Net assets and equity aren't exactly the same, but they're closely related. You calculate net assets by subtracting total liabilities from total assets. Equity also uses the same formula, representing the value left for shareholders after the company's debts. While both terms reveal financial health, net assets give a broader view, including intangibles. In contrast, equity focuses solely on shareholder interest. Understanding these differences is essential for evaluating your business's financial status and making informed decisions. If you want to uncover more about how these concepts impact your finances, keep exploring the topic.

Key Takeaways

- Net assets equal total assets minus total liabilities, while equity specifically refers to the residual interest of shareholders in those net assets.

- Both net assets and equity represent financial health but focus on different aspects of a company's financial position.

- Net assets can include intangible assets, whereas equity is primarily concerned with shareholders' interests and retained earnings.

- The balance sheet reflects both net assets and equity, structured around the fundamental accounting equation: Assets = Liabilities + Equity.

- Regular analysis of both net assets and equity is essential for assessing financial stability and guiding strategic decision-making.

Definition of Net Assets

When evaluating a company's financial health, understanding net assets is essential. Net assets represent the residual value of a business after settling all debts, calculated by subtracting total liabilities from total assets. This straightforward formula—Net Assets = Total Assets – Total Liabilities—provides vital insight into a company's financial position.

By analyzing common financial terms related to net assets, investors can better understand how these figures impact overall valuation and stability.

Net assets are synonymous with a company's book value, making them pivotal for investors and stakeholders determining financial stability and potential profitability.

When you look at the balance sheet, you'll typically find net assets reflected in the shareholders' equity section. This section reveals what remains after liabilities are accounted for, giving you a snapshot of the company's worth at a specific moment.

Calculation of Net Assets

Calculating net assets is vital for understanding your company's financial health.

You'll use the formula Total Assets minus Total Liabilities to get a clear picture of what's left after settling debts. This assessment is essential for investors, especially in the context of emerging trends in various industries, such as sector performance metrics.

Keep in mind that net assets include various components, such as tangible and intangible assets, which can greatly impact your overall valuation.

Components of Net Assets

Understanding the components of net assets is essential for evaluating a company's financial health. Net assets are calculated by subtracting total liabilities from total assets, offering a clear snapshot of a business's financial value. For instance, if a company has total assets of $100,000 and total liabilities of $30,000, its net assets would be $70,000. Effective keyword optimization can help businesses highlight their financial strengths and attract potential investors.

When appraising net assets, consider both tangible and intangible assets. Tangible assets include physical items like property and equipment, while intangible assets may encompass intellectual property and goodwill. Additionally, cash equivalents and accounts receivable contribute to the total assets, showing liquidity and potential cash flow.

Keep in mind that accurate net asset calculations might require adjustments for depreciation or other factors impacting asset values. These components play a significant role in determining financial stability, as net assets reflect the residual value available to shareholders after all obligations are settled.

Calculation Formula Explained

Identifying net assets starts with a straightforward calculation: Net Assets = Total Assets – Total Liabilities. This calculation formula provides a clear snapshot of a company's financial health, similar to how precious metal investments can enhance your overall financial strategy.

For instance, if your company has total assets valued at $500,000 and total liabilities of $200,000, your net assets would amount to $300,000.

Net assets encompass all types of assets, including cash, property, equipment, and accounts receivable, minus all liabilities like loans and accounts payable. It's essential to adjust these values carefully for accuracy, as net assets reflect the residual value left after settling all financial obligations.

Understanding this calculation is fundamental for evaluating your company's profitability and financial stability. For investors and stakeholders, net assets can indicate the true value of shareholders' equity.

By grasping how to calculate net assets, you gain valuable insight into your business finances. This understanding not only informs your current financial standing but also helps you plan for future growth.

Net Assets Vs. Equity

When it comes to evaluating a company's financial standing, distinguishing between net assets and equity is vital. While both terms might seem interchangeable, they serve different purposes. Net assets are calculated as total assets minus total liabilities, offering a thorough view of a company's financial health. On the other hand, equity focuses on the net worth attributable to shareholders, which includes intangible assets like goodwill and patents. This distinction becomes particularly important when analyzing a company’s balance sheet, as it highlights the nuances between what the company owns outright and what belongs to its shareholders. Understanding the relationship between net assets vs total equity helps stakeholders assess financial stability and investment potential more comprehensively. While net assets provide a snapshot of the overall financial position, total equity offers insight into the ownership structure and shareholder value.

Here's a quick comparison:

| Net Assets | Equity |

|---|---|

| Total assets minus total liabilities | Assets minus liabilities |

| Excludes intangible assets | Includes intangible assets |

| Reflects overall financial health | Reflects shareholders' net worth |

| Found in shareholders' equity section | Found in balance sheet |

| Important for investors evaluating financial stability | Indicates company's financial position |

Understanding the distinction between net assets and equity is vital for you as an investor or stakeholder. By grasping these concepts, you can better assess a company's profitability potential and overall financial health, ultimately aiding in your investment decisions.

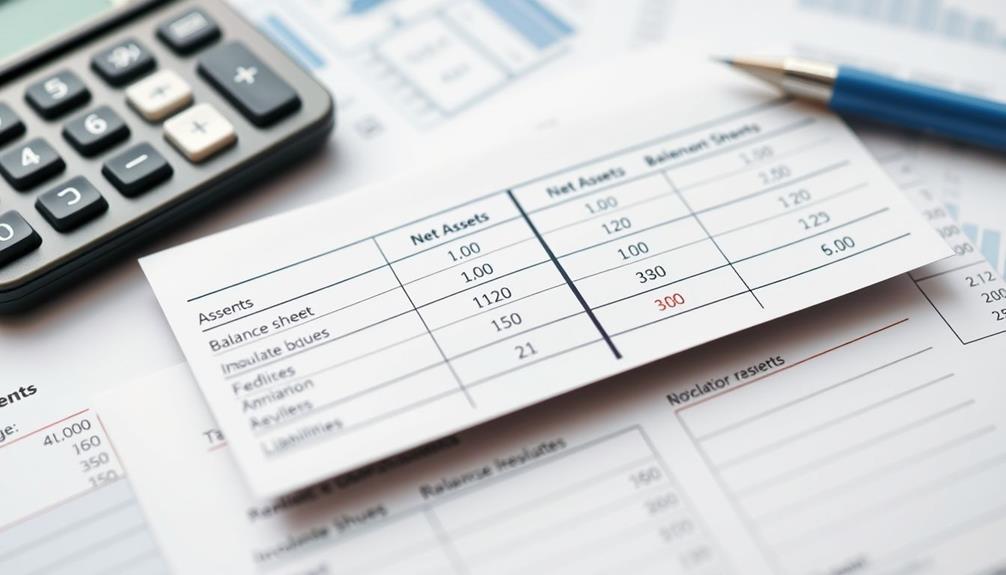

Net Assets on the Balance Sheet

Net assets on the balance sheet represent your company's financial position, calculated by subtracting total liabilities from total assets.

This key figure includes both current and long-term assets while focusing on tangible items, excluding intangibles. Understanding net assets is vital for evaluating your financial health and stability, helping you make informed decisions for your business.

Additionally, much like how diversification in investment strategies can enhance financial security, maintaining a healthy net asset position can serve as a buffer against economic uncertainties and market fluctuations.

For insight on related topics, consider exploring investment strategies that can further stabilize your finances.

Definition of Net Assets

Understanding net assets is essential for evaluating a company's financial health. Net assets represent the residual value of a company after all obligations are settled, calculated as total assets minus total liabilities. They provide insight into a company's financial position at a specific point in time, as reflected in the shareholders' equity section of the balance sheet.

Here's a quick overview:

| Aspect | Description |

|---|---|

| Total Assets | All resources owned by the company |

| Total Liabilities | All obligations owed by the company |

| Net Assets | Total assets minus total liabilities |

| Shareholders' Equity | Reflects the net assets of the company |

Net assets include tangible and liquid assets like property, equipment, cash, and accounts receivable, providing a conservative view of a company's value. While equity encompasses intangible items, net assets focus on the physical resources that contribute to business stability. By understanding net assets, you can better assess a company's profitability and overall financial health, making it vital for investors and stakeholders.

Components of Net Assets

At the heart of evaluating a company's financial stability are the components of net assets, which play an essential role on the balance sheet. Net assets, calculated as total assets minus total liabilities, represent the residual value of a company's assets after accounting for all debts. This figure is included in the shareholders' equity section, providing a snapshot of the company's financial health at a specific moment.

Understanding how to protect your savings through careful financial evaluations can also apply to appraising net assets.

When appraising net assets, consider both tangible and intangible assets. While most assets contribute to the total, some intangibles may be excluded for a more conservative evaluation. For instance, if a company has total assets of $100,000 and total liabilities of $40,000, its net assets would amount to $60,000. This value indicates the potential liquidity available if all assets were sold and liabilities settled.

Additionally, retained earnings are an important component of net assets, reflecting the accumulated profits that haven't been distributed to shareholders. Understanding these components helps you grasp the overall picture of business finances and the strength of a company's equity position.

Importance in Financial Analysis

Evaluating net assets is essential for financial analysis, as they reveal the true value of a company after settling its debts. When you look at the balance sheet, net assets show up in the shareholders' equity section, giving you a clear picture of financial health.

In the context of retirement planning, understanding the importance of diversification of retirement portfolio is similarly important, as it impacts overall financial stability.

Here's why understanding net assets matters:

- Assessing Company's Net Worth: Net assets help you determine a company's actual worth by subtracting total liabilities from total assets.

- Evaluating Solvency: A strong net asset position indicates that a company can meet its long-term obligations, significant for stakeholders.

- Understanding Profitability: Analyzing net assets alongside equity provides insights into operational sustainability and potential profitability.

Accurate accounting of all assets and liabilities is essential, as it impacts the calculation of net assets.

Importance of Net Assets

Why should you pay attention to net assets? Understanding net assets is crucial for gauging your company's financial health and stability. They represent your total assets minus total liabilities, offering a snapshot of your business's value. This calculation is essential for investors; it signals the potential cash available if all assets are sold and debts are settled.

Here's a quick comparison of key concepts:

| Concept | Description |

|---|---|

| Net Assets | Total assets minus total liabilities |

| Equity | Ownership interest after liabilities are deducted |

| Financial Health | Overall stability and performance of the business |

| Profitability | Ability to generate profit from operations |

Monitoring net assets aids in evaluating overall success and informs your strategic financial planning. It also impacts your investment decisions, as a strong net asset position can enhance your attractiveness to potential investors. By keeping an eye on net assets, you can better assess your company's profitability and operational efficiency over time, ensuring that your business finances remain robust.

Components of Equity

Understanding net assets naturally leads to a closer look at equity, which represents your company's residual interest in its assets after all liabilities are accounted for.

Equity is essential for evaluating financial health, and it consists of several key components, including the importance of diversification to mitigate risks.

Retained Earnings: These are the accumulated net earnings that haven't been distributed as dividends. They reflect your company's ability to reinvest in growth.

Common Stock: This represents the equity stake of shareholders and is a primary source of investment in your business.

Treasury Shares: These are the company's own repurchased shares held in a contra account, reducing the total equity.

It's essential to keep an eye on shareholder equity because negative shareholder equity indicates that your total liabilities exceed total assets.

This situation raises concerns about potential insolvency, making it critical for investors and stakeholders to monitor.

Understanding these components helps you better navigate your business finances and make informed decisions about funding operations and returning value to shareholders.

Calculation of Equity

Calculating equity is straightforward and essential for gauging your company's financial health. Equity is calculated using the formula Shareholders Equity = Total Assets – Total Liabilities. This formula provides a clear measure of what remains for shareholders after all debts are settled, reflecting the book value of your company.

Here's a quick breakdown of the components involved in this calculation:

| Item | Description | Example Value |

|---|---|---|

| Total Assets | Everything your company owns | $500,000 |

| Total Liabilities | All debts, including loans and payables | $300,000 |

| Shareholders Equity | Residual interest after liabilities deducted | $200,000 |

| Retained Earnings | Cumulative net income not paid as dividends | $100,000 |

| Net Worth | Same as shareholders equity | $200,000 |

Understanding these figures helps you assess your financial position. Positive equity indicates stability and growth potential, while variations in equity can occur over time based on changes in asset valuations, liabilities, and retained earnings. This dynamic measure is vital for evaluating your financial health.

Types of Equity

Equity comes in various forms, each serving a distinct purpose in the financial landscape. Understanding these types can help you navigate your business finances more effectively. As industries evolve, the significance of roles like AI Ethicist Jobs is becoming increasingly apparent in how businesses manage their financial decisions.

Here are three key types of equity:

- Stockholders' Equity: This includes funds contributed by shareholders and retained earnings. It reflects total equity available after all liabilities have been settled, fundamentally your net asset value.

- Home Equity: For homeowners, this represents the interest in their property, calculated as the current market value minus outstanding mortgage debt. It's a crucial part of personal finance and can influence overall financial performance.

- Brand Equity: This measures the value of a brand based on recognition and customer loyalty. Unlike generic brands, strong brand equity can greatly enhance a company's standing in corporate finance.

In all these forms, equity includes retained earnings and reveals the relationship between total assets minus liabilities.

Understanding these distinctions allows you to assess your total equity effectively, ensuring you maintain a healthy balance between liabilities and equity for sustainable growth.

Understanding the Balance Sheet

At the end of each financial period, you'll want to take a close look at your balance sheet to grasp your company's financial position. This document provides a snapshot of your firm's assets, liabilities, and owners' equity at a specific point in time.

The balance sheet is structured around the accounting equation: Assets = Liabilities + Owners' Equity, which guarantees it remains balanced. Investing in gold IRAs can be a strategic way to enhance your company's financial stability and diversify its asset base.

Your assets are categorized into current assets, which can be converted to cash within a year, and long-term assets, or fixed assets. On the other hand, liabilities are divided into current liabilities, due within a year, and non-current liabilities, due after a year.

By analyzing this information, you can determine your net assets, which reflect the residual value of your business after settling all liabilities.

Owners' equity shows the value attributable to shareholders and is vital for understanding your financial health. Regularly reviewing your balance sheet helps you assess the overall stability of your business and make informed decisions for future growth.

Conclusion

In summary, understanding net assets and equity is essential for anyone steering through business finances. Did you know that, on average, companies with higher net assets tend to have a 20% better chance of securing funding? By distinguishing between net assets and equity, you can make more informed financial decisions that drive growth. Keep these concepts in mind as you analyze your balance sheet, and you'll be better equipped to manage your business's financial health effectively.