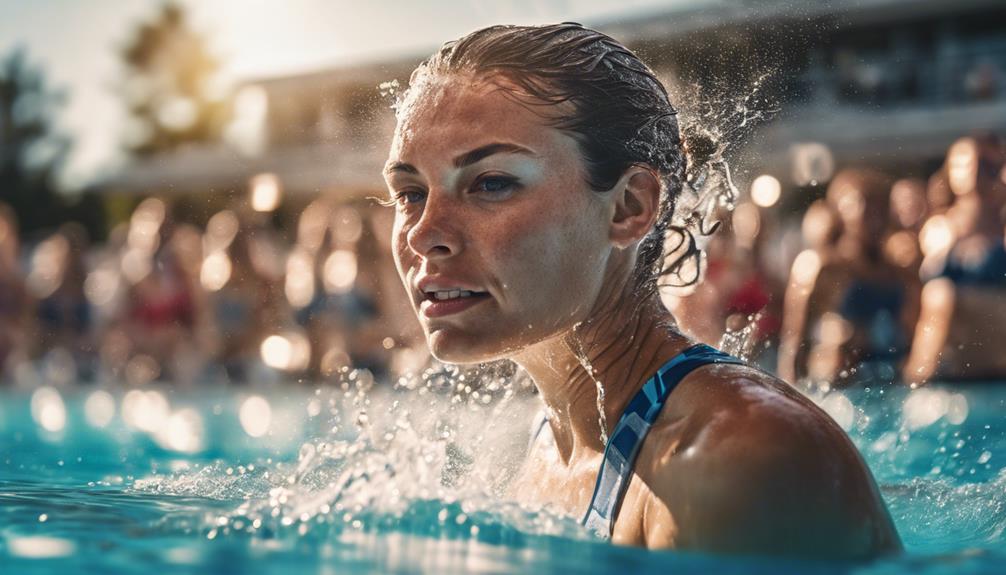

Amanda Beard's journey as an elite swimmer is nothing short of inspiring. Starting at just four, she made waves by winning five Olympic medals, including two golds. But her impact goes far beyond the pool. As an advocate for mental health, she speaks out on issues that resonate with many, especially female athletes. She's even co-authored a book tackling mental health challenges. Today, Beard's engaging in new projects, like a swimwear line and charitable events, all while promoting swimming as a life skill. To uncover more about her incredible story and ongoing work, keep exploring what she's up to.

Background Information

Amanda Beard started swimming at just four years old, showing early signs of her incredible talent.

By the age of 14, she became an Olympic gold medalist, cementing her place in sports history.

Beyond the pool, she's made a name for herself through television appearances and advocacy work, sharing her journey to inspire others.

Swimming at Age Four

Starting swimming at the age of four, she quickly developed a deep love for the water that would shape her future in the sport. Your early introduction to swimming laid a strong foundation, allowing her to refine her skills from a young age.

Growing up in a family that cherished sports, Amanda received the encouragement she needed to thrive. This support fueled her passion, helping her to become a skilled swimmer long before she reached her teenage years.

By the age of 14, Amanda made her Olympic debut at the 1996 Atlanta Olympics, where she became the second youngest swimmer to medal. This remarkable achievement highlighted the dedication and hard work she put in during her formative years.

Her journey reflects how essential those early swimming lessons were—not just for her athletic career but also for her identity as a prominent figure in the swimming community.

Amanda Beard's early experiences in the water ignited a lifelong commitment to swimming, ultimately leading her to Olympic glory. This inspiring journey reminds us how starting young can create pathways to extraordinary accomplishments in sports.

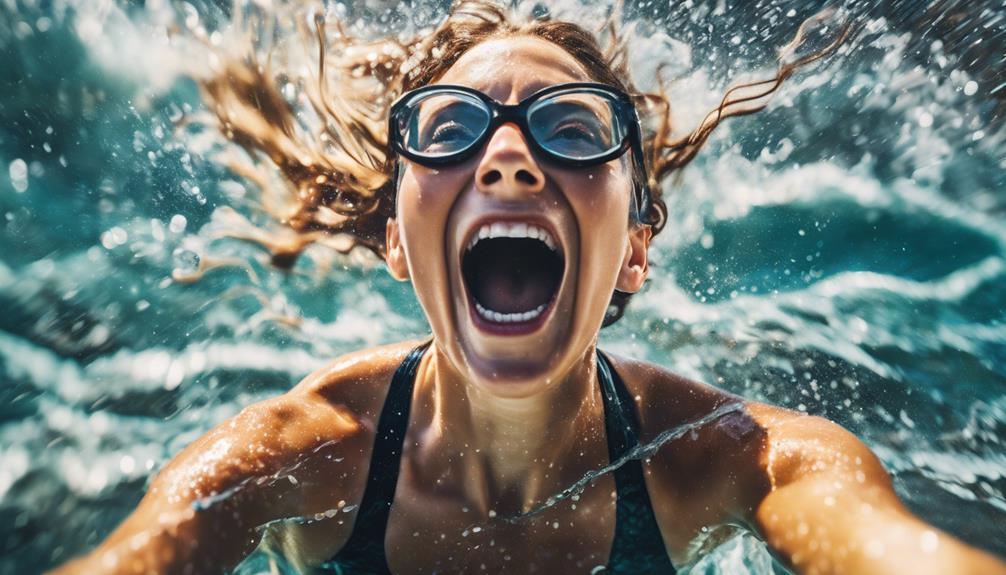

Olympic Gold Medalist

Beard's impressive journey as an Olympic gold medalist began when she made her debut at just 14 years old, showcasing her exceptional talent and determination. Competing at the 1996 Atlanta Games, you saw her shine, winning two silver medals and one gold. This early success marked the start of a remarkable career.

Over the years, she solidified her status as an outstanding Olympic swimmer, ultimately securing a total of five Olympic medals: two golds, two silvers, and one bronze across four Olympic Games in 1996, 2000, 2004, and 2008.

Her accomplishments didn't stop there. Beard set world records in the 200-meter breaststroke, breaking the record twice during her competitive years. Her dominance extended to the national level, where she earned eight USA Swimming National Titles, proving her prowess in the pool.

Additionally, you might admire her leadership, as she served as the captain of the USA Olympic Swimming Team twice. Through hard work and resilience, Beard's legacy as an Olympic gold medalist continues to inspire future generations of swimmers aiming for greatness.

Television Appearances and Advocacy

Television appearances have allowed Beard to share her inspiring journey and advocate for important causes, highlighting her experiences as an Olympic swimmer and her personal struggles. You've likely seen her on popular shows like *The Tonight Show* and *Good Morning America*, where she candidly discusses the challenges faced by female athletes and the importance of mental health.

Through her advocacy, Amanda focuses on women's issues, health, and personal growth, using her platform to motivate others. She's not just a swimmer; she's a voice for change. By co-authoring the New York Times Bestseller *In the Water They Can't See You Cry*, she dives deep into her own mental health challenges, emphasizing the pressures that come with elite athletics.

Moreover, she passionately promotes water safety and swimming education for children, embodying her commitment to community outreach. Her blog, 'Swim Like a Mom,' extends this advocacy by offering insights into parenting, healthy living, and fitness.

Through her television appearances and personal initiatives, you can see how Amanda Beard relentlessly inspires others to overcome obstacles and embrace a healthier lifestyle.

Current Updates or Main Focus

Amanda Beard's journey continues to evolve as she announces an exciting new book release, sharing her insights and experiences.

You're sure to appreciate her shift into motivational speaking, where she connects with audiences to inspire and uplift.

Plus, keep an eye out for her upcoming swimwear line, which promises to blend functionality and style for active lifestyles.

New Book Release Announcement

This month marks the exciting announcement of Amanda Beard's latest book, continuing her mission to inspire others through her remarkable journey. Following the success of her New York Times Bestseller, *In the Water They Can't See You Cry*, Beard's new work promises to explore deeper into her experiences as an Olympic swimmer and the personal battles she faced.

In this upcoming release, you can expect Amanda to candidly discuss her ongoing journey with mental health, motherhood, and the societal pressures on female athletes. She aims to create a safe space for readers, encouraging them to confront their own struggles while emphasizing the importance of mental well-being.

Beard's previous memoir resonated with many, as it addressed issues like depression and bulimia while highlighting the need for self-acceptance and healing. With her latest book, she hopes to build on that foundation and reach even more people.

Through book tours and media engagements, Amanda remains committed to sharing her story and sparking conversations around women's issues and mental health. Keep an eye out for this inspiring new release; it's sure to motivate and uplift readers everywhere. Her powerful message underscores the importance of resilience and advocacy, encouraging individuals to find strength in their own struggles. Amanda Nguyen’s activism journey serves as a testament to the impact one voice can have in driving meaningful change. This heartfelt narrative is a must-read for anyone seeking both inspiration and a deeper understanding of the challenges women and mental health advocates face today.

Transition to Motivational Speaking

Frequently taking the stage, Beard inspires audiences with her powerful messages about resilience, mental health, and the unique challenges faced by female athletes. Shifting from her successful swimming career, she's embraced motivational speaking, focusing on women's issues and personal growth. Through her engaging talks at universities and organizations, you'll find her discussing the pressures female athletes face, connecting deeply with listeners.

Beard's memoir, *In the Water They Can't See You Cry*, has been instrumental in her speaking journey. It highlights her struggles with mental health, emphasizing the importance of seeking help. By sharing her personal stories, she encourages openness about mental health challenges, fostering an environment where vulnerability is celebrated.

In addition to her motivational speaking, Beard participates in health and fitness events, advocating for swimming education and water safety for children. Her commitment to these causes further amplifies her message of resilience and empowerment.

As you listen to her speak, you can't help but feel inspired by her journey and the strength she embodies. Amanda Beard's shift to motivational speaking not only showcases her passion but also serves as a beacon of hope for those facing similar struggles.

New Swimwear Line Launch

Building on her journey of empowerment, Beard has launched a new swimwear line that beautifully merges functionality and style for swimmers of all levels. This collection caters to both competitive athletes and casual beachgoers, ensuring everyone can find the perfect piece. Each item in the line reflects her personal experiences as an elite swimmer, focusing on comfort and performance in the water.

What's truly inspiring is Beard's commitment to health and wellness, which shines through in her choice of sustainable materials and ethical production practices. By prioritizing these values, she not only provides high-quality swimwear but also promotes a healthier planet. The line includes a diverse range of sizes and styles, championing body positivity and inclusivity within the swimwear market.

Beard actively connects with her audience through social media, sharing insights and behind-the-scenes glimpses of the design process. This engagement fosters a community where swimmers can celebrate their journeys together. As you explore her swimwear line, you're not just investing in stylish swimwear; you're joining a movement that emphasizes empowerment, health, and wellness for all.

Detailed Analysis

You'll see how Amanda Beard's recent charity swim event highlights her commitment to giving back to the community while also showcasing her brand collaborations and endorsements.

These partnerships not only boost her profile but also emphasize her resilience in competition and life.

Let's unpack these key points to understand her journey better.

Recent Charity Swim Event

Amanda Beard's recent charity swim event not only brought together former Olympic athletes but also underscored the significant need for children's swimming education and water safety programs. This event aimed to raise funds specifically for these causes, demonstrating Beard's commitment to community outreach. With numerous participants rallying around the cause, the atmosphere was electric, emphasizing the importance of teaching young children essential swimming skills.

The charity swim successfully raised over $50,000, benefiting local organizations dedicated to providing swim lessons to underprivileged children. This financial boost is essential, as it allows these organizations to reach more kids and instill confidence in the water.

During the event, Beard shared her personal experiences, passionately discussing the life-saving benefits of swimming and the fundamental role of water safety. Her advocacy resonates deeply, encouraging attendees to understand that swimming isn't just a sport; it's a significant skill that can prevent drowning and foster a lifelong love for the water.

Brand Collaborations and Endorsements

Brand collaborations and endorsements play an essential role in amplifying Amanda Beard's influence, seamlessly blending her advocacy for swimming education with her entrepreneurial ventures. By co-founding Mission Skincare Products, she targets active lifestyles with skincare designed specifically for athletes. This venture not only promotes healthy living but also reinforces her commitment to water safety.

You'll notice that Amanda frequently engages in collaborative projects with high-profile athletes. These partnerships enhance her brand's visibility and credibility within the sports community, making her initiatives more impactful. Her collaborations often center around water safety and swimming education, perfectly aligning with her advocacy for children's safety in aquatic environments.

Additionally, Amanda's blog, 'Swim Like a Mom,' connects her personal experiences with parenting and active living, creating a relatable image for her audience. Her media presence, including appearances on CNN and the Today Show, further bolsters these brand collaborations. By reaching wider audiences through these media outlets, she effectively promotes her entrepreneurial ventures while spreading her message about swimming education and safety.

Emphasizes Resilience in Competition

Resilience is a defining trait that shines through in Amanda Beard's competitive journey, as she navigated the pressures of elite athletics from a young age. Competing in the Olympic Games at just 14, she quickly showcased her strength by winning a gold and two silver medals in 1996. This early success set the stage for a career filled with highs and lows, highlighting her remarkable resilience.

Despite battling emotional struggles like depression and body image issues, Beard earned a total of seven Olympic medals, including a gold in 2004. Her ability to overcome personal challenges became evident after a disappointing performance at the 2008 Olympics. Instead of succumbing to defeat, she used that period to refocus her motivations, ultimately reclaiming her happiness in both sport and life.

Beard's commitment to excellence is exemplified by her world record in the 200-meter breaststroke, a reflection of her determination amidst adversity. After retiring, she transformed her journey into a platform for motivation, inspiring others facing their own challenges.

Amanda Beard's story is a true illustration of resilience in competition, encouraging you to push through obstacles to achieve your goals.

Public Reaction or Expert Opinions

You might notice that social media has been buzzing with support for Amanda Beard's achievements, reflecting her impact on fans and fellow athletes alike.

While many media outlets praise her memoir for its honest look at the challenges athletes face, some critiques focus on her motivational approach.

This mix of admiration and skepticism sets the stage for a deeper discussion on how her journey resonates with both the public and experts in the field.

Social Media Celebrates Her Achievements

Fans and fellow athletes have taken to social media to celebrate Amanda Beard's remarkable achievements, sharing heartfelt messages that highlight her impact both in and out of the pool. With seven Olympic medals to her name, Beard's legacy in swimming is unmistakable. However, it's her openness about mental health struggles that truly resonates with many.

As she shares her experiences in her memoir, 'In the Water They Can't See You Cry,' you can see how her honesty fosters a supportive dialogue around mental well-being, especially among athletes. The positive response to her advocacy for swimming education and water safety through Beard Swim Co. has also been significant. Parents and communities praise her efforts, recognizing the importance of these initiatives.

Her shift from competitive swimming to motherhood has inspired numerous followers, as many celebrate her choice to prioritize family life over athletic accolades. Engagement on platforms like Instagram and Twitter reflects a community that values her authenticity and vulnerability. By sharing both her triumphs and challenges, Beard connects deeply with her audience, encouraging others to embrace their journeys, mental health struggles included.

Media Praise for New Book

Amanda Beard's memoir, *In the Water They Can't See You Cry*, has garnered widespread acclaim, with readers and experts alike praising its raw honesty and powerful insights into the mental health challenges faced by athletes. Achieving New York Times bestseller status, this book resonates deeply with those familiar with the pressures of competitive sports.

Many readers appreciate how Beard candidly addresses her personal struggles, shedding light on issues such as body image and emotional well-being that often plague female athletes.

Critics have commended Beard for her bravery in sharing her vulnerabilities, noting that it inspires others to confront their own challenges. The memoir encourages open conversations about mental health, emphasizing its importance in sports, especially among young and elite athletes.

This conversation is vital, as it not only highlights the mental health issues within competitive swimming but also serves as a call for greater advocacy and support in the athletic community.

Critique of Her Motivational Approach

While many find inspiration in Beard's storytelling, some critics argue her motivational approach lacks actionable strategies for overcoming the very struggles she describes.

Experts note that her memoir, *In the Water They Can't See You Cry*, provides a raw look into her mental health challenges, yet they feel it falls short in detailing her emotional growth and recovery process.

You might appreciate Beard's focus on personal challenges over competitive achievements, as it sheds light on the psychological pressures elite female athletes face. However, some readers express disappointment, wishing she'd included more concrete advice for tackling similar issues.

In her motivational speaking engagements, Beard connects deeply with audiences, but feedback indicates that many attendees desire specific takeaways that could help them navigate their own emotional hurdles.

While her advocacy for mental health awareness in sports resonates widely, particularly among women, the call for practical strategies remains.

Ultimately, while Beard's vulnerability offers comfort and solidarity, the quest for actionable steps in addressing mental health concerns continues to be a significant gap in her motivational approach.

Broader Implications

Amanda Beard's journey can reshape how youth swimming programs approach mental health and body image.

As her upcoming documentary highlights her life, it'll likely inspire young athletes to prioritize emotional well-being alongside physical achievement.

Shaping Youth Swimming Programs

How can effective youth swimming programs, like Beard Swim Co., reshape attitudes towards water safety and inspire future generations? By emphasizing swimming education as an essential life skill, these programs help instill confidence in young swimmers while reducing the risk of drowning incidents.

Amanda Beard's commitment to water safety reflects her personal journey, both as an accomplished swimmer and a dedicated mother. Through community engagement, Beard Swim Co. offers clinics and private lessons that make swimming education accessible.

This approach not only promotes individual health and wellness but also fosters a sense of responsibility among parents and children alike. When you participate in such programs, you're not just learning to swim; you're embracing a culture that values water safety.

Beard's motivational speaking and outreach initiatives further amplify the message that swimming education is vital. By inspiring both kids and their families to prioritize water safety, these programs create a ripple effect that can lead to safer communities.

Ultimately, effective youth swimming programs empower the next generation to approach water with knowledge and respect, ensuring they're equipped with skills that could save lives.

Upcoming Documentary on Her Life

The upcoming documentary on Beard's life promises to shed light on the complex journey of an elite athlete maneuvering both triumph and personal challenges, emphasizing the importance of mental health support. This film dives deep into Amanda's experiences, showcasing her Olympic success alongside her struggles with depression and anxiety.

By candidly addressing these mental health issues, the documentary aims to break the stigma surrounding them, particularly in the world of competitive sports. You'll witness interviews with family, friends, and fellow athletes, illustrating how essential support systems are in overcoming personal adversities.

Moreover, the film explores broader themes like body image, toxic relationships, and the immense societal pressures faced by female athletes. By highlighting these challenges, Beard's story encourages viewers to engage in open discussions about mental health, inspiring others to seek help and pursue personal growth beyond their athletic accolades.

Ultimately, this documentary isn't just about Amanda; it's about the journey of countless athletes grappling with similar issues, reminding everyone of the need for compassion and understanding in the world of sports.

Influence on Young Athletes

Young athletes can find powerful inspiration in Beard's journey, as it underscores the importance of mental health and self-acceptance in sports.

Her memoir, *In the Water They Can't See You Cry*, reveals the emotional struggles elite athletes face, highlighting the need to prioritize mental well-being. As a role model, Beard emphasizes that young competitors shouldn't let societal pressures dictate their self-worth, particularly regarding body image.

By openly sharing her experiences with depression and anxiety, she encourages you to seek help and communicate your challenges. This openness fosters a healthier athletic culture where mental health is a priority.

Beard's advocacy for swimming education through her business, Beard Swim Co., also inspires you to view swimming as an essential life skill, not just a competitive pursuit.

Through her speaking engagements, she motivates young athletes to embrace resilience and self-acceptance. In a world that often demands perfection, Beard reminds you that it's okay to be vulnerable and seek support.

Her journey teaches you that success in sports isn't just about medals; it's also about nurturing your mental health and fostering a positive self-image.

Frequently Asked Questions

What Is Amanda Beard Known For?

You'll find Amanda Beard is known for her incredible achievements as an Olympic swimmer, winning multiple medals, breaking world records, and advocating for mental health awareness and swimming education through her work with Beard Swim Co.

Is Amanda Beard Still Married?

Yes, Amanda Beard's still married. She and her husband, Sacha Brown, maintain a strong relationship, focusing on their family life while supporting each other's personal and professional growth throughout their journey together.

Conclusion

Amanda Beard's journey as a swimmer is a demonstration of resilience and determination.

You've seen how her struggles and triumphs have inspired countless individuals, proving that challenges can lead to growth.

As she continues to advocate for mental health and body positivity, her story resonates on a broader scale, encouraging others to embrace their own journeys.

Remember, it's not just about winning; it's about the lessons learned along the way and the strength you discover within yourself.