Tata Group's true wealth is impressive, standing at a market capitalization of $311 billion and generating $128 billion in revenue for FY 2021-22. This financial prowess comes from its diverse portfolio of 29 publicly-listed companies, which spans various sectors. With over 935,000 employees globally, the group's operations contribute considerably to job creation and economic development. While Tata's philanthropic efforts are well-known, the staggering numbers highlight the group's financial success independent of donations. These impressive figures reflect not just wealth, but also the group's commitment to sustainable growth and social responsibility, hinting at further insights on their overall impact.

Key Takeaways

- Tata Group's market capitalization stands at approximately $311 billion, showcasing its substantial economic value in the global marketplace.

- The group generated revenues of around $128 billion in FY 2021-22, reflecting its diverse and robust business operations.

- With over 935,000 employees, Tata Group significantly contributes to job creation and economic development worldwide.

- Ratan Tata's personal net worth is estimated at Rs 3,800 crore, illustrating his focus on philanthropy over wealth accumulation.

- Tata Group operates 29 publicly-listed companies, emphasizing its vast scale and influence across various sectors without factoring in philanthropic contributions.

Overview of Tata Group's Wealth

The Tata Group stands as a giant in the global business landscape, with its wealth stemming from a diverse array of industries. As of fiscal year 2021-22, the group boasts a remarkable market capitalization of approximately $311 billion. This impressive figure reflects the combined strength of its 29 publicly-listed companies, which generated revenues of around $128 billion in the same period.

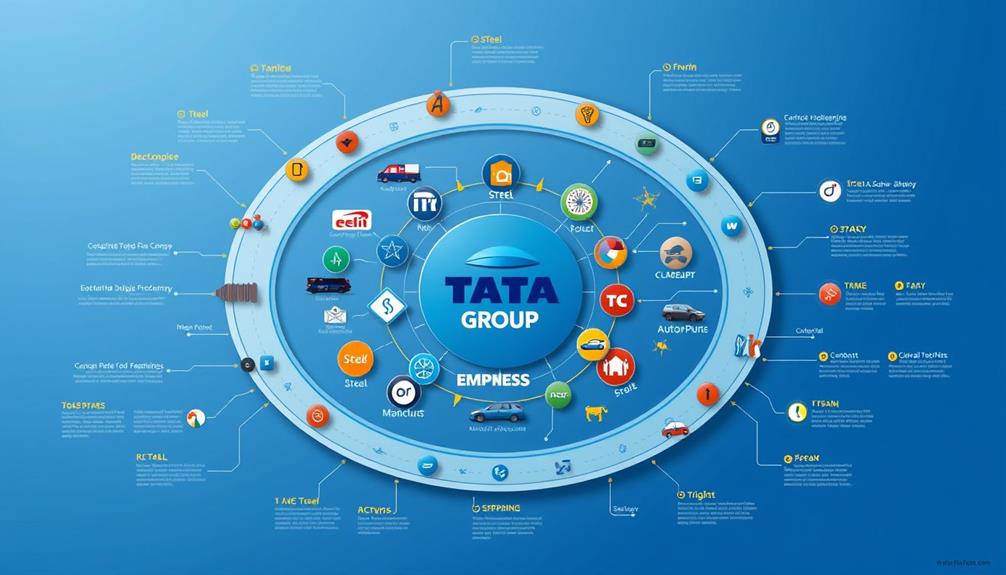

Understanding the importance of financial health is essential when evaluating such a vast conglomerate. Your understanding of the Tata Group's wealth is incomplete without acknowledging its diverse portfolio, which spans sectors like IT, automotive, metals, chemicals, and consumer goods. This wide-ranging involvement not only enhances its economic impact but also positions the group as a key player in various market segments.

Moreover, with over 935,000 employees globally, the Tata Group is one of the largest employers in India, considerably contributing to job creation. Despite its substantial wealth, the group prioritizes social responsibility by allocating 66% of its profits to philanthropic efforts through Tata Trusts.

This commitment reflects how the Tata Group aims to create a positive impact beyond mere financial success, intertwining wealth with a mission to uplift communities and foster sustainable development.

Ratan Tata's Financial Status

Ratan Tata embodies a unique blend of wealth and humility, ranking 421st in the IIFL Wealth Hurun India Rich List 2022 with an estimated net worth of Rs 3,800 crore. His financial status reflects a slight increase from Rs 3,500 crore in 2021, showcasing his ongoing wealth accumulation primarily through Tata Sons, the holding company of the Tata Group.

Curiously, his philanthropic initiatives mirror the celebrity ethos of prioritizing social responsibility, much like Nikki Reed and Ian Somerhalder's sustainable lifestyle as a couple, emphasizing the importance of giving back.

Despite his significant net worth, Ratan Tata remains absent from global wealth lists, which highlights his focus on philanthropy over personal gain. You might find it remarkable that he's recognized more for his humanitarian efforts than for his financial status. His approach is a reflection of his belief that wealth should serve a greater purpose, reinforcing the Tata legacy of social responsibility. It’s a refreshing contrast to the conspicuous consumption often associated with the ultra-wealthy. Tata’s commitment to making a positive impact in the world sets him apart from others in his position. In a world where “tiger woods’ wealth secrets” are often sought after, Ratan Tata’s example reminds us that true fulfillment comes from using one’s wealth to better the lives of others.

Ratan Tata's financial journey isn't just about numbers; it's about the impact behind those numbers. His commitment to improving lives through responsible corporate practices sets him apart in a world often driven by mere wealth accumulation.

Ultimately, Ratan Tata's story is one of a wealthy individual who prioritizes giving back over personal prosperity, making him a true icon of altruism in modern business.

Philanthropic Contributions of Tata Group

Tata Group's commitment to philanthropy sets it apart in the corporate world, building on Ratan Tata's legacy of social responsibility. Founded by Jamsetji Tata, the group has dedicated 66% of Tata Sons' profits to charitable initiatives through Tata Trusts. Over the past century, these efforts have led to a staggering total of $102.4 billion in donations, primarily benefiting healthcare and education sectors.

Here's a quick overview of Tata Group's philanthropic focus:

| Sector | Contribution |

|---|---|

| Healthcare | $40 billion |

| Education | $25 billion |

| Community Aid | $20 billion |

| Research & Development | $17.4 billion |

Ratan Tata continues to lead these significant efforts, ensuring they align with Jamsetji's vision and create a lasting impact on society. The Tata Group ranks among the top global corporate contributors, influencing future philanthropic practices both in India and worldwide. By prioritizing strategic giving, Tata sets a model for how businesses can improve the quality of life through meaningful social causes and community initiatives.

Business Empire Structure

With 29 publicly-listed companies under its umbrella, Tata Group showcases a diverse business empire that spans multiple sectors, including IT, retail, chemicals, metals, and mining. The group's market capitalization, estimated at $311 billion, reflects its significant presence in the global marketplace. This impressive scale enables Tata Group to drive substantial revenue, generating $128 billion in the fiscal year 2021-22.

Significantly, companies like Augusta Precious Metals and Noble Gold demonstrate how well-structured organizations can thrive in competitive markets, similar to Tata's strategic approach in diverse investment options.

You can see how Tata Group isn't just a business powerhouse but also a major job creator, supporting over 935,000 individuals across various industries. This vast workforce emphasizes the company's commitment to economic growth and opportunity. Each segment of the diverse portfolio contributes to the overall strength of the group, ensuring its resilience in the face of market fluctuations.

Moreover, Tata Group's legacy of social responsibility, rooted in the vision of founder Jamsetji Tata, plays a vital role in its business ethos. A majority of earnings are directed towards philanthropic causes, reinforcing the group's dedication to making a difference in society.

This blend of profitability and responsibility defines Tata Group's business empire, making it a unique entity in the corporate world.

Market Impact and Revenue Generation

When you look at Tata Group's impressive revenue growth trends, it's clear how influential they're in the market.

With a staggering $128 billion in revenue for the fiscal year 2021-22, their performance speaks volumes about their operational prowess.

Their success demonstrates effective investment strategies in precious metals, showcasing how diversified portfolios can enhance financial security.

You'll see that their market influence metrics reflect not just financial success, but a broader impact on various sectors.

Revenue Growth Trends

Driving strong revenue growth, Tata Group has carved out a significant niche in the market, generating an impressive $128 billion for the fiscal year 2021-22. This remarkable figure underscores the conglomerate's operational efficiency and diversified business model, which spans 29 publicly-listed companies across sectors like IT, retail, and chemicals. With a market capitalization of $311 billion, Tata Group stands among India's largest corporations, reflecting its substantial contributions to economic development.

Moreover, Tata Group employs over 935,000 individuals, making it a crucial player in job creation. The company's commitment to philanthropy is remarkable; historically, most of its earnings have been directed towards social causes, seamlessly merging revenue generation with social responsibility.

Here's a snapshot of Tata Group's financial impact:

| Metric | Value | Significance |

|---|---|---|

| Revenue | $128 billion | Demonstrates market strength |

| Market Capitalization | $311 billion | Indicates economic influence |

| Employees | 935,000 | Drives job creation and growth |

In essence, Tata Group exemplifies how a robust business model can foster both financial success and societal benefit.

Market Influence Metrics

Tata Group's market influence is evident through its impressive metrics, which reflect its substantial impact on the global economy. With a combined market capitalization of $311 billion as of the fiscal year 2021-22, Tata Group stands tall among the world's largest conglomerates. In that same fiscal year, it generated a staggering $128 billion in revenue, showcasing its extensive economic footprint across diverse industries like metals, mining, IT, retail, and chemicals.

This diverse portfolio highlights the importance of sector performance metrics in understanding the conglomerate's contributions to various markets.

Employing over 935,000 individuals globally, Tata Group plays a critical role in job creation, considerably contributing to economic development. This remarkable employment figure underscores the conglomerate's commitment to enhancing livelihoods and fostering growth.

Furthermore, Tata Group has a long-standing tradition of directing a considerable portion of its earnings toward philanthropic causes, reinforcing its dedication to social responsibility.

Through its varied business operations and focus on ethical practices, Tata Group not only shapes markets but also sets a standard for corporate responsibility. This combination of market impact and revenue generation illustrates why Tata Group is a pivotal player in shaping the global economy while prioritizing social welfare.

Comparison With Other Billionaires

The stark contrast between Ratan Tata's wealth and that of other billionaires highlights a different approach to success. With an estimated net worth of ₹3,800 crore, Ratan ranks 421st on the IIFL Wealth Hurun India Rich List 2022. This figure is modest compared to the staggering wealth amassed by billionaires like Elon Musk, who gained $151 billion in just one year.

As a comparison, different asset classes, such as Gold IRAs, can provide a hedge against inflation and diversify portfolios, showcasing how various investments contribute to financial stability.

In terms of donations, Ratan's commitment to philanthropy is commendable, with 66% of Tata Sons' profits allocated to charitable causes. However, when you look at Jamsetji Tata's total donations of $102.4 billion, it becomes clear just how significant this legacy is, overshadowing contemporary philanthropists like Bill Gates and Warren Buffett. Their contributions, worth $74.6 billion and $37.4 billion respectively, are dwarfed by Tata's historical impact.

Moreover, the average donation among the top 50 philanthropists is around $16.5 billion, making Tata's philanthropic efforts a benchmark for current and future billionaires. This comparison not only underscores Ratan Tata's unique approach but also reflects the varying definitions of wealth among the wealthiest.

Legacy of Philanthropy

Tata's philanthropic impact is immense, with a commitment to education and healthcare that started back in 1892.

The group's approach to giving reflects a deep understanding of community needs, similar to how families navigate financial implications in divorce when seeking stability during tumultuous times.

You can see how his vision shaped a culture of giving that inspires others to contribute to society.

Today, the Tata Group continues this legacy by dedicating a significant portion of its profits to charitable efforts, driving meaningful change in India and beyond.

Philanthropic Impact Overview

Throughout its history, few companies have made such a profound impact on society as Tata Group. Founded by Jamsetji Tata, recognized as the world's biggest philanthropist, the group's legacy of philanthropy has transformed lives through considerable donations, primarily focused on education and healthcare.

This commitment to social responsibility resonates with the importance of emotional well-being, as seen in initiatives that support mental health and community welfare mental health initiatives. Since 1892, Tata Trusts has allocated an impressive 66% of Tata Sons' profits to charitable causes, cementing a commitment to social responsibility.

Ratan Tata, the current Chairman Emeritus, not only honors Jamsetji's vision but also guarantees that these philanthropic efforts continue to align with the evolving needs of society. Tata Group's contributions markedly enhance the quality of life in India, supporting various social initiatives that address critical issues.

The emphasis on education and healthcare empowers communities and creates opportunities for countless individuals.

This enduring legacy of philanthropy serves as an inspiring model for future generations, highlighting the importance of giving back to society. By fostering a culture of social responsibility, Tata Group not only uplifts those in need but also encourages other organizations to follow suit in making a meaningful difference in the world.

Tata's Commitment to Society

With a legacy rooted in altruism, Tata Group continuously exemplifies its commitment to society through extensive philanthropic efforts. Founded by Jamsetji Tata, the group has donated an astounding $102.4 billion, making it the world's biggest philanthropist of the last century. Since as early as 1892, Tata's philanthropic activities have focused on education and healthcare, reflecting the foundational values that guide the organization.

The group's dedication to societal welfare aligns with the importance of emotional and psychological support for families, which resonates with their community-focused initiatives.

The Tata Trusts oversee the majority of these efforts, allocating about 66% of Tata Sons' profits to charitable causes. This guarantees a steady flow of resources to various societal initiatives, greatly improving the quality of life across India.

Ratan Tata, the current Chairman Emeritus, has played a vital role in maintaining and expanding this philanthropic legacy. He aligns closely with Jamsetji Tata's vision of social responsibility, emphasizing the importance of giving back to the community.

Through initiatives that support education, healthcare, and cultural enrichment, Tata Group remains dedicated to enhancing societal welfare. Their impact resonates deeply, showcasing that true wealth lies not just in financial success but in the positive change they foster within society.

Future Aspirations of Tata Group

Looking ahead, the Tata Group's future aspirations revolve around a steadfast commitment to sustainable growth and innovation. The group plans to invest in emerging startups and entrepreneurs, fostering a greener future while enhancing its philanthropic contributions. Under Ratan Tata's leadership, the focus shifts towards a deeper commitment to social responsibility, ensuring that business success intertwines with community engagement initiatives.

Here's how Tata Group plans to align its strategies:

| Focus Areas | Initiatives |

|---|---|

| Sustainable Growth | Investment in green startups |

| Innovation | Leveraging technology for social good |

| Philanthropic Contributions | Increased support for community projects |

| Ethical Business Practices | Prioritizing long-term societal benefits |

Conclusion

In the grand tapestry of wealth, Tata Group weaves a story rich with purpose and impact. Their staggering numbers reflect not just financial prowess but a heart that beats for society. Ratan Tata stands as a beacon, illuminating a path where business and philanthropy dance hand in hand. As you contemplate their legacy, you see a future shimmering with hope, reminding us that true wealth isn't just counted in dollars, but in the lives touched and transformed.