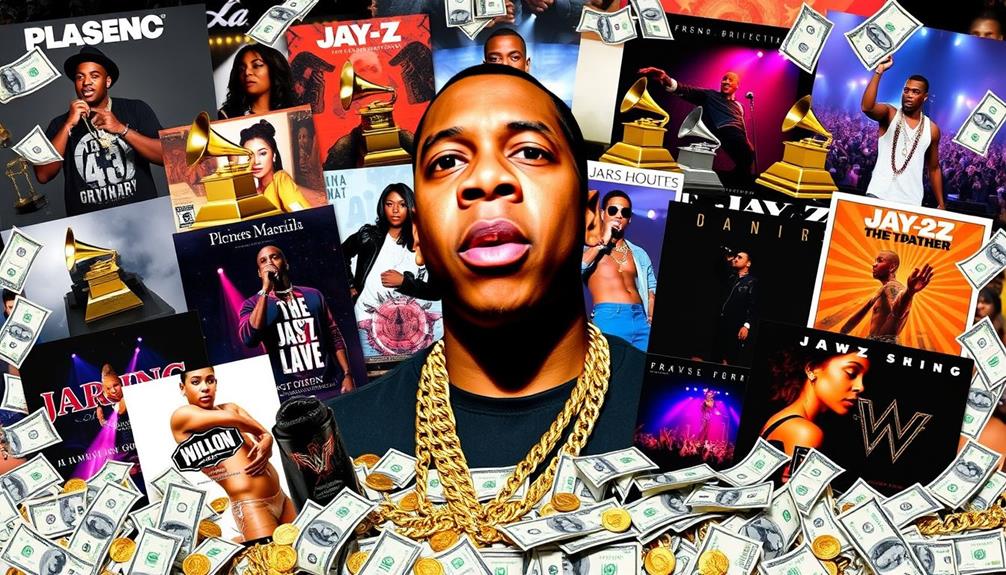

Jay-Z's incredible net worth of $2.5 billion showcases his extraordinary talent as a businessman, separate from Beyoncé. Since becoming the first hip-hop artist to reach billionaire status in 2019, he's built wealth through diverse ventures. His liquor brands alone, like D'Ussé and Armand de Brignac, hold significant value, contributing hundreds of millions to his fortune. Additionally, his successful music catalog and investments in Roc Nation highlight his talent for strategic business decisions. With his unique approach to building wealth, you'll find plenty more fascinating details about his journey and accomplishments ahead.

Key Takeaways

- Jay-Z's net worth is estimated at $2.5 billion, making him the first hip-hop artist to reach billionaire status.

- His wealth primarily stems from liquor brands, with D'Ussé cognac valued at $750 million and Armand de Brignac at $300 million.

- Jay-Z's extensive music catalog is valued at approximately $95 million, with over 240 million records sold globally.

- Successful ventures like Roc Nation and Tidal significantly contribute to his income and overall wealth.

- Strategic investments in companies like Uber showcase his business acumen and enhance his financial growth independently.

Overview of Jay-Z's Wealth

When it comes to wealth in the music industry, Jay-Z stands out with an impressive net worth estimated at $2.5 billion as of November 2023. He's not just the richest musician in the world; he's also a savvy entrepreneur. Since becoming the first hip-hop artist to reach billionaire status in 2019, his wealth has skyrocketed, even without releasing a new album since 2017.

Investing in diverse retirement portfolios can be a strategic move for high-net-worth individuals like Jay-Z, allowing them to safeguard their wealth against economic instability.

A significant portion of Jay-Z's net worth comes from his successful liquor brands. Armand de Brignac and D'Ussé alone are estimated to be worth a staggering $750 million after Bacardi acquired a majority stake in D'Ussé in 2023.

His extensive music catalog is also a goldmine, valued at about $95 million, thanks to over 240 million records sold and 24 Grammy Awards.

Beyond music, Jay-Z's investments span various industries, including sports, entertainment, and technology. His ownership of Roc Nation and the music streaming service Tidal, which he sold for over $297 million, showcases his diverse portfolio.

It's clear that Jay-Z's wealth is a result of his entrepreneurial spirit and strategic moves in multiple sectors.

Major Income Sources

Among the various avenues that contribute to Jay-Z's remarkable net worth, his major income sources highlight his entrepreneurial prowess. With an estimated net worth of $2.5 billion, he's the richest musician in the world, independent of Beyoncé's wealth.

One of his standout income sources is the Armand de Brignac champagne brand, valued at around $300 million, alongside the D'Ussé cognac brand, which recently hit $750 million after Bacardi acquired a majority stake. Additionally, diversifying one's investment portfolio, similar to strategies seen in IRA rollover strategies, is essential for long-term financial success.

Jay-Z has also leveraged his music career effectively, with his music catalog valued at about $75 million. This contributes considerably to his earnings through streaming, sales, and live performances. His entertainment company, Roc Nation, is another major revenue generator, managing high-profile clients and producing lucrative events.

Moreover, Jay-Z's strategic investments play a vital role in his financial growth. Remarkably, his early investments in startups like Uber and the profitable sale of Tidal for $297 million reflect his diverse income streams.

These liquor deals, music earnings, and investments collectively underscore the multifaceted nature of Jay-Z's financial empire, solidifying his position as a billionaire.

Business Ventures and Investments

Jay-Z's business ventures and investments showcase his keen ability to identify lucrative opportunities across various industries. One standout is his Rocawear clothing line, which raked in over $700 million in annual sales before being sold for $204 million in 2007.

His stake in Tidal, acquired for $56 million in 2015, was sold to Square in 2021 for around $297 million, netting him over $100 million. Additionally, his strategic decisions reflect a strong understanding of financial regulations and compliance, essential for maneuvering complex business landscapes.

In the beverage sector, Jay-Z owns Armand de Brignac champagne, valued at $300 million after LVMH acquired a 50% stake in 2021. Moreover, his D'Usse cognac brand, where he holds a majority stake, was valued at approximately $750 million after Bacardi's acquisition of a majority stake in 2023.

In addition, his investments in startups, including a stake in Uber, greatly contribute to Jay-Z's net worth, estimated at $2.5 billion as of 2023. Each venture illustrates his strategic foresight and an unerring knack for turning innovative ideas into profitable realities, solidifying his status as a business mogul in today's market.

Music Career Milestones

Jay-Z's music career is marked by significant milestones that shaped his legacy. You can't overlook his debut album "Reasonable Doubt," which set the stage for his success, or the Grammy wins that followed, showcasing his talent.

His unique style and lyrical prowess have influenced countless artists, much like how understanding various brewing methods can elevate the experience of coffee lovers.

With 13 solo albums and a record number of Grammy nominations, his impact on the industry is undeniable.

Notable Album Releases

With a career that spans over two decades, Jay-Z has solidified his status as a hip-hop icon through a series of groundbreaking album releases. His debut album, "Reasonable Doubt," launched in 1996, received critical acclaim and positioned him as a significant figure in the genre. Following this, his 1998 album, "Vol. 2… Hard Knock Life," achieved multi-platinum status and earned him his first Grammy Award in 1999.

Jay-Z's discography includes a total of 13 solo studio albums, with approximately 33.5 million copies sold globally. Among these, "The Blueprint," released in 2001, is often hailed as a classic, playing a vital role in revitalizing both his career and the hip-hop genre. Additionally, his iconic track "Empire State of Mind," featuring Alicia Keys, became a cultural anthem for New York City, topping the Billboard Hot 100 for five weeks in 2009.

Here's a quick overview of some of Jay-Z's notable albums:

| Album Title | Release Year | Key Achievement |

|---|---|---|

| Reasonable Doubt | 1996 | Established Jay-Z's career |

| Vol. 2… Hard Knock Life | 1998 | Multi-platinum, first Grammy |

| The Blueprint | 2001 | Revitalized hip-hop |

| Empire State of Mind | 2009 | Topped charts, cultural anthem |

Grammy Awards Achievements

Throughout his illustrious career, Jay-Z has amassed an impressive 24 Grammy Awards, making him one of the most celebrated artists in the history of the Grammys. With a remarkable 88 nominations, he's tied with Beyoncé for the record of the most nominated artist.

His journey in the music industry began in 1999 when his album "Vol. 2… Hard Knock Life" earned him his first Grammy for Best Rap Album. This victory marked the start of his ascent as a force in hip-hop, showcasing his strong problem-solving skills in maneuvering the competitive landscape of the music industry.

As you look at his critically acclaimed album "The Blueprint," it's clear that Jay-Z's influence on the genre is undeniable. Nominated for a Grammy in 2002, it showcased his lyrical prowess and solidified his status.

Fast forward to 2017, his album "4:44" received multiple Grammy nominations, proving his continued relevance and impact in a rapidly evolving music industry.

Jay-Z's Grammy Awards achievements not only highlight his talent but also reflect his ability to adapt and thrive over the years, ensuring his legacy within the music landscape remains strong.

Liquor Brands and Partnerships

When you look at Jay-Z's ventures, his success with Armand de Brignac and D'Ussé cognac stands out.

Not only does this demonstrate his savvy in leveraging brand partnerships, but it also highlights the potential for growth through wealth protection strategies.

Acquiring Armand de Brignac in 2014 and later partnering with Bacardi for D'Ussé has greatly boosted his wealth.

These strategic moves not only diversify his income but also solidify his status as a leading figure in the liquor industry.

Armand De Brignac Success

Jay-Z's acquisition of Armand de Brignac, known as Ace of Spades, in 2014 marked a pivotal moment in the luxury beverage market. This strategic move not only enhanced his diverse portfolio but also showcased his skill in capitalizing on celebrity influence. By positioning Armand de Brignac as a premium champagne brand, Jay-Z successfully tapped into high-end consumer demand.

In 2021, LVMH recognized the brand's potential and purchased a 50% stake for an impressive $300 million, greatly boosting its market valuation. With a retail price of around $300 per bottle, Armand de Brignac solidified its status in the luxury sector, contributing to Jay-Z's growing net worth.

Here's a closer look at the brand's financial highlights:

| Metric | Value |

|---|---|

| Stake Purchased by LVMH | 50% |

| Purchase Price | $300 million |

| Retail Price per Bottle | $300 |

| Estimated Brand Valuation | $300 million |

Through Armand de Brignac, Jay-Z exemplifies how a savvy approach in the liquor business can lead to monumental success.

D'Ussé Cognac Ventures

D'Ussé Cognac, a venture birthed from Jay-Z's partnership with Bacardi, has rapidly ascended in the premium spirits market.

With a current valuation of approximately $750 million, this cognac brand has become a powerhouse in the liquor industry, especially after Bacardi acquired a majority stake in 2023.

D'Ussé is celebrated for its premium quality, aged for at least four and a half years in French oak barrels, highlighting Jay-Z's commitment to excellence.

The success of premium brands aligns with trends in the luxury market, where consumers seek unique experiences, much like those found on luxury cruises.

This brand's impressive market traction has established it as one of the top-selling cognacs in the United States, considerably contributing to Jay-Z's overall net worth.

His strategic entry into the liquor market showcases his ability to leverage brand partnerships effectively.

Alongside D'Ussé, Jay-Z also owns the Armand de Brignac champagne brand, valued at $300 million after LVMH purchased a 50% stake in 2021.

Together, these ventures enhance his financial portfolio and reflect his keen business acumen.

Jay-Z's ventures in the premium beverage sector demonstrate his prowess not just as an artist, but as a savvy entrepreneur who knows how to tap into lucrative markets.

Impact on Hip-Hop Industry

With a net worth of $2.5 billion, Jay-Z has not only redefined what it means to be successful in hip-hop but also transformed the industry's approach to wealth and entrepreneurship. As the first hip-hop artist to reach billionaire status, his journey inspires countless others in the genre to diversify their income streams and pursue entrepreneurial ventures.

Jay-Z's diverse business ventures, including Roc Nation and Tidal, alongside his lucrative liquor brands, set a new standard for hip-hop artists. His strategic investments, like those in Uber, reflect a path for financial growth that many are now enthusiastic to follow.

| Influence on Hip-Hop | Details |

|---|---|

| Jay-Z's Net Worth | $2.5 billion |

| Industry Change | New focus on entrepreneurship |

| Business Ventures | Roc Nation, Tidal, liquor brands |

| Financial Growth | Strategic investments |

| Philanthropy | Social impact initiatives |

Jay-Z's success proves that hip-hop artists can create lasting legacies beyond music, while also giving back to their communities, reshaping the narrative around hip-hop culture and responsibility.

Conclusion

To sum up, Jay-Z's solo fortune is nothing short of astronomical, proving that he's a financial titan in the hip-hop universe. With his unmatched business acumen and groundbreaking ventures, he's crafted a legacy that eclipses even the brightest stars. It's as if he's got a Midas touch, turning every project into gold. So, whether you're a fan or not, you can't ignore the sheer magnitude of his success, which reshapes the landscape of wealth in music forever.