Roger Staubach's transformation from a celebrated NFL quarterback to a thriving business leader showcases his grit and vision. After winning the Heisman Trophy and two Super Bowls with the Dallas Cowboys, you'll find he didn't stop there. Staubach shifted gears into real estate, founding The Staubach Company in 1977. His innovative strategies and a focus on client advocacy reshaped the industry, leading to a $613 million company sale in 2008. Beyond business, he's committed to philanthropy, supporting education and youth sports. Stay with us, and you'll uncover more about his impactful journey and legacy.

Background Information

Roger Staubach's journey began at the Naval Academy, where he shone as a football standout, earning the Heisman Trophy.

His NFL career skyrocketed when he led the Dallas Cowboys to victory, even snagging the Super Bowl VI MVP award.

After hanging up his cleats, he shifted into real estate, launching successful ventures that showcased his business acumen.

Naval Academy Football Standout

At the United States Naval Academy, Staubach emerged as a football standout, leading his team to impressive victories and earning the Heisman Trophy in 1963 by the largest margin in history. His performance during his junior season was nothing short of remarkable. You'd see him rack up over 1,700 passing yards and 400 rushing yards, showcasing his dual-threat capability as a quarterback. This unique skill set made him a nightmare for opposing defenses and solidified his reputation as a top-tier athlete.

Graduating in Spring 1965, Staubach commissioned into the Supply Corps, but his dream of professional football had to wait. He voluntarily served a tour of duty in Vietnam, balancing military responsibilities while holding onto his passion for football. His commitment to both his country and the game set him apart from many athletes of his era.

Staubach's journey at the Naval Academy not only shaped him into a football hero but also instilled values of leadership and discipline that would serve him well in his future endeavors. His legacy as a Heisman Trophy Winner and military officer remains a reflection of his dedication and talent.

Super Bowl VI MVP Award

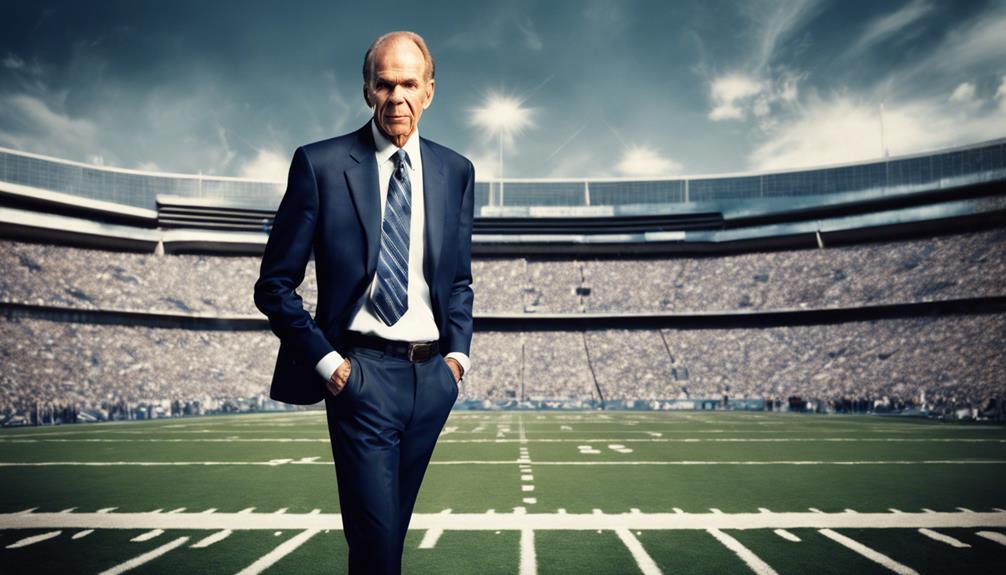

The MVP award for Super Bowl VI, held on January 16, 1972, marked a pivotal moment in the Dallas Cowboys' history as they triumphed over the Miami Dolphins with a commanding score of 24-3.

Roger Staubach's performance was nothing short of spectacular; he completed 12 of 19 passes for 119 yards, throwing two touchdown passes and displaying exceptional leadership on the field. This victory wasn't just another game—it was the first Super Bowl win for the Cowboys, cementing Staubach's legacy as a key player in the franchise's history.

Winning the Super Bowl MVP title elevated Staubach to NFL legend status. His accomplishments on the field helped shape the Cowboys into what fans now recognize as 'America's Team.'

The significance of this award extended beyond the game itself, laying the groundwork for Staubach's successful shift into business. After his football career, he founded the Staubach Company, focusing on commercial real estate.

His ability to lead and excel under pressure on the field translated into success in the business world, proving that the lessons learned in sports can pave the way for future achievements.

Real Estate Ventures and Partnerships

Staubach's journey in real estate began in 1970, blending his passion for business with the skills he honed on the football field. While still an NFL player, you might find him working part-time as a broker with Henry S. Miller Co., a top commercial real estate firm in Texas.

In 1977, Roger Staubach founded The Staubach Company, focusing on tenant representation. Over 25 years, he expanded the business to 68 offices globally, emphasizing a client-centric approach that prioritized meeting clients' needs.

In 2008, Staubach sold The Staubach Company for an impressive $613 million to Jones Lang LaSalle. Even after the sale, he stayed on as Executive Vice Chairman, continuing to influence the company until his retirement in 2018.

His business philosophy, deeply rooted in the teamwork and resilience from his football career, fostered a strong company culture that thrived on collaboration and client satisfaction.

Staubach's remarkable success in real estate has greatly contributed to his estimated net worth of $600 million, showcasing his seamless shift from athlete to successful businessman.

Current Updates or Main Focus

Right now, Roger Staubach's focus spans recent real estate acquisitions and a shift towards philanthropic efforts.

You'll also find him exploring tech startups and innovations that align with his vision for the future.

Each of these areas reflects his commitment to growth, community, and inspiring others.

Recent Real Estate Acquisitions

Recently, JLL has expanded its portfolio with several key office property acquisitions in major metropolitan areas, reflecting Roger Staubach's strategic vision for growth. Under Staubach's leadership, JLL continues to capitalize on emerging markets, identifying lucrative investment opportunities that align with current trends in the real estate sector.

In 2022, the firm reported a notable increase in tenant representation services, a demonstration of Staubach's influence and innovative approach within commercial real estate. His commitment to sustainability is evident in these recent acquisitions, as JLL focuses on eco-friendly developments that meet the growing demand for sustainable practices in the industry.

Moreover, Staubach's guidance has led JLL to adopt cutting-edge technology solutions, enhancing client services and operational efficiency. By prioritizing sustainability in its acquisitions, JLL not only addresses environmental concerns but also positions itself as a leader in responsible real estate practices.

With each strategic move, Staubach reinforces his legacy, ensuring that JLL remains at the forefront of the commercial real estate market while staying true to his vision of growth and innovation.

Transition to Philanthropic Endeavors

Roger Staubach is making a significant impact through his philanthropic endeavors, focusing on education, youth sports, and health to uplift underprivileged communities. His commitment is evident in the establishment of the Roger Staubach Foundation, which provides scholarships and support for youth who mightn't otherwise have access to these opportunities. By prioritizing education, Staubach aims to equip the next generation with the tools they need to succeed.

In addition to scholarships, Staubach actively participates in mentorship programs, sharing his invaluable experiences with young athletes. He inspires them not only in sports but also in life, teaching the importance of hard work, dedication, and giving back to the community. His involvement with organizations like the Special Olympics and the Salvation Army showcases his dedication to serving those in need.

Staubach's philanthropic efforts extend beyond financial support; he encourages others to engage in community service, fostering a culture of compassion and support. His passion for uplifting others reflects his understanding of the challenges many face, and he's determined to make a lasting difference through his philanthropic work.

Tech Startups and Innovations

Tech startups today thrive on innovation, leveraging advanced technologies to reshape industries and enhance user experiences. In real estate, for instance, companies like The Staubach Company have set a precedent by adopting technology innovations early on. They utilized data analytics and digital tools to streamline tenant representation and improve client services, creating a more efficient experience for all parties involved.

You can learn a lot from Staubach's emphasis on teamwork and a client-centric approach. These principles are essential for tech startups aiming to foster collaborative environments while prioritizing user experience. By focusing on how to best serve your clients, you'll set your startup up for success in a competitive market.

Moreover, Staubach's recent efforts in mentoring entrepreneurs highlight the importance of balancing traditional business values with modern tech advancements. His insights offer invaluable guidance for those venturing into the startup world.

As you navigate your journey, keep in mind the importance of adapting to technology trends and fostering a culture of teamwork. That way, you can create innovative solutions that resonate with clients and stand out in today's rapidly evolving landscape.

Detailed Analysis

In examining Roger Staubach's journey, you'll see how recent charity events reflect his commitment to giving back.

His philanthropic efforts not only enhance his public perception but also underline the idea that success requires hard work and dedication.

Let's explore how these elements intertwine in his life and career.

Recent Charity Event Highlights

Recently, a charity event featuring Roger Staubach successfully raised over $100,000 for local youth sports programs, highlighting the significance of community involvement. This event not only showcased Staubach's enduring popularity but also his commitment to philanthropy. With over 500 attendees, it's clear that the community supports his efforts to uplift youth through sports.

The event included a silent auction, where memorabilia from Staubach's illustrious NFL career drew significant bids, further contributing to the total funds raised. During his keynote speech, Staubach emphasized how sports play an essential role in youth development, sharing personal anecdotes that resonated with many. By reflecting on his own experiences, he inspired attendees to recognize the benefits of youth sports.

Staubach's philanthropic efforts extend beyond this single event, as he has a long history of supporting educational initiatives. He believes in the power of education and perseverance, showing that his commitment to community goes hand in hand with nurturing future generations.

This charity event not only raised funds but also reinforced the important connection between sports, education, and community well-being, a cause staunchly championed by Roger Staubach.

Philanthropy Enhancing Public Perception

Philanthropy has played an essential role in shaping Roger Staubach's public image as a respected role model and community leader. His philanthropic efforts reflect a deep commitment to giving back, particularly in the areas of education and youth sports. By championing these causes, Staubach not only enhances the lives of young people but also promotes the values of teamwork and perseverance.

Receiving the Horatio Alger Award in 2007 stands as proof of his dedication. This prestigious recognition highlights individuals who've overcome adversity while positively impacting society. Staubach's involvement in various charitable activities demonstrates his belief in contributing to the greater good, inspiring others to follow suit.

His active participation in community events further solidifies his reputation. People see Staubach not just as a former football star but as a dedicated family man who genuinely cares about social causes. By engaging in these philanthropic efforts, he encourages athletes and public figures alike to embrace their roles as community leaders, fostering a culture of giving and support.

Ultimately, Staubach's commitment to philanthropy has greatly enhanced his public perception, making him a beloved figure in and out of the sports arena.

Success Requires Hard Work

Roger Staubach's philanthropic efforts showcase his commitment to community, but it's his relentless work ethic that truly defines his journey to success in both football and business. You can see this dedication reflected in his shift from a part-time real estate broker to the founder of The Staubach Company, which grew to 68 offices around the globe. Before he even stepped onto an NFL field, Roger volunteered for military service in Vietnam, emphasizing his commitment to service.

His rise from a 27-year-old rookie to a two-time Super Bowl champion and Hall of Famer illustrates that success isn't just about talent; it requires hard work and adaptability. Roger's business philosophy, shaped by his experiences on the gridiron, stresses teamwork and a client-centric approach. This work ethic played a significant role in his real estate firm's success, culminating in a remarkable sale for $613 million.

Additionally, Roger balanced family responsibilities with his NFL and business commitments, proving that hard work is essential for managing multiple aspects of life effectively. His story is a powerful reminder that success stems from perseverance and dedication.

Public Reaction or Expert Opinions

You can see how Roger Staubach's philanthropic efforts have sparked conversations across social media, particularly on Twitter.

Media outlets consistently praise his commitment to giving back, highlighting the impact of his charitable work.

Sports business analysts also offer valuable insights into how Staubach's character and values shape public perception, reinforcing his legacy both on and off the field.

Twitter Trends on Staubach's Philanthropy

Social media buzzes with gratitude as communities highlight Staubach's impactful charitable efforts, showcasing his commitment to education and mentorship. You'll find Twitter filled with heartfelt messages from beneficiaries who've experienced firsthand the positive effects of his philanthropy. His initiatives often focus on enhancing educational opportunities, which resonates deeply with many followers.

People aren't just acknowledging his contributions; they're celebrating his ability to inspire others in their community. Tweets often point out how Staubach's involvement with youth sports provides invaluable mentorship, creating a ripple effect that empowers the next generation.

Experts on Twitter emphasize the significance of Staubach's legacy in leveraging his sports fame to foster meaningful change. They note that his work reflects his military service values, underlining his dedication to uplifting others. This dedication has made him a respected figure, bridging the gap between sports and social responsibility.

Media Praise for Philanthropic Efforts

Recognized for his unwavering commitment to philanthropy, Staubach's efforts have drawn widespread admiration from media outlets and experts alike. His philanthropic initiatives, particularly in education and community service, highlight how he uses his platform to effect real change. By supporting youth sports programs, Staubach not only nurtures athletic talent but also fosters teamwork and discipline among underprivileged children.

Experts often commend Staubach for his dedication to mentoring young individuals. They emphasize the essential role he plays in inspiring the next generation to pursue their dreams. His recognition with the Horatio Alger Award in 2007 underscores his belief in education and perseverance, showcasing how he encourages others to overcome obstacles.

Media coverage of Staubach's philanthropic work consistently reinforces his image as a compassionate leader. He demonstrates that success goes beyond personal achievements—it encompasses giving back to the community.

Insights From Sports Business Analysts

Sports business analysts frequently commend Roger Staubach for his remarkable ability to apply the skills he honed on the football field to navigate the complexities of the corporate world.

His shift from NFL quarterback to real estate mogul showcases how teamwork and integrity can lead to success in business. Analysts often highlight the founding of The Staubach Company in 1977, which he sold for an impressive $613 million in 2008.

Staubach's business philosophy, rooted in the values he learned as 'Captain Comeback,' emphasizes ethical practices and long-term relationships.

His approach to tenant representation transformed the commercial real estate landscape, establishing standards that prioritize client advocacy and conflict-free advisory roles.

This commitment to integrity and teamwork not only earned him respect in the industry but also set a benchmark for aspiring athletes.

Broader Implications

Roger Staubach's journey highlights how his success reshaped the real estate market and set new trends that prioritize client needs.

You can see the ripple effect of his philanthropic efforts empowering communities, proving that business can have a heart.

As you explore these implications, consider how his legacy inspires future athletes to blend their sports experience with entrepreneurial spirit.

Real Estate Market Transformation

Through innovative strategies and a commitment to client interests, Staubach fundamentally reshaped how commercial real estate operates, setting new standards for ethical practices and transparency in the industry.

By pioneering the concept of Tenant Representation, he emphasized the importance of unbiased advocacy, ensuring that clients' needs took precedence over the traditional dual agency conflicts that often plagued real estate transactions.

His company, The Staubach Company, became a model for commercial real estate firms during the 1980s, expanding to 68 offices globally. This growth wasn't just about numbers; it was about building trust with clients through integrity and a genuine focus on their best interests.

Staubach's approach included surveying all available properties rather than limiting options to just listings, which considerably enhanced transparency and client satisfaction.

This transformation set a precedent for ethical practices in real estate, elevating the role of Tenant Representatives and fostering a culture of client advocacy.

Staubach's legacy remains influential, proving that necessity and innovation can drive substantial changes in business practices, ultimately benefiting clients and the industry as a whole.

Emerging Trends in Real Estate

As the real estate landscape evolves, emerging trends like sustainability, technology integration, and shifting work patterns are reshaping industry practices and client expectations.

Today, you'll find that 70% of investors prioritize environmental impact when making decisions, underscoring the growing emphasis on sustainability in developments.

You can't ignore technology integration either. Tools like AI and big data analytics are revolutionizing tenant representation, allowing for more precise market analysis and informed decision-making. This shift is essential as remote work trends change commercial real estate demand; about 50% of companies are planning to downsize their office spaces, forcing a reevaluation of property values and leasing strategies.

Urbanization is another critical factor, as cities attract approximately 1.5 million people annually. This surge prompts developers to invest in mixed-use properties that meet various needs.

Finally, the rise of e-commerce is driving demand for logistics and warehouse spaces, with a 20% increase in investment over the past year.

These trends paint a clear picture: the real estate industry is adapting to a new era, and you'll need to stay ahead of these changes to succeed.

Community Empowerment Through Philanthropy

Community empowerment thrives when individuals like Staubach leverage their resources and experiences to uplift those around them. His commitment to philanthropy showcases how influential figures can transform communities through education and mentorship. Staubach understands that by investing in youth programs, he's not just playing a part; he's fostering a culture of empowerment.

Education is a cornerstone of Staubach's philanthropic efforts. He advocates for initiatives that provide underprivileged youth with access to quality educational resources, believing that knowledge is a powerful tool for change. By emphasizing mentorship, Staubach encourages successful individuals to guide the next generation, creating a ripple effect of positive influence.

Moreover, Staubach's active involvement in charitable organizations highlights the importance of giving back. He views community service as essential, not just for personal fulfillment, but as a means to uplift others. His legacy, built on both athletic prowess and dedication to community betterment, serves as a powerful reminder of the impact one person can have.

Ultimately, Staubach's journey illustrates that true success isn't just measured by achievements, but by the empowerment and upliftment of the community you leave behind.

Frequently Asked Questions

What Business Did Roger Staubach Own?

You'll find that Roger Staubach owned The Staubach Company, a commercial real estate firm he founded in 1982. It focused on tenant representation and grew considerably before being sold to Jones Lang LaSalle in 2008.

Why Is Roger Staubach so Famous?

You might find Roger Staubach famous for his outstanding football achievements, including winning the Heisman Trophy and leading the Dallas Cowboys to two Super Bowl victories, along with his impressive business success after retiring from sports.

What Does Roger Staubach Do Today?

Today, you'll find Roger Staubach actively leading at JLL, inspiring others through public speaking, and engaging in philanthropy. He's committed to mentoring youth, promoting education, and influencing real estate practices with his extensive expertise.

How Much Did the Staubach Company Sell For?

The Staubach Company sold for approximately $613 million in 2008. This significant transaction highlighted its success in the commercial real estate sector, marking a pivotal moment in its history and growth.

How Did Roger Staubach Transition From Football to Business?

After retiring from football, Roger Staubach made a successful transition to business, founding a real estate company and becoming a highly regarded businessman. Known for his leadership and strategic thinking on the field, Staubach applied these skills to his business ventures, solidifying his reputation as a jimmy wong multitalented star.

Conclusion

In conclusion, Roger Staubach's journey from a celebrated football player to a successful businessman showcases the power of dedication and adaptability.

His ability to leverage his sports fame into a thriving real estate career inspires many.

As you reflect on his story, consider how his principles of teamwork and perseverance can apply to your own endeavors.

Staubach's legacy reminds us that success can come from embracing new challenges and continuously pursuing excellence.