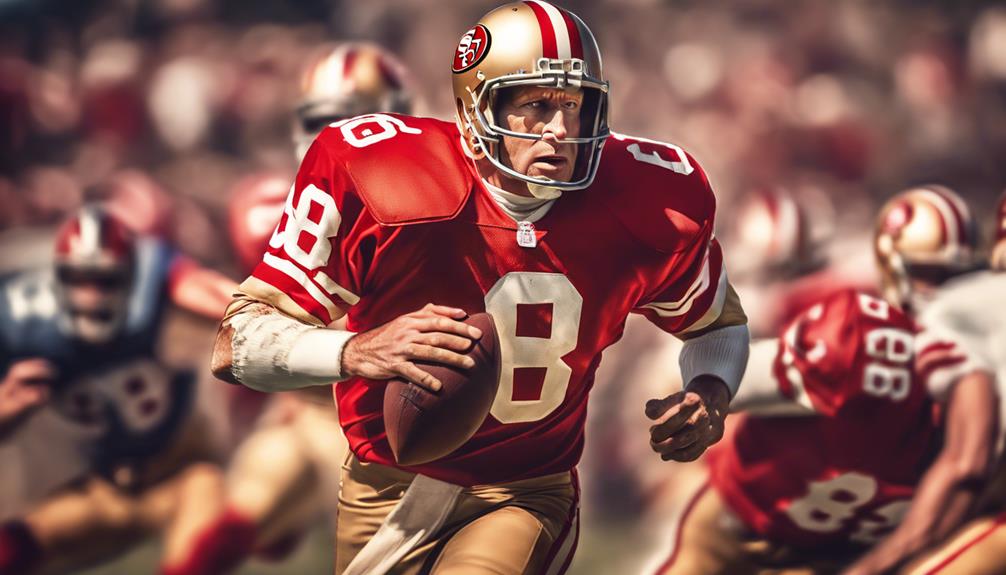

Steve Young's journey to greatness is a demonstration of resilience and hard work. You see a young athlete who excelled in various sports before honing his quarterback skills under Coach Doug Scovil. His time at Brigham Young University laid the foundation for a record-breaking NFL career. With three Super Bowl championships and an MVP title, he transformed the quarterback position. Beyond football, he's dedicated to empowering youth, promoting mental health awareness, and strengthening communities through education. Young's legacy continues to inspire and uplift. There's much more to discover about his impactful journey and contributions to the sport.

Background Information

When you look at Steve Young's background, you'll see how his early sports experiences shaped his career. His youth training laid the groundwork for his future success, including his impressive Super Bowl MVP honors.

Additionally, his commitment to coaching and mentoring reflects his desire to give back to the sport that defined him.

Youth Sports and Early Training

Steve Young's journey in youth sports laid a strong foundation for his future success, as he dove into various activities like baseball, basketball, and football from an early age. Growing up in a devoutly religious family, Young learned the value of hard work and discipline. His early exposure to sports not only honed his athletic skills but also instilled a competitive spirit that would serve him well throughout his career.

During his high school years, Young faced challenges with his playing style, which initially focused more on running than passing. However, under the guidance of his influential coach Doug Scovil, he adapted and grew into a standout football player. Scovil's mentorship was essential, helping Young refine his skills and build confidence.

As he excelled in youth football, his talent caught the attention of college scouts, paving the way for a successful collegiate career at Brigham Young University. Here, Young shattered records, becoming the first college quarterback to pass for over 3,000 yards and rush for over 1,000 in a single season. This early training in youth sports set the stage for his remarkable journey to greatness.

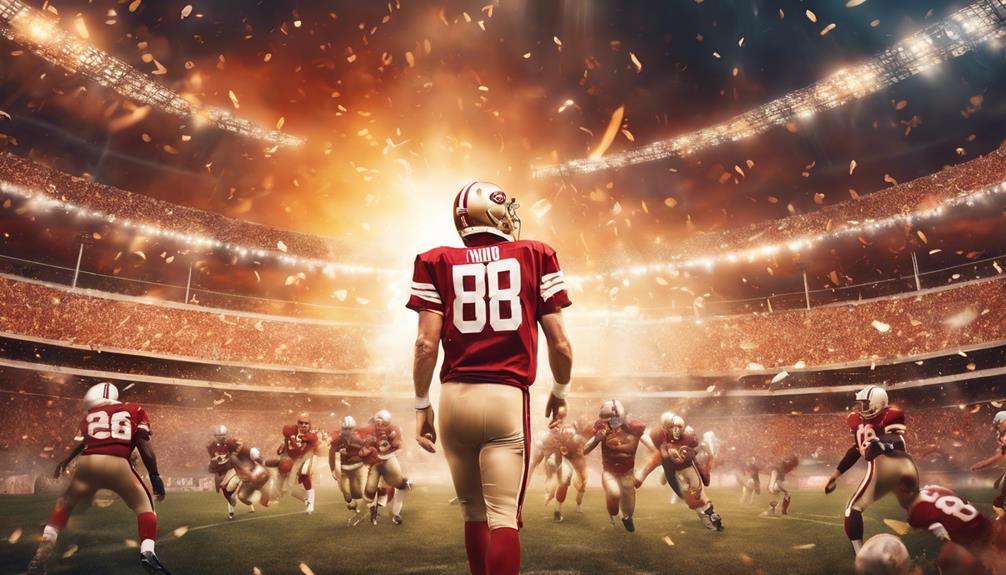

Super Bowl MVP Honors

After a remarkable collegiate career, Young's skills culminated in a standout performance that earned him Super Bowl MVP honors in Super Bowl XXIX. Leading the San Francisco 49ers against the San Diego Chargers, he delivered an unforgettable game, throwing a record six touchdown passes. This achievement not only showcased his exceptional skill as a quarterback but also demonstrated his ability to perform under pressure on the biggest stage in football.

Young's performance in Super Bowl XXIX solidified his legacy as one of the greatest quarterbacks in NFL history. It marked his third Super Bowl championship, reinforcing his role as a key leader for the 49ers. Additionally, his victory made him the first left-handed quarterback to win the Super Bowl MVP award, a significant milestone in a league dominated by right-handed players.

This game was pivotal in establishing Young's reputation and contributed to his overall success, which includes two NFL MVP awards. His strategic play and remarkable ability to read defenses set him apart, ensuring his place in football history. Through this win, Young not only claimed personal accolades but also left an indelible mark on the sport.

Coaching and Mentoring Initiatives

Inspiring youth through education and mentorship, Young aims to establish a school that emphasizes high ideals and community values. His vision isn't just about academics; it's about coaching and guiding young individuals to develop into well-rounded citizens. By focusing on mentoring, he plans to share his personal experiences, particularly regarding mental health, to help young athletes build resilience and perseverance.

Young's commitment to philanthropy extends beyond the classroom. He seeks to support start-up businesses and initiatives that uphold strong family values. Through public speaking engagements, he emphasizes the importance of character, teamwork, and integrity—not just in sports but in all aspects of life.

He also looks to collaborate with local organizations, like the Salt Lake Olympics, to create mentorship opportunities that foster positive change in the community. By promoting these initiatives, Young aims to empower the next generation, ensuring they've the tools and support needed to succeed.

His holistic approach to coaching and mentoring will certainly leave a lasting impact on youth, guiding them on their journey to greatness.

Current Updates or Main Focus

Steve Young's journey continues as he focuses on impactful philanthropic efforts in education, enhancing opportunities for future generations.

You'll also find him making waves in sports commentary, sharing his insights and experiences with a new audience.

Additionally, his investments in tech startups showcase his commitment to innovation and growth in the business world.

Philanthropic Efforts in Education

Recognizing the critical need for quality education in underserved communities, Young is dedicated to expanding his philanthropic efforts to empower students and families. His vision includes opening a school that prioritizes high ideals, ensuring that students receive the support they need to thrive. Young believes that education is a powerful tool, and he actively works to enhance community engagement through various initiatives.

In addition to establishing educational programs, Young supports start-up businesses that align with his values. By doing so, he not only provides resources but also encourages local entrepreneurship, which strengthens community ties. He understands that building strong families is essential for successful educational outcomes, and he emphasizes this connection in his philanthropic efforts.

Through his ongoing involvement in educational initiatives, Young aims to inspire youth by promoting resilience, perseverance, and personal growth. His commitment to education extends beyond the classroom, as he engages with families and communities to create a supportive environment where students can flourish.

With each step, Young reinforces his belief that a strong educational foundation can transform lives and uplift entire communities.

Transition to Sports Commentary

Shifting seamlessly from the NFL field to the broadcast booth, Young has become a respected sports analyst, sharing his insights and expertise with fans across various networks. His change into sports commentary showcases his extensive football knowledge and experience, which he brings to every broadcast.

Working with networks like ESPN and ABC, you'll find him dissecting game strategies, analyzing player performances, and discussing NFL trends. Fans appreciate Young's depth of analysis, as he combines his on-field experiences with a keen understanding of the game. His thoughtful commentary not only informs viewers but also enhances their appreciation for the sport.

Young's humble demeanor and approachability further solidify his status as a beloved figure in sports media. Beyond commentary, he engages in public speaking and philanthropic efforts, using his platform to promote mental health awareness.

This balance of sports analysis and community involvement keeps him connected to fans and accessible to a wider audience. You can see how effortlessly he navigates this new chapter, proving that his journey to greatness continues even off the field.

Tech Startups and Investments

Investing in tech startups, Young focuses on innovative companies that reflect his values of integrity and community impact. He's committed to supporting entrepreneurial ventures that not only drive profits but also promote strong family values and contribute positively to society. You'll find his investments primarily in sectors like education technology and health tech, as he believes these areas can greatly enhance quality of life.

By leveraging his experience and extensive network in the tech industry, Young aims to mentor young entrepreneurs, fostering a culture of growth and resilience. He understands that the right guidance can make a huge difference in launching successful startups.

Moreover, his philanthropic efforts are intricately woven into his investment strategy. Young seeks to create opportunities that empower communities and drive social change, ensuring that his financial backing translates into real-world benefits.

This dual approach—investing for profit while promoting social good—illustrates his dedication to making a lasting impact. By choosing to invest in companies that prioritize community welfare, you can see how Young's journey continues to evolve beyond the field, shaping a brighter future for aspiring entrepreneurs and communities alike.

Detailed Analysis

As you explore Steve Young's impact beyond the football field, you'll see how his recent charity events highlight his commitment to giving back.

His reputation as a community leader showcases the passion that drives his purpose, inspiring others to make a difference.

Let's take a closer look at how these elements intertwine to define his legacy.

Recent Charity Event Highlights

Recently, Steve Young's charity event not only raised over $500,000 for mental health initiatives but also highlighted his personal journey with anxiety and the importance of community support. This event stands as a reflection of his dedication to philanthropy, showcasing how a public figure can effectively use their platform for social good.

During the evening, Young delivered a heartfelt speech, sharing his own struggles with anxiety disorder. He emphasized that seeking help is essential and that a supportive community can make a significant difference in overcoming such challenges. The event attracted former teammates and notable figures from the sports world, illustrating Young's strong connections and influence.

A live auction added excitement, featuring exclusive sports memorabilia like signed jerseys and game tickets. Proceeds from these items went directly to local mental health organizations, further amplifying the event's impact.

Young's philanthropic efforts resonate deeply, encouraging others to join in the fight for mental health awareness. This charity event not only raised funds but also fostered a sense of unity, reminding everyone that addressing mental health is a collective responsibility.

Reputation as a Community Leader

Steve Young's reputation as a community leader is rooted in his unwavering commitment to uplifting others through philanthropy and advocacy. You can see this dedication in his plans to open a school and a law firm focused on high ideals, reflecting his passion for community development. His involvement in the Salt Lake Olympics showcases how he promotes positive values through sports and engages actively with the local community.

As a role model, Young emphasizes themes of perseverance and resilience in his public speaking and mentorship programs. He encourages individuals to overcome challenges and endeavor for success, making a significant impact on those who look up to him. His aspirations to support start-up businesses and advocate for strong family values further underline his desire to uplift his community.

Young's legacy extends far beyond his football career. He exemplifies integrity and a strong commitment to improving lives. Through his philanthropic efforts and community engagement, he inspires others to take action and contribute positively, proving that one person's dedication can spark meaningful change in the community. In every initiative, you can see his true commitment to nurturing a brighter future for all.

Passion Drives My Purpose

Fueled by an unwavering passion for football, Young's journey showcases how dedication and love for the game can shape one's purpose and drive success. From his early days at Brigham Young University, you can see how his exceptional talent and relentless work ethic set him apart. Despite starting as the eighth-string quarterback, his perseverance pushed him to break records, becoming the first college quarterback to pass for over 3,000 yards and rush for over 1,000 in a single season.

Young's passion didn't just manifest in individual achievements; it also transformed his approach to teamwork. He built strong relationships with teammates, emphasizing camaraderie, which played a significant role in their collective success. His two NFL MVP awards and Super Bowl MVP title are indications of how his love for the game fueled his drive to excel.

Even after retiring, Young didn't let his passion fade. Instead, he channeled it into philanthropy and public speaking, inspiring countless individuals to pursue their dreams. His story illustrates that with purpose and perseverance, you can overcome challenges and achieve greatness in whatever you set your mind to.

Public Reaction or Expert Opinions

As you explore the public reaction to Steve Young's autobiography, you'll notice trending conversations on Twitter highlighting its profound impact.

Fans are sharing heartfelt feedback, celebrating not just his career but also his openness about mental health struggles.

Meanwhile, sports analysts are offering insights that underscore his role as a relatable figure in sports, making his story resonate on multiple levels.

Twitter Trends and Highlights

Fans and experts alike celebrate Steve Young's impactful legacy on Twitter, highlighting his revolutionary playing style and inspirational messages that resonate far beyond the football field. Since his Hall of Fame induction in 2005, social media has buzzed with admiration for Young's dual-threat capabilities, which many argue transformed the quarterback position. You'll often see tweets praising his ability to connect with fans, showcasing his humility and approachability.

Conversations frequently touch on Young's perseverance, as he overcame challenges throughout his career, becoming a beacon of hope for many facing personal struggles. His messages about resilience inspire those who look to sports for motivation and guidance.

Moreover, Young's philanthropy hasn't gone unnoticed. Tweets celebrating his community involvement reflect a strong public admiration for his efforts beyond football. People recognize him not just as a player but as a role model who embodies the spirit of giving back.

Fan Reactions and Feedback

The admiration for Steve Young extends beyond social media, with fans and readers praising his autobiography for its powerful insights on personal growth and resilience. Many fans recommend the book for its inspirational content, which encourages reflection on their own journeys. Young's honesty about his struggles, particularly with anxiety, resonates deeply, making him relatable to many. This openness about mental health awareness is a significant reason why readers see him as a role model, transcending his football achievements. His candid storytelling not only highlights his challenges but also showcases the persistence and mindset required to overcome them, inspiring readers to pursue their own goals with renewed determination. Similar to the widely admired Matt Higgins business success story, Young’s journey emphasizes the importance of resilience and embracing vulnerability in the face of adversity. This parallel underscores the universal nature of these lessons, making his autobiography a valuable read for people from all walks of life.

The narrative not only captivates football enthusiasts but also appeals to those interested in personal development. Feedback from international audiences highlights how Young's experiences inspire readers to embrace their challenges and foster resilience. Personal anecdotes and engaging storytelling leave a lasting impression, reinforcing his legacy as a beloved figure in sports culture.

In a world where vulnerability is often overlooked, Young's journey serves as a beacon of hope. Fans appreciate how his story illustrates the importance of perseverance and growth, proving that greatness isn't just measured by touchdowns, but by the strength of character and the courage to overcome adversity.

Insights From Sports Analysts

Highlighting Steve Young's unique skills, sports analysts often emphasize his exceptional passing accuracy and mobility, which revolutionized the quarterback position during his era.

They point out how Young's dual-threat capabilities set a new standard, allowing him to pass for over 4,170 yards and 36 touchdowns in a single season. His resilience in facing and overcoming mental health challenges, particularly his openness about anxiety, has resonated deeply within the sports community, promoting mental health awareness among athletes.

Analysts also regard Young's leadership as a pivotal aspect of his success. Shifting from Joe Montana, he inspired and uplifted his teammates, showcasing the qualities of a true leader. His ability to rally the San Francisco 49ers during critical moments is often highlighted, demonstrating how he built trust and camaraderie within the team.

Post-retirement, Young has continued to influence the game as a sports analyst and public speaker. Fellow commentators praise his insightful perspectives and strong communication skills, reinforcing his status not just as a player but as a respected voice in the sports world.

Young's journey exemplifies the profound impact of resilience, leadership, and mental health awareness in athletics.

Broader Implications

As you explore Steve Young's journey, consider how his experiences can inspire innovations in quarterback training programs and youth leadership initiatives.

His story underscores the potential of sports to empower young people, fostering essential skills and resilience.

You'll see that Young's legacy goes beyond the field, igniting a movement toward cultivating future leaders through athletics.

Quarterback Training Program Innovations

Innovations in quarterback training programs are reshaping how players develop their skills, emphasizing a blend of technical proficiency and mental resilience.

You'll notice that modern training incorporates game simulation scenarios, which enhance decision-making and performance under pressure. This shift reflects the impact of legends like Steve Young, who showcased the importance of dual-threat quarterback skills—combining passing accuracy with mobility.

Coaching techniques have evolved as well, emphasizing tailored approaches that cater to each player's unique strengths and weaknesses. Young's mentorship experiences underscore the value of personalized coaching, ensuring that players receive the guidance they need to excel.

Moreover, mental health awareness has become an essential aspect of quarterback training. Programs now integrate mental conditioning techniques, promoting resilience and emotional well-being. This focus not only prepares you for the physical demands of the game but also equips you to handle the psychological pressures that come with being a quarterback.

As you begin your own journey, understanding these innovations in training will empower you to develop both your skills and your mindset, setting the stage for your growth and success on the field.

Emerging Youth Leadership Programs

Building on the advancements in quarterback training, emerging youth leadership programs are also shaping the next generation by instilling critical life skills like teamwork and resilience. These programs focus on developing leadership qualities, enabling you to communicate effectively and collaborate with others.

With mentorship from successful athletes like Steve Young, you gain insights into overcoming challenges and the importance of perseverance in achieving your goals. Research shows that when you engage in these leadership programs, you often experience boosts in self-esteem, academic performance, and civic engagement.

This holistic approach not only enhances your personal growth but also fosters a sense of responsibility towards your community. By participating in community service components, you connect with local issues and develop a strong sense of belonging, echoing Young's emphasis on family and relationships.

Moreover, these programs promote values such as integrity and perseverance, equipping you with essential tools to navigate life's obstacles. As you learn from mentors and collaborate with peers, you're not just preparing for a career; you're building a foundation for a fulfilling life.

Embracing these opportunities paves the way for a brighter future, much like Young's own remarkable journey.

Youth Empowerment Through Sports

How can youth empowerment through sports transform lives and cultivate crucial life skills that extend beyond the playing field?

Engaging in sports teaches you resilience, as you learn to face challenges, setbacks, and even failures. Just like Steve Young, who overcame his own struggles, you can find strength in adversity and develop a strong sense of self-belief.

Teamwork is another essential skill you gain through sports. Collaborating with teammates fosters camaraderie and helps you understand the value of communication and trust. These relationships can shape your social skills and enhance your ability to work well with others in various aspects of life.

Moreover, sports can serve as a platform for empowerment. By witnessing athletes like Young share their mental health experiences, you're encouraged to prioritize your well-being and seek help when needed. This openness cultivates a supportive environment where young athletes can thrive.

Ultimately, the lessons learned in sports extend far beyond the field. Embracing resilience, teamwork, and empowerment equips you with the tools to navigate life's challenges, encouraging personal growth and integrity as you endeavor for success.

Frequently Asked Questions

How Did Steve Young End His Career?

You'll find that he ended his career after much reflection, announcing his retirement in an emotional press conference. He wanted his legacy to focus on family values, philanthropy, and personal growth beyond football.

How Did Steve Young Make His Money?

You'll find that he made his money through a lucrative NFL contract, endorsement deals with major brands, and a successful broadcasting career after retirement. His smart investments and philanthropic efforts further enhanced his financial success.

Does Steve Young Have a Law Degree?

Yes, you're right—Steve Young has a law degree. He earned it from the J. Reuben Clark Law School while playing in the NFL, showcasing his commitment to education alongside his professional football career.

How Fast Was Steve Young?

Steve Young was incredibly fast, clocking a personal best of 4.3 seconds in the 40-yard dash. His speed and quickness on the field allowed him to evade defenders and extend plays effectively throughout his career.

Conclusion

Steve Young's journey to greatness isn't just about his stats; it's a demonstration of perseverance and dedication.

You can see how his resilience in the face of challenges shaped not only his career but also inspired countless fans and players.

As you reflect on his legacy, remember that true greatness comes from overcoming adversity and continuously pursuing improvement.

Young's story encourages you to push your limits, reminding you that the path to success is often paved with hard work and determination.