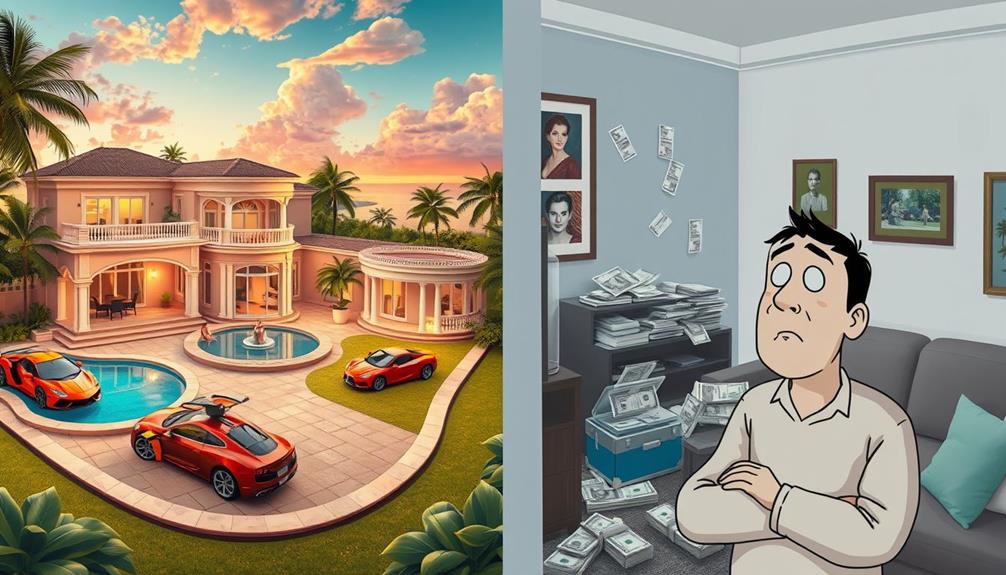

Having 6 million dollars might seem like you're filthy rich, but that wealth doesn't guarantee happiness. You may feel pressure to maintain a certain lifestyle or compare yourself to others, which can lead to anxiety and emotional distress. Social media can amplify these feelings, presenting curated versions of success that distort reality. Furthermore, wealth often creates shifting expectations, leaving you feeling inadequate regardless of how much you have. The truth is, financial status can take a serious toll on your well-being. There's so much more to explore about this complex relationship between money and happiness.

Key Takeaways

- Relative Wealth Perspective: $6 million can appear wealthy, but relative comparisons may lead to feelings of inadequacy based on peers' financial statuses.

- Status Anxiety: Even those with substantial wealth may experience anxiety about maintaining their status, affecting self-esteem and overall well-being.

- Curated Social Media Influences: Social media often presents idealized lifestyles, distorting perceptions of wealth and leading to unrealistic expectations and comparisons.

- Emotional Impact of Wealth: Financial success can create cycles of emotional distress, as initial joy diminishes and expectations shift, leaving individuals feeling unfulfilled.

- True Fulfillment Beyond Money: Genuine connections, humor, and community support often provide greater life satisfaction than financial wealth alone, highlighting the importance of intangible values.

The True Cost of Wealth

Wealth can come with hidden costs that often go unnoticed in the pursuit of financial success. You might think that having much money and a high net worth brings happiness and fulfillment, but the reality can be quite different. As your financial status improves, you may find yourself constantly comparing your wealth to others, particularly through social media. This distorted perception can leave you feeling inadequate, even when your financial situation is better than before.

Additionally, understanding the importance of budgeting for financial health can help mitigate some of these feelings by providing a clearer picture of your financial standing.

Moreover, the emotional consequences of wealth can be significant. As you accumulate more, the initial excitement fades, leaving you with a diminished sense of fulfillment. The hedonic treadmill effect kicks in, where your expectations of happiness rise alongside your net worth. Any financial loss feels magnified, leading to distress and anxiety.

Historical market behaviors remind us that downturns are inevitable, occurring roughly every 10-11 months. During these times, it's essential to detach emotionally to avoid panic selling.

Relative Wealth in Society

You often find yourself comparing your wealth to that of your peers, which can skew your perception of financial success.

Social media amplifies this by offering constant reminders of others' achievements, leading to a cycle of status anxiety. In this landscape, it's easy to focus on relative gains instead of appreciating your own journey and accomplishments.

Additionally, just as individuals can develop specific auditory skills through targeted therapies, recognizing and valuing your unique financial path can help mitigate feelings of inadequacy.

Strategies like mastering R sounds are essential in overcoming communication barriers, much like understanding your personal financial narrative can help clarify your own success.

Perception of Wealth Disparity

In a world filled with curated Instagram feeds and highlight reels of others' lives, perceptions of wealth disparity can feel overwhelming. You might notice that your financial status often gets compared to that of your peers, rather than relying on absolute measures. This can lead to feelings of inadequacy, even if you've made personal gains.

The constant quest for wealth can create an anxiety-driven treadmill effect, where you're always aiming for more. Embracing a mindset of curiosity and happiness can help shift your focus from comparison to personal growth, allowing you to appreciate your unique journey and achievements.

Consider these points about wealth perception:

- Relative Comparison: You often measure your success against friends or influencers, not just your bank account.

- Social Media Impact: Curated lifestyles portray unrealistic benchmarks, fueling feelings of inadequacy.

- Intangible Traits: Qualities like wisdom and humor are undervalued, complicating what it means to be "wealthy."

- Shifting Views: Historical trends show that societal attitudes toward wealth change over time, reflecting moral judgments about the rich.

Ultimately, understanding these dynamics can help you navigate your feelings about wealth disparity and the pressures that come with it, especially when swiping that credit card feels like a status symbol.

Social Media's Role

Social media's influence creates a complex web of relative wealth, where followers and likes become new currency. You might notice how platforms emphasize superficial engagement, often leading to the creation of a new hierarchy of status. Content creators chase public approval, resulting in a feedback loop that equates social validation with financial success.

This dynamic can distort your perception of reality, making it easy to feel inadequate when comparing your life to the curated highlights of influencers. For instance, Kourtney Kardashian's nude photo scandal showcases how public perception can impact celebrity reputations and, by extension, their financial standing.

Even something as simple as a post can trigger feelings of envy or inadequacy. Algorithms amplify this effect, often trapping you in echo chambers that reinforce your beliefs while shaping your investment behaviors based on perceived social status.

As you scroll, you may find yourself measuring your self-worth against the seemingly perfect lives of others, regardless of their actual circumstances.

Criticism of influencers underscores how societal judgments about wealth persist, evolving with the digital age. In this landscape, social media doesn't just reflect wealth; it actively shapes it, blurring the line between genuine connections and the pursuit of likes, making you wonder if anyone is truly "filthy rich" or just getting by.

Relative Status Comparison

Wealth acts like a mirror, reflecting not only individual financial standing but also the status of those around you. This constant comparison can lead to feelings of inadequacy, even if you're doing well financially.

The influence of social media compounds this issue, making it easy to gauge success through likes and followers, which often results in much risk to your self-esteem. Individuals struggling with emotional dysregulation may find this comparison particularly challenging, as they're more susceptible to fluctuations in self-worth based on perceived social status and wealth emotional dysregulation in BPD.

Here are four ways relative wealth affects your life:

- Status Anxiety: You might feel pressured to keep up with peers, overshadowing your own achievements.

- Skewed Self-Worth: Many prioritize tangible wealth over qualities like humor or wisdom, leading to a distorted sense of value.

- Treadmill Effect: The relentless pursuit of perceived wealth can leave you feeling stuck, as personal milestones feel insignificant compared to others' successes.

- Emotional Impact: Fluctuations in financial status can deeply affect your self-identity and well-being, especially in a society that emphasizes status over happiness.

In traversing wealth, remember that your worth isn't solely defined by what you have compared to others, but by who you are. In traversing wealth, remember that your worth isn’t solely defined by what you have compared to others, but by who you are. The difference between net worths may highlight material disparities, but it can never truly measure the depth of a person’s character, kindness, or integrity. True fulfillment stems not from what’s in your bank account, but from the values you nurture and the impact you leave on the lives of others. While the difference between net worths might capture attention in a world often fixated on numbers and status, it serves as a shallow lens through which to view personal success. What truly endures are the moments of connection, the compassion shared, and the legacy of positivity you create. After all, true wealth lies in the relationships you build and the principles you stand by, not in fleeting measures of financial comparison.

Social Media's Role in Perception

Transforming how we perceive status, social media has created a landscape where popularity is quantified through likes and followers, much like traditional measures of wealth. You might scroll through your feed and think there's an endless parade of influencers flaunting lifestyles that seem unattainable—like private jets and luxury vacations.

This quantification of popularity often leads to superficial engagement, where the number of followers is prioritized over genuine connections. In a world where cold medications overview could be likened to the choices influencers make for their public personas, individuals often feel pressured to curate their lives to fit an idealized narrative.

Algorithms reward content that garners public approval, pushing creators to chase virality rather than authenticity. As a result, perceptions of success become skewed, equating audience size with financial prosperity. This phenomenon of audience capture means that influencers adapt their content to meet audience expectations, perpetuating a cycle where social validation becomes a stand-in for real achievement.

Social media also amplifies confirmation bias, reinforcing existing beliefs about wealth and success. You may find yourself influenced by echo chambers that affect your investment behaviors and financial decisions.

The critique of digital influencers mirrors historical judgments of the wealthy, showcasing how online interactions continually reshape our understanding of status and success in today's world.

Emotional Toll of Financial Status

Your financial status can weigh heavily on your emotions, especially when you compare your wealth to others, often shaped by social media's curated portrayals of success.

This feeling can be exacerbated by the stress of managing issues like assisted living expenses or facing financial scams, which can leave many feeling insecure about their financial situation.

The gap between perceived wealth and reality can create feelings of inadequacy, leaving you vulnerable to anxiety and stress.

Steering through these emotional challenges requires resilience as you confront not just your financial situation, but the societal pressures that come with it.

Perceived Wealth Vs. Reality

Steering through the choppy waters of perceived wealth can take an emotional toll that's often overlooked. You might find yourself caught in a cycle of status anxiety, feeling inadequate despite your financial improvements. The pressure to maintain a certain image can lead to severe emotional responses, especially during financial losses.

Relationships can also be affected, as trust issues with boyfriends may arise from the anxieties surrounding financial status. Here are four key aspects to reflect upon:

- Comparison Trap: Constantly measuring your wealth against peers can amplify feelings of inadequacy.

- Hedonic Treadmill: The initial joy of wealth fades quickly, leaving you craving more, regardless of how much you accumulate.

- Moral Judgments: Society often places moral weight on wealth, making you feel guilty or defensive about your financial status.

- Superficial Metrics: In our social media-driven world, likes and followers can overshadow real achievements, intensifying your status anxiety.

These factors create an emotional landscape where perceived wealth doesn't always match reality. While you might seem affluent on the outside, the internal struggles can be profound, leaving you questioning your worth beyond your bank balance.

Social Media's Role

Social media plays a considerable role in amplifying the emotional toll of financial status, often exacerbating the feelings of inadequacy that stem from perceived wealth. You might find yourself scrolling through curated feeds, comparing your life to the seemingly perfect lifestyles of others. This constant comparison can heighten your status anxiety, making you feel inadequate despite any financial improvements you've made.

The pressure to maintain a certain image online can lead to a distorted sense of self, further complicating your relationship with money and success, as evidenced by discussions on the influence of technology on artistic expression.

In the quest for social validation through likes and followers, your self-worth may feel tied to superficial measures of wealth. Many creators prioritize public approval over authenticity, reflecting a troubling shift in how status is perceived and valued. As you witness wealth exposure on social media, it can drastically alter your personal identity, leaving you grappling with the pressures of maintaining your perceived status.

The emotional consequences of fluctuating wealth become even more pronounced in this digital landscape. Public displays of success or failure can profoundly impact your self-esteem and mental health, making it challenging to navigate your feelings about financial status.

Ultimately, social media can intensify the emotional toll of wealth, leaving you feeling trapped in a cycle of comparison and distress.

Emotional Resilience Challenges

Steering through the emotional landscape shaped by financial status can feel like walking a tightrope. You may find that wealth brings unexpected identity shifts, as seen with figures like Elon Musk, whose behaviors drastically change after gaining riches.

Maintaining wealth often feels less fulfilling than its acquisition, while losing it can lead to severe emotional distress. Additionally, maneuvering the complexities of investments, such as IRA rollovers to gold, can add another layer of stress and uncertainty for many individuals.

Here are some challenges to reflect on regarding emotional resilience:

- Hedonic Treadmill: You might constantly adjust your happiness expectations, feeling inadequate even when your financial situation improves.

- Market Downturns: Emotional responses to financial loss are often underestimated, with collective despair evident during events like the Great Depression.

- Social Media Comparisons: The constant comparison to others' perceived wealth can amplify feelings of inadequacy.

- Fulfillment vs. Acquisition: The initial thrill of wealth often fades, leaving you questioning your identity and worth.

Ultimately, these emotional resilience challenges highlight the deep psychological ties between your financial status and personal well-being, making it essential to maneuver this landscape mindfully.

Understanding Investment Behavior

Understanding investment behavior is essential for anyone looking to navigate the often turbulent waters of the financial markets. Successful investing hinges on your ability to resist panic selling, especially during inevitable market declines.

Historical data shows that markets typically drop by 10% every 10-11 months and 30% every 3-4 years. If you grasp this pattern, you can maintain a level of emotional detachment that prevents irrational choices during downturns.

The emotional impact of losing wealth can be severe, as many people tie their self-worth and social status to financial success. This connection can lead to heightened anxiety during tough times.

However, ongoing education about market cycles and economic trends can help you maintain perspective and resilience amidst volatility.

Beyond Money: What Really Matters

Recognizing that money isn't the only measure of worth opens the door to deeper insights about what truly enriches our lives. We often chase wealth, but in doing so, we overlook the intangible values that provide real joy and fulfillment.

Rather than focusing solely on financial status, consider these aspects that can greatly impact your well-being:

- Relationships: Genuine connections with friends and family nurture your emotional health much more than a bank account ever could.

- Humor: Finding joy in laughter can brighten your days and foster resilience against life's challenges.

- Wisdom: Acquiring knowledge and life lessons enriches your perspective and helps you navigate the complexities of life.

- Community: Being part of a supportive community offers a sense of belonging that wealth alone can't provide.

In our capitalistic society, the relentless pursuit of money can overshadow personal achievements, leaving you feeling inadequate.

By prioritizing these intangible values, you can cultivate a more balanced life, focusing on what truly matters rather than a mere number on a balance sheet.

Conclusion

So, when you think about that $6 million, remember it's not just about the number. Surprisingly, studies show that nearly 70% of millionaires feel they're still living paycheck to paycheck. This highlights how relative wealth can skew our perceptions. It's easy to assume that financial status equates to happiness, but it's the connections we build and the experiences we share that truly define our richness in life. Ultimately, it's about finding balance and fulfillment beyond just dollars.