Having five million dollars might seem like you've hit the jackpot, but wealth is often more complicated than numbers. You might feel comfortable, yet many face issues like a lack of purpose or happiness despite their financial status. Personal beliefs and childhood experiences greatly shape how you view money. Wealth can provide freedom and security, but it doesn't always guarantee fulfillment. It's essential to examine your relationship with money and how it reflects your identity. Curious about how these perspectives can shift your understanding of financial success? There's much more to unpack on this journey.

Key Takeaways

- The perception of wealth varies; 5 million can feel rich or just comfortable depending on individual beliefs and financial goals.

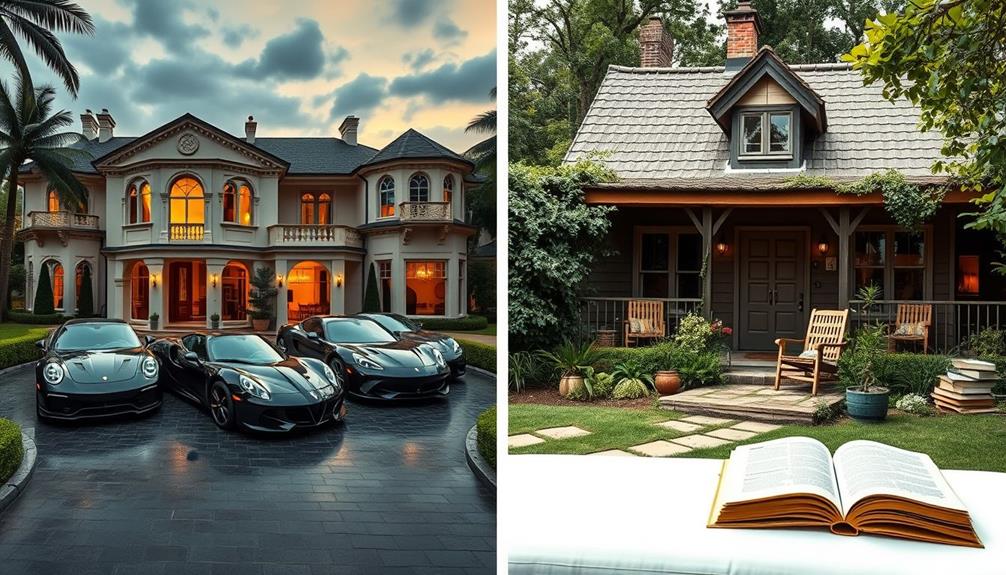

- Lifestyle choices and expenses significantly impact the feeling of richness; living modestly may make 5 million feel ample, while lavish spending can lead to discomfort.

- Personal money narratives shape attitudes; positive stories about wealth can enhance feelings of richness, while negative narratives may evoke feelings of inadequacy.

- Financial security is relative; 5 million may provide comfort but may not be sufficient for those with high-cost lifestyles or aspirations.

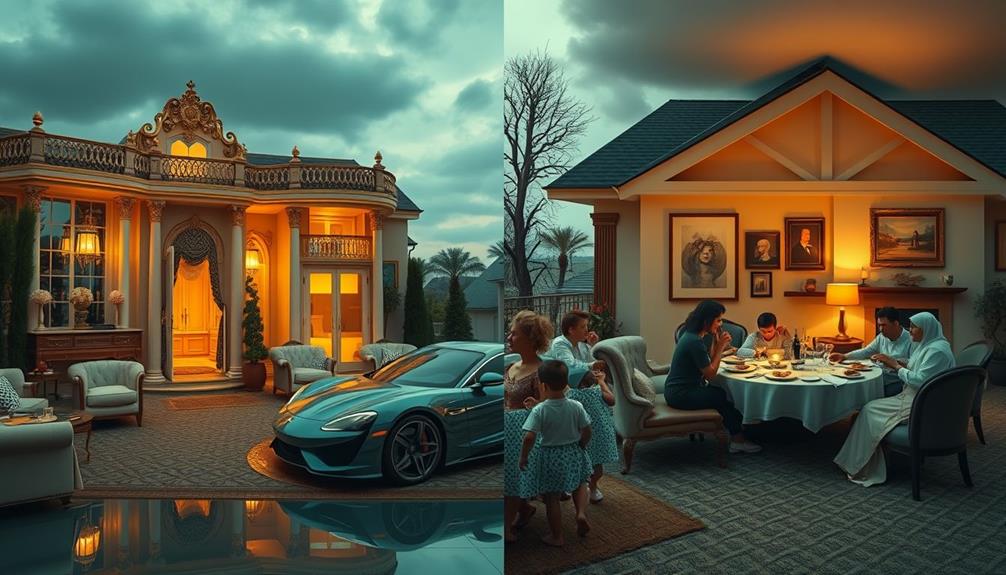

- True wealth encompasses more than money; fulfillment, purpose, and personal freedom play critical roles in perceiving one's financial status.

Personal Journeys With Wealth

In exploring personal journeys with wealth, it's clear that money means different things to different people.

Take Geoff, for example. Despite achieving millions, he found himself grappling with depression and a sense of purposelessness. His journey led him to prioritize creative ventures over mere financial gain, illustrating that wealth can sometimes feel like a burden.

Meanwhile, Laura's experience showcases a different perspective. Living a luxurious lifestyle thanks to her corporate success, she questions the necessity of accumulating more money. For her, wealth represents freedom, not an ultimate goal.

Understanding the risks and rewards of Bitcoin IRAs can further shape how individuals perceive their financial journeys and investment choices.

Your personal journey with wealth might also reflect how childhood experiences shape your beliefs about money.

Perhaps you'd a rich relative whose financial success influenced your aspirations, or maybe you grew up in circumstances that taught you to see money as security or even a trap. Recognizing these influences is essential.

By reclaiming power over your finances, you can develop a healthier relationship with wealth, independent of your current financial status.

Ultimately, understanding personal journeys with wealth can help you navigate your path more intentionally, fostering a sense of purpose and fulfillment that transcends mere numbers.

Different Perspectives on Money

Different perspectives on money shape how we approach our financial lives. You might see money as a tool for success, security, or even freedom. However, your beliefs and experiences greatly influence this view. For some, money represents liberation, while for others, it feels like entrapment. These different things stem from individual stories and contexts that can vary widely.

Understanding concepts like budgeting for financial health can provide a foundation for a more positive relationship with money.

Your childhood upbringing plays a significant role in shaping how you see money. If you grew up in an environment of scarcity, you might struggle with feelings of lack, even as an adult. Conversely, a background emphasizing financial security can foster a positive relationship with wealth.

It's important to recognize that positive money narratives can motivate you to pursue wealth, while negative perceptions may create an unconscious aversion to financial success.

To redefine your financial identity, consider understanding and rewriting your personal money story. By doing so, you can cultivate healthier relationships with money, ultimately impacting your financial choices and overall well-being.

The Impact of Money Narratives

Money narratives shape your financial behaviors and attitudes more than you might realize. Your personal experiences and upbringing play an essential role in how you view and interact with wealth. Positive money narratives can empower you, motivating you to pursue financial success. On the other hand, negative narratives often lead to self-sabotage and a reluctance to embrace wealth.

To better understand your money narratives, consider how childhood experiences of financial security or scarcity impact your adult beliefs. Writing a personal money life story can reveal the unique narratives you carry, enabling you to reshape your beliefs and improve your financial relationships.

Here's a simple table to illustrate different types of money narratives:

| Narrative Type | Impact on Behavior | Example |

|---|---|---|

| Positive | Encourages wealth attraction | Investing in personal growth |

| Negative | Leads to financial self-sabotage | Avoiding investment opportunities |

| Neutral | Indifferent to financial success | Spending without purpose |

Recognizing these money narratives is vital for achieving healthier financial well-being. It's time to confront and reshape the stories you tell yourself about money.

Reclaiming Your Financial Power

Understanding that money is merely a tool can empower you to reclaim your financial power. By recognizing this, you can shift your relationship with money, allowing you to separate your identity from your bank account balance.

Engaging in affirmations and mindfulness techniques helps you decouple your self-worth from your financial situation, fostering independence and empowerment. Additionally, considering investments like gold can provide a hedge against market volatility, reinforcing your financial strategy and stability essential queries before precious metals investment.

Consider writing your personal money life story. This exercise uncovers underlying beliefs and emotions about money, enabling you to reshape your narrative and develop a healthier relationship with wealth.

Acknowledge any negative financial identities, like feelings of insecurity; embracing them can facilitate personal liberation and enhance your creative expression in financial matters.

To further transform your money relationship, utilize workshops, coaching, and tools like Maptio. These resources provide practical strategies to build a healthier financial mindset.

Living Creatively Beyond Money

In a world where creativity thrives, letting go of financial superstitions can unfasten new avenues for expression.

When you embrace a passion-driven lifestyle, you'll discover that creativity often attracts resources organically. Instead of viewing money as a measure of worth, see it as a tool that should serve your creative ideas.

Here are three steps to live creatively beyond money:

- Shift Your Mindset: Recognize that financial limitations don't define your worth. This mindset shift allows you to explore your full range of identities and express yourself authentically.

- Engage with Your Passions: Immerse yourself in activities that ignite your creativity. When you focus on what you love, opportunities will begin to align with your interests, often leading to unexpected resources.

- Seek Support: Participate in workshops or coaching that provide practical tools to transform your relationship with money. These resources can help you adopt a more liberated approach to living, making creativity your priority.

Conclusion

As you step back and examine your relationship with money, you might find it's less about the numbers and more about the stories you tell yourself. Picture a vibrant garden, where wealth blossoms in various forms—security, passion, and freedom. You hold the watering can; it's up to you to nurture what truly matters. Embrace your narrative, reclaim your power, and remember that comfort can be just as rich as a bank account overflowing with cash.