A $5 million net worth might sound impressive, but it's more about perception than reality. Many perceive this amount as comfortable, especially when the average American feels wealthy with just $560,000. However, high net worth doesn't guarantee financial security or happiness. Emotional well-being often hinges on relationships and personal fulfillment, not just cash. You could find yourself living paycheck to paycheck despite a hefty net worth if cash flow management isn't effective. Understanding these nuances can change your perspective on wealth. Stick around to discover more insights on what it really means to be financially comfortable.

Key Takeaways

- A net worth of $5 million is often perceived as comfortable, but true wealth is defined by income-generating assets valued at $150-200 million.

- Financial stability relies on effective cash flow management; high net worth does not guarantee freedom from financial stress.

- Emotional well-being is influenced more by health and relationships than by monetary wealth, highlighting a nuanced view of financial success.

- Community support and open discussions about wealth can alleviate feelings of isolation and financial stress among individuals.

- Personal fulfillment and experiences shape perceptions of wealth, suggesting that happiness often stems from non-monetary factors rather than net worth alone.

Understanding Net Worth Perception

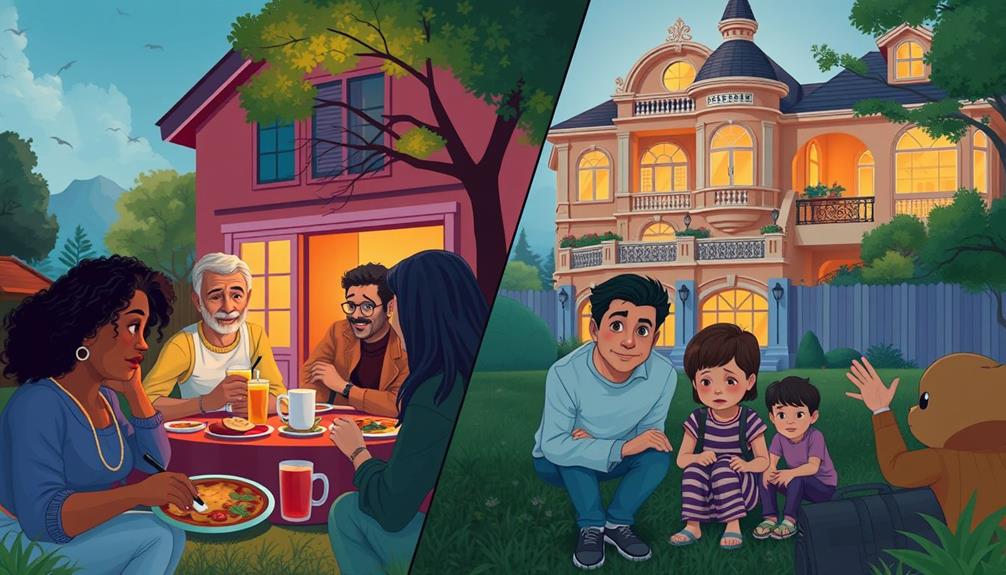

Understanding net worth perception can be complex, as it's influenced by various factors beyond just numbers. You might think that a net worth of $2.2 million automatically qualifies you as wealthy. However, this perception varies widely, shaped by demographics like age and location. Notably, nearly half of Americans feel wealthy with an average net worth of just $560,000.

This discrepancy shows that personal fulfillment and life circumstances play an essential role in how you define wealth. Additionally, factors like budget management and savings goals can greatly impact one's financial outlook.

Moreover, non-monetary aspects such as good health and strong relationships greatly impact your view of wealth. Younger individuals often have different benchmarks for feeling wealthy compared to older generations who may have accumulated more assets over time.

Your perception of financial comfort can also fluctuate based on societal norms and personal experiences.

Ultimately, understanding net worth perception goes beyond mere figures; it intertwines with emotional well-being and lifestyle choices. So, as you evaluate your own wealth, consider how your experiences and values influence your perception of what it truly means to be wealthy.

Financial Stability Vs. Cash Flow

When evaluating your financial situation, it's important to recognize the distinction between financial stability and cash flow. Many people assume that a high net worth guarantees financial security, but that's not always the case.

You can have substantial assets yet still struggle to meet monthly expenses. Cash flow is essential for your daily living and emergencies, and it plays a significant role in achieving true financial stability.

To protect your savings, avoid gold IRA scams by researching companies thoroughly and consulting with a financial advisor before making decisions.

To better understand this relationship, consider these key points:

- Cash Flow Management: Effective management can prevent financial distress and guarantee you can cover your expenses without relying on illiquid assets.

- Realistic Financial Goals: Aim for at least $5 million in liquid assets to enhance your cash flow and provide a safety net.

- Debt Control: Maintaining control over your debt is imperative; high net worth doesn't protect you from living paycheck to paycheck.

Ultimately, you need to focus on cash flow to achieve peace of mind and financial independence, regardless of your total net worth. Understanding this distinction will empower you to make better financial decisions for your future.

The Emotional Impact of Wealth

Wealth can be a double-edged sword, bringing both advantages and emotional challenges. While having a net worth of a million dollars may provide a sense of financial security, it doesn't automatically translate to happiness. Many individuals with a net worth up to $1.5 million still grapple with financial distress, revealing that money alone isn't the key to emotional well-being.

Developmental milestones and emotional growth can also be influenced by social factors, highlighting that personal relationships and community support play significant roles in our emotional stability key domains of development.

Your emotional stability can be influenced more by personal safety and health than by your financial status. Recent studies show that societal concerns can overshadow financial metrics, leaving you feeling less secure despite your wealth. In fact, 70% of American Jews reported feeling less safe after recent events, illustrating how external factors can greatly impact your emotional state.

Furthermore, the perception of wealth varies among individuals. Non-monetary elements, such as personal fulfillment and relationships, play vital roles in how you respond emotionally to your financial situation.

Engaging in discussions about financial stress can foster community support, helping to reduce stigma and promote empathy among those facing similar challenges. Ultimately, wealth might cushion certain worries, but it doesn't shield you from the emotional complexities of life.

Community Support and Financial Stress

Steering through financial stress can feel isolating, but connecting with others who share similar struggles can create a powerful support network.

Just as individuals with Borderline Personality Disorder (BPD) find strength in shared experiences, those facing financial challenges can benefit from fostering community support to navigate these difficulties together.

Here are three ways to build that network:

- Open Discussions: Initiate conversations about wealth and financial struggles, breaking down stigma and allowing for honest exchanges.

- Empathy and Understanding: Acknowledge that everyone's financial journey is unique. Recognizing diverse experiences fosters compassion and can ease feelings of disconnect.

- Resource Sharing: Pool resources and advice with your community. Whether it's budgeting tips or emotional support, collective knowledge can lighten the burden of financial stress.

Lessons From Wealthy Individuals

Connecting with others during financial struggles can provide valuable insights into different perspectives on wealth. Learning from wealthy individuals like Felix Dennis can reshape how you view success. He emphasizes that true fulfillment isn't found in accumulating money, but rather in the richness of experiences and relationships.

| Wealth Definition | Key Insight |

|---|---|

| True Wealth | Income-producing assets valued at $150-200 million |

| Comfortable Poor | Perception of $2-4 million |

| Happiness Source | Simple joys over monetary wealth |

The Financial Independence, Retire Early (FIRE) movement illustrates the shift toward valuing life experiences more than excessive wealth accumulation. Dennis warns that obsessing over money can hinder your self-belief and integrity, as happiness is often fleeting when tied to material possessions.

Instead, focus on investing in life insurance, relationships, and personal growth. By redefining success beyond financial metrics, you can cultivate a more meaningful and happy life. Remember, wealth isn't just about numbers; it's about how you engage with the world around you. Embrace the lessons from those who've experienced both extremes, and find your unique path to true wealth.

Conclusion

In the grand tapestry of life, a $5 million net worth is just one thread. It's not merely a badge of wealth, but a symbol of choices and responsibilities. You might feel secure, yet remember, even a gilded cage can confine. Embrace the lessons from those who've walked this path; true richness lies in connection, purpose, and the freedom to give back. So, as you navigate your financial landscape, let your heart guide you beyond the numbers.