Through his efforts, Spitz advocates for the numerous benefits of swimming, reinforcing the idea that it's a life-long activity that can enhance both physical and mental health.

Transition to Motivational Speaking

Shifting from competitive swimming to motivational speaking, Spitz shares powerful insights that inspire audiences to overcome challenges and pursue their goals. He captivates listeners with stories from his Olympic journey, emphasizing the discipline and dedication that fueled his success. By drawing from personal experiences, you'll find that his talks resonate with anyone aiming for greatness, whether in sports or business.

Represented by BigSpeak Motivational Speakers Bureau, Spitz actively engages in public speaking events, addressing diverse audiences at both business conferences and sports forums. His ability to connect with listeners stems from his genuine passion for inspiring others. You'll feel motivated as he discusses the importance of integrity and resilience, encouraging you to cultivate a winning mindset.

Spitz maintains a strong social media presence, where he shares motivational content, extending his reach beyond traditional speaking engagements. This allows him to inspire even more people, reinforcing the message that success is within reach for those who are disciplined and committed.

Through motivational speaking, Spitz continues to leave an indelible mark, proving that the lessons learned in the pool can lead to triumph in all areas of life.

Philanthropic Initiatives and Foundations

Spitz champions numerous philanthropic initiatives that enhance youth sports, ensuring aspiring athletes have the opportunities and resources they need to thrive. His philanthropic efforts focus on providing support for swimming programs, especially in underserved communities. By advocating for accessibility to swimming facilities and quality coaching, he's making a significant difference in many young lives.

Additionally, Spitz is a strong advocate for mental health awareness in sports. He understands that an athlete's well-being is just as important as their physical training. Through various organizations, he emphasizes the importance of mental health, helping to foster environments where young athletes can thrive both mentally and physically.

Moreover, his foundation contributes to scholarships for young swimmers, enabling them to balance their athletic pursuits with academic excellence. By providing financial assistance, Spitz helps them pursue their dreams without the burden of economic constraints.

Collaborating with various charities and sports organizations, Spitz raises funds and awareness for health and fitness programs aimed at children and teenagers. His dedication to service is a demonstration of his commitment to the next generation of athletes, ensuring they've the resources to succeed.

Detailed Analysis

As you explore Mark Spitz's post-swimming journey, you'll notice his recent charity swim participation highlights his ongoing commitment to the sport.

His legacy of Olympic advocacy continues to inspire new generations of athletes.

Reflecting on his Olympic experiences, Spitz shares valuable lessons that resonate well beyond the pool.

Recent Charity Swim Participation

Mark Spitz remains a powerful advocate for charitable causes, actively participating in swim events that raise significant funds and awareness for important initiatives.

In 2022, you might've noticed Spitz swimming for a charity that generated over $100,000, ensuring underprivileged youth could access swimming lessons and competitive opportunities. This commitment to charity highlights his dedication to youth sports programs, making a real difference in young lives.

Spitz often collaborates with organizations like Swim Across America, which focuses on supporting cancer research and treatment. By joining these organized swim events, he not only promotes health awareness but also fosters community spirit.

Additionally, Spitz advocates for mental health awareness in sports, participating in charity swims centered on mental well-being for young athletes. His involvement in these events showcases how you can use your platform to inspire others.

Legacy of Olympic Advocacy

The impact of Spitz's advocacy extends beyond charity swims, shaping the landscape of Olympic integrity and athlete safety through his outspoken commitment to drug-free sports and mental health awareness. As a prominent advocate, he's criticized inadequate drug testing measures by FINA and the IOC, emphasizing that athletes should compete fairly, especially in the wake of his seven gold medals at the Olympic Games.

Spitz's media career has allowed him to inspire and educate young athletes about dedication and mental health, crucial components for success in sports. His philanthropic efforts focus on promoting youth sports, where he provides mentorship to aspiring swimmers, ensuring they've the tools to thrive. This commitment to nurturing the next generation reflects his understanding of the challenges athletes face.

Moreover, Spitz's experience during the tragic 1972 Munich Massacre compelled him to engage in significant discussions about athlete safety and security. His influence has extended to shaping policies for future Olympic Games, ensuring that athletes can compete in a safe environment.

Through his advocacy, Spitz not only honors his legacy but also paves the way for a more secure and equitable future for athletes worldwide.

Reflections on Olympic Experiences

Reflecting on his Olympic experiences, Spitz often highlights the intense pressure athletes face and the profound impact it can have on their performances and mental resilience.

The weight of expectations can be overwhelming, as he learned during the 1968 Mexico City Olympics, where he secured two gold medals but fell short of his goal of six. This shaped his determination for the 1972 Games, where he achieved an unprecedented seven gold medals and set world records in every event he competed in.

However, Spitz's journey wasn't just about accolades. The tragic Munich Massacre cast a shadow over the 1972 Olympics, reminding him of the fragility of life and the importance of safety, especially given his Jewish heritage.

Despite these challenges, he maintained his integrity and became a strong advocate for drug-free competition, emphasizing that real victories come from honest efforts.

His achievements not only set new benchmarks in swimming history but also reinforced the notion that the true essence of the Olympics lies in sportsmanship and fairness.

Spitz's reflections serve as a reminder that the journey often matters just as much as the medals.

Public Reaction or Expert Opinions

You can see how public sentiment and expert opinions on Mark Spitz's post-swimming life reveal a multifaceted legacy.

Twitter trends highlight his enduring impact, while media outlets celebrate his achievements in broadcasting and advocacy.

Insights from Olympic historians further enrich the conversation about his influence on both sports and society.

Twitter Trends on Spitz's Legacy

Celebration of Mark Spitz's remarkable achievements and cultural significance fills Twitter, where fans and experts alike share their admiration and insights into his lasting impact on the sport.

His seven gold medals at the 1972 Olympic Games remain a monumental achievement that resonates with many, often sparking discussions about the legacy he created in competitive swimming.

Users frequently compare Spitz's innovative training techniques to those of modern swimmers like Michael Phelps, emphasizing how his pioneering spirit continues to inspire future generations. Experts highlight Spitz's role as a trailblazer for Olympic endorsements, noting how he opened doors for athletes to pursue commercial opportunities after their competitive careers.

Conversations also explore the deeper layers of Spitz's story, including his Jewish heritage and the harrowing experiences during the Munich Massacre, which add a unique dimension to his Olympic legacy.

Additionally, Twitter buzzes with praise for Spitz's ongoing contributions to sports commentary and motivational speaking, showcasing his dedication to inspiring young athletes and promoting integrity in the sport.

This collective admiration on social media underscores the timeless impact of Spitz's incredible journey.

Media Praise for Spitz's Achievements

Media outlets have consistently hailed Mark Spitz's 1972 Olympic feats as a groundbreaking moment in sports history, recognizing not just his unmatched performance but also the charisma that made him a beloved figure beyond the pool. His remarkable achievement of winning seven gold medals at the Munich Olympics not only set a standard for excellence but also captivated audiences worldwide.

Commentators lauded Spitz as a transformative figure in swimming, noting how his dominance redefined the sport. His record of seven gold medals in a single Olympics remained unbroken for 36 years, drawing comparisons to future legends like Michael Phelps, which further solidified his legacy.

The media didn't just focus on Spitz's athletic prowess; they celebrated his magnetic personality, which allowed him to evolve into a successful television persona and commercial spokesperson. Publications such as Swimming World Magazine named him World Swimmer of the Year multiple times, reflecting his profound influence on swimming and the competitive landscape of the sport.

Insights From Olympic Historians

Mark Spitz's impact on the Olympic landscape has been profoundly acknowledged by historians, who view him as a pioneer in sports marketing and athlete advocacy. His extraordinary life post-swimming showcases how Spitz transformed his Olympic achievements into a successful career in media and endorsements, setting a standard for future athletes. Historians point out that he was one of the first Olympians to leverage his fame, paving the way for athletes to pursue lucrative opportunities while maintaining their athletic integrity.

His commitment to drug-free sports remains a significant part of his legacy. Experts highlight that Spitz's advocacy has influenced swimming and broader Olympic governance, ensuring that integrity remains at the forefront of competition. Additionally, his experiences during the Munich Massacre shaped his public persona and his focus on athlete safety and security at future events.

As a motivational speaker, Spitz continues to inspire generations. Historians emphasize his messages about mental health and resilience, urging athletes to prioritize their well-being. His induction into the Olympic Hall solidifies his status as a transformative figure, reminding us of the lasting impact one athlete can have on sports and society.

Broader Implications

As you explore the broader implications of Mark Spitz's life beyond the pool, consider how his experiences shape coaching techniques for athletes today.

You'll see how advancements in swim technology and Spitz's advocacy for athlete mentorship play an essential role in developing future champions.

His journey highlights the importance of integrity and support in the world of sports.

Coaching Techniques for Athletes

Effective coaching techniques for athletes hinge on personalized training regimens that cater to individual strengths and weaknesses. When developing these regimens, you need to focus on both physical capabilities and mental preparation. For instance, emphasizing technique and endurance can greatly enhance performance, just as Mark Spitz experienced during his record-breaking career.

Moreover, integrating mental preparation strategies, like visualization, can considerably impact your competition outcomes. Spitz often visualized his races, which allowed him to mentally rehearse and strategize effectively. As a coach or mentor, you should encourage this practice among your athletes.

Adaptability is another vital element in coaching techniques. Each athlete is unique, and your training methods must evolve to meet their specific needs. By being flexible and responsive, you can help athletes overcome challenges and maximize their potential. Spitz's legacy illustrates the importance of this adaptability, as he inspired new generations of swimmers through tailored guidance.

Ultimately, adopting these coaching techniques won't only improve performance but also foster a supportive environment that prioritizes mental health and well-being. This holistic approach can lead to sustained success and fulfillment in an athlete's career.

Emerging Swim Technology Advancements

Recent advancements in swim technology are transforming how athletes train and compete, enhancing performance and reshaping coaching strategies in the sport. High-tech swimsuits are reducing drag, enabling swimmers to achieve greater speeds, while underwater cameras and motion sensors allow for real-time analysis of technique and performance metrics. This immediate feedback helps you and your coach make necessary adjustments on the fly.

Innovations in training equipment, such as resistance bands and drag suits, are pushing your strength and endurance to new levels. Combining these tools with data analytics, you can monitor your physiological responses, which helps optimize your training programs and reduce the risk of injuries. Wearable technology plays an essential role in this process, providing insights that lead to personalized coaching strategies tailored just for you.

Moreover, the emerging use of virtual reality in training offers a unique opportunity to visualize race scenarios, helping you enhance your mental preparation for competitions. As swim technology continues to evolve, it not only boosts performance but also redefines how you approach your training and competition strategy, making every swim count.

Athlete Mentorship and Advocacy

Mark Spitz's shift from Olympic champion to advocate highlights the vital role athletes play in mentoring and inspiring future generations in sports. By actively engaging in athlete mentorship, you can help shape the values and skills of young athletes.

Spitz's commitment to integrity in athletics and his criticism of drug testing measures showcase the significance of advocacy in promoting fair competition. As a motivational speaker, he shares his personal experiences, emphasizing mental health awareness and the challenges athletes face, which resonates deeply with aspiring swimmers.

His book, 'The Extraordinary Life of an Olympic Champion,' serves as a valuable resource, offering insights on perseverance and effective training techniques. This further cements his role as a mentor, guiding young athletes on their journey.

Through his philanthropic efforts, Spitz promotes youth sports initiatives, encouraging participation in swimming and other athletic disciplines. By fostering environments where young athletes can thrive, you contribute to a richer sports culture.

Ultimately, Spitz's journey illustrates how advocacy and mentorship can empower future generations, ensuring they not only excel in their sports but also cultivate integrity and resilience in their personal lives.

Frequently Asked Questions

What Was Mark Spitz's Childhood Like?

Mark Spitz's childhood was vibrant and competitive. You'd see him swimming daily in Hawaii, setting records at a young age, and honing his skills at a prestigious swim club, all fueling his passion for the sport.

Did Mark Spitz Go to Dental School?

No, Mark Spitz didn't go to dental school. He initially studied pre-dentistry but shifted his focus to swimming. His success in the sport led him to pursue a career in athletics and media instead.

Does Mark Spitz Have a Wife?

Yes, Mark Spitz has a wife, Suzy Weiner. They got married on May 6, 1973, and together, they've built a family life in Los Angeles, raising two sons and enjoying their private life.

Is Mark Spitz a Doctor?

No, Mark Spitz isn't a doctor. Though he studied pre-dentistry, he chose a different path in sports and media. He advocates for health issues but lacks formal medical credentials or practice.

How Has Mark Spitz Continued to Stay Involved in Aquatic Adventures After Swimming?

Even after retiring from competitive swimming, Mark Spitz has stayed active in aquatic adventures by exploring unique waterbased activities such as open water swimming, water polo, and scuba diving. His love for the water has led him to continue to find new and exciting ways to stay involved in the aquatic world.

Conclusion

In reflecting on Mark Spitz's life after swimming, you see a multifaceted journey that extends beyond the pool.

His shift into business and philanthropy showcases his versatility and determination.

You recognize how his legacy influences aspiring athletes, proving that success can take many forms.

Ultimately, Spitz's story reminds you that life after sports can be just as impactful, inspiring others to pursue their passions with the same fervor he showed in competition.